- The Vester Pulse

- Posts

- When the Market turns Risk-On

When the Market turns Risk-On

The Vester Pulse | August 11, 2025

This week’s market action was defined by a decisive risk-on move, with DeFi leading sector gains and drawing the most capital. Regulatory shifts are opening new paths for investor access, and a high-profile DeFi court case is forcing a rethink on developer liability. Together, these events point to a market regaining momentum while testing the limits of how crypto operates in practice.

Vester Updates

Progress continues across Vester - bugs are being resolved, our follower base is growing across platforms, and we’re moving closer to full-scale launch. Three agents are already live, with several more on the roadmap. In that spirit, we shared a LinkedIn post this week highlighting what’s next.

We’re always looking to refine what we’re building, so if you’ve tried our product or have ideas for what should come next, we’d love to hear your thoughts. We’ll be sending out a poll next week to gather feedback and help prioritize upcoming features.

Market Updates

Market Overview — August 11, 2025

| Segment | Current Value | 7-Day Change |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $4.01 T | ↑ ≈ 4.5 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | ≈ 92.6 | ↑ 14.9 % |

| Layer-1 (GMCI L1 Index) | ≈ 185.8 | ↑ 5.7 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | $118,481 | ↑ 2.9 % |

| Ethereum (ETH) | $4,206 | ↑ 13.0 % |

| Solana (SOL) | $175 | ↑ 3.5 % |

| BNB (Binance Coin) | $801 | ↑ 4.5 % |

| XRP (Ripple) | $3.10 | ↑ 1.7 % |

Crypto News

Crypto Recovers Ground After Pullback

The market’s rebound last week was led by a decisive rotation into higher-risk segments, with DeFi taking center stage. The GMCI DeFi Index surged 14.9%, far outpacing other sectors as traders moved into smaller-cap protocols and higher-volatility plays. Layer-1 networks also gained ground, with the GMCI L1 Index up 5.7%, reflecting broader confidence in risk assets. Overall, the total crypto market cap rose 4.5%, reversing much of the early-August dip.

Stablecoin flows and rising derivatives volumes point to renewed speculative positioning rather than defensive capital allocation. The move was supported by a constructive macro backdrop - equities hovered near record highs, inflation data stayed manageable, and a mid-week pullback in the dollar added fuel to dollar-denominated asset flows.

If this risk-on rotation persists, DeFi’s current momentum could define market leadership into mid-August, though macro data and policy signals remain key watchpoints.

Executive Order opens 401(k)s

In a move that could reshape how millions of Americans save for retirement, President Trump signed an executive order on August 7th authorizing 401(k) plans to invest in alternative assets like cryptocurrency and private equity. This is a seismic shift, representing the biggest change to retirement investing since target-date funds were introduced. For decades, federal rules have kept these higher-risk, less-liquid assets out of employer-sponsored plans, but this directive instructs regulators to tear up the old playbook.

The administration is framing this as a win for the everyday investor, a way to "democratize" access to the kind of high-growth opportunities that have traditionally been the exclusive playground of the wealthy. The idea is to give you a shot at the same asset classes that have built fortunes on Wall Street.

Supporters frame the change as a democratizing step, giving retail investors access to the same high-growth opportunities historically reserved for accredited and institutional players. Critics warn of steep management fees, reduced liquidity, and elevated portfolio risk, particularly when combining crypto’s volatility with the long-term, relatively conservative profile of retirement savings.

Private equity fee structures (“2 and 20”) and crypto’s multi-year drawdowns stand in sharp contrast to the low-cost, broad-market index funds that dominate current 401(k) menus.

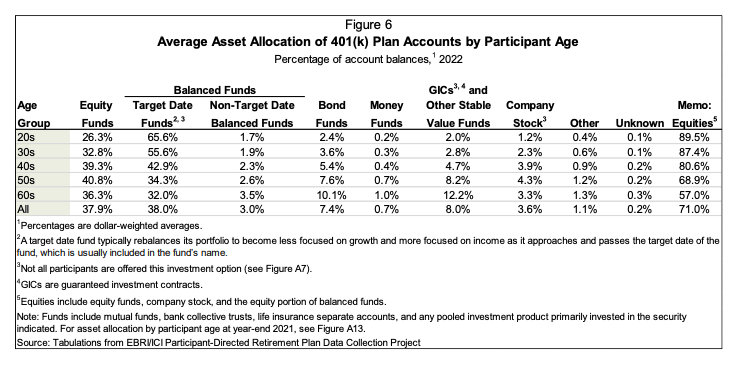

This major policy shift raises a key question: who among the 90 million Americans affected would actually add these riskier assets to their 401(k)? As the chart below illustrates, a look at current investment habits provides a telling glimpse into which generation might be the first to embrace the change. Hint, it’s those belonging to the younger age groups who have a higher risk tolerance

Implementation will not be immediate. Employers must opt-in, and financial providers need to design compliant investment products. Industry experts estimate a 12–15 month rollout before the first crypto-enabled retirement products are available, but large plan administrators could accelerate the timeline.

If adopted at scale, the move would create a substantial new channel of capital into digital assets, potentially boosting long-term demand and legitimizing crypto as a mainstream retirement allocation.

SEC Declares Liquid Staking Outside Securities Definition

The U.S. Securities and Exchange Commission has provided crucial clarity for the cryptocurrency world, confirming that liquid staking services do not constitute securities offerings under federal law. This decision resolves one of the largest regulatory uncertainties facing the proof-of-stake ecosystem.

The agency’s guidance centers on a key distinction: where the investment returns come from. According to the SEC, staking rewards are generated by the blockchain protocol itself, not by the "entrepreneurial or managerial efforts" of the service provider.

Because the yield is driven by the network's automated rules rather than a company's management, it falls outside the legal test used to define a security.

This marks a notable shift from the SEC's recent enforcement actions against centralized staking programs at major exchanges for unregistered securities sales. The new position draws a clear line between custodial services that simply facilitate participation in staking and investment contracts that tie returns to a company’s operational performance.

The announcement provides long-awaited relief for DeFi protocols, custodians, and institutional investors who had been cautious due to compliance risks. With this legal uncertainty resolved, larger financial players are expected to accelerate their staking activity.

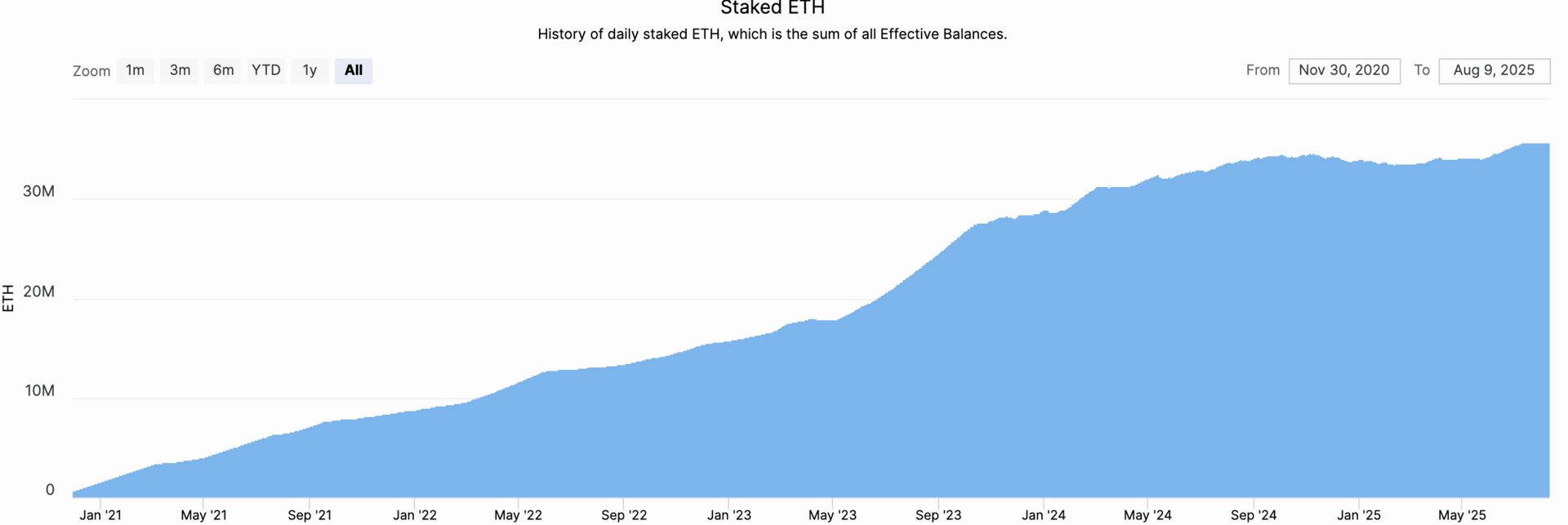

As a proxy for the broader trend, the total amount of ETH staked offers a clear view into the scale and growth of proof-of-stake participation.

In the long term, this ruling could solidify liquid staking as a foundational and compliant yield-generating strategy in digital asset portfolios, positioning it as a legitimate alternative to traditional fixed-income products.

Roman Storm Convicted on One Count

The verdict is in for Roman Storm, one of the creators of the crypto mixer Tornado Cash, and it’s a complicated one. A jury found him guilty of running an unlicensed money-transmitting business, a charge that could land him in prison for up to five years.

But on the two heavier charges - money laundering and violating U.S. sanctions - the jury was deadlocked. It's a partial victory for prosecutors, but not the slam dunk they were hoping for. Storm is currently free on bail and is already planning to appeal.

This case cuts to the heart of one of crypto's biggest debates. Tornado Cash was designed as a privacy tool, a way for regular users to transact on Ethereum without having their entire financial history exposed. But U.S. authorities argued it became the go-to laundromat for bad actors, most notably North Korea's Lazarus Group, which allegedly used it to wash stolen funds.

Prosecutors didn't just go after the protocol; they went after the men who wrote the code, arguing they knew it was being used for illicit purposes and failed to stop it.

Even without a conviction on the biggest charges, this verdict sends a chilling warning shot across the bow of the entire DeFi world. The message from regulators is clear: claiming your project is "decentralized" won't shield you from liability. If you build a tool that can be used like an unlicensed bank, the government may treat you like a banker.

The real battle, however, is yet to come. The appeal is set to become a flashpoint for defining the future of decentralized development. It will tackle the thorniest question in the space: when you just write open-source code, where does your responsibility end?

Closing Thoughts

This week’s rebound, led by DeFi, shows how fast capital can rotate back into risk when conditions line up. Regulatory shifts and market structure changes are opening new avenues for participation, but they also add layers of complexity.

Navigating that balance between opportunity and data overwhelm is where Vester is focused (as you know).

We want to make sure we’re building the most useful version of that tool, so we’ll be sending out a poll next week (as mentioned) to gather your feedback and help us focus on what matters most to you.

Thank you for reading, see you next week.