- The Vester Pulse

- Posts

- Vanguard Finally Opens the Door to Crypto

Vanguard Finally Opens the Door to Crypto

A major access barrier just fell for millions of investors

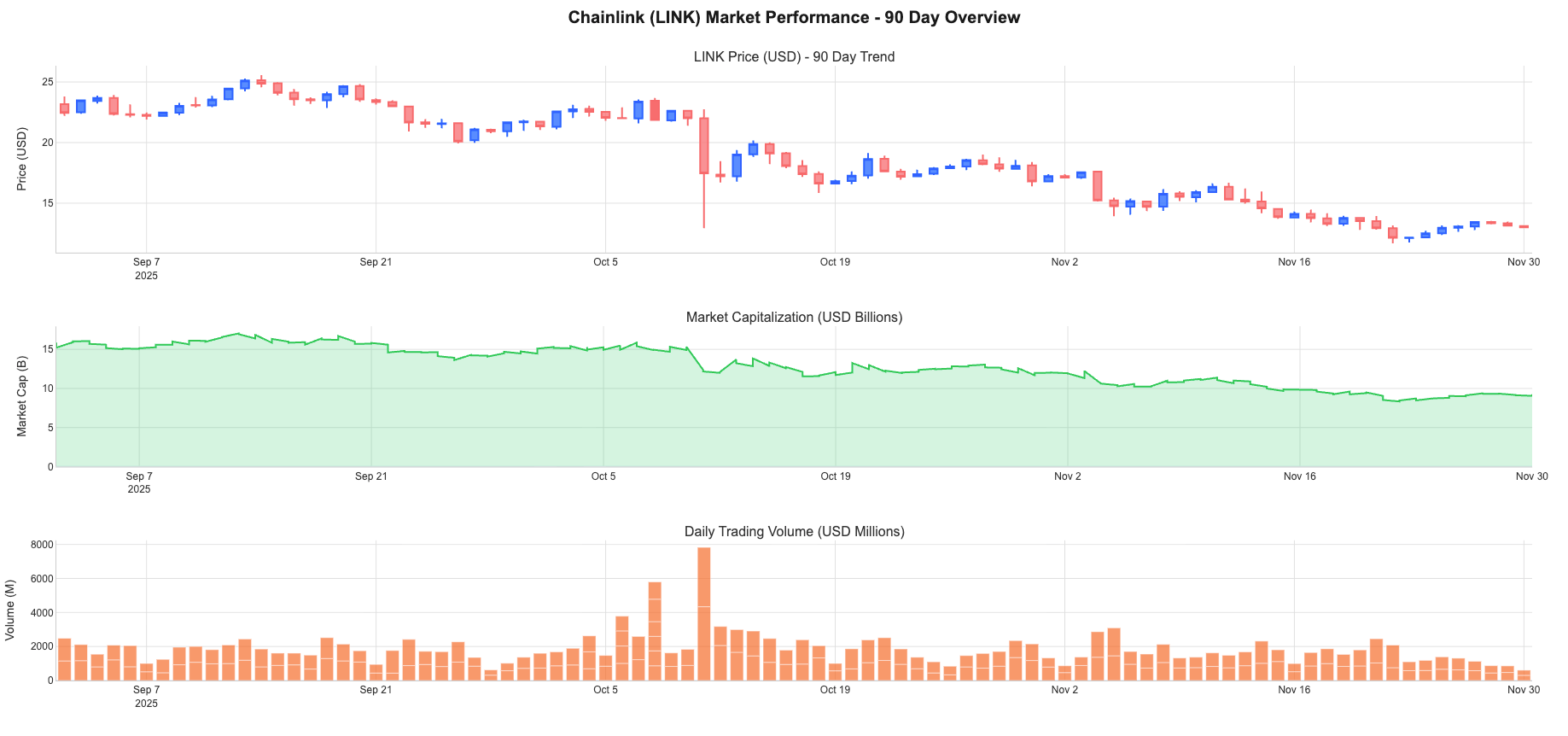

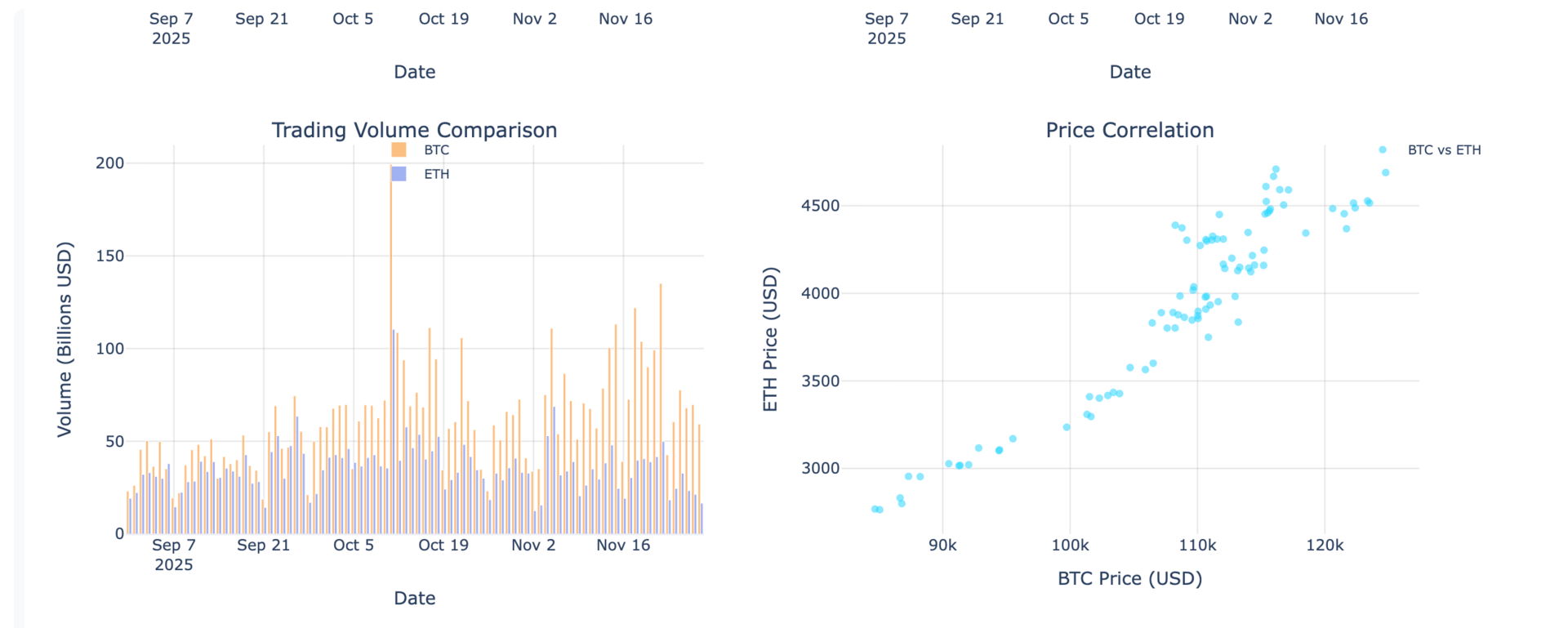

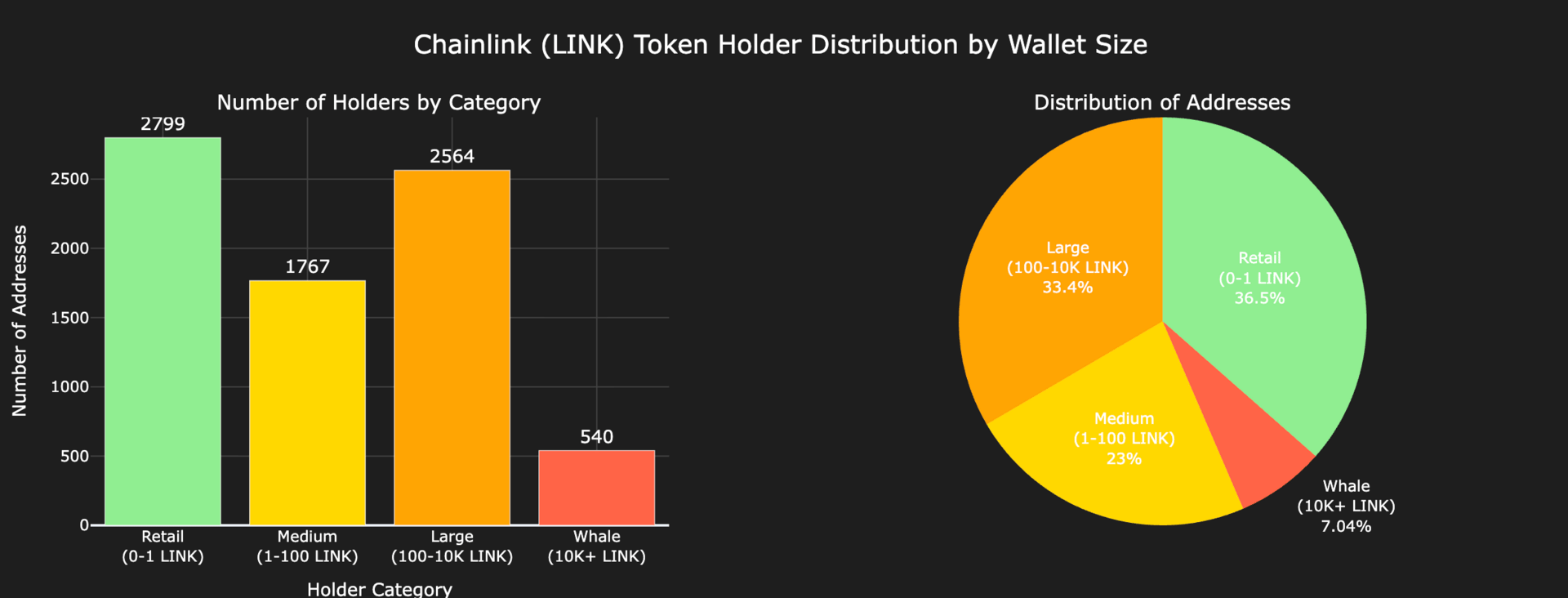

The team has been focused this week on expanding the internal visualization engine that will power the next stage of the product. Token coverage is being extended beyond the current universe, with support for deeper market structure metrics and a broader set of assets.

We’re also adding TradFi price integrations, allowing Vester to place crypto movements in context with equities, rates, commodities, and macro risk benchmarks. On-chain data coverage is widening as well, including wallet-size distributions, entity-level activity, and a more complete view of flows across major networks.

These updates are all part of preparing for the next version of Vester’s dashboard and feed.

Sneak peak below:

Plenty of work left to be done and bugs to be fixed, but the future is exciting and we look forward to rolling out this update at scale.

Market Updates

Market Overview — December 7, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.7 T | ↓ 2.9 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 55.9 | ↓ 4.0 % |

| Layer-1 (GMCI L1 Index) | 152.4 | ↑ 0.9 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $91,404 | ↓ 0.0 % |

| Ethereum (ETH) | ≈ $3,139 | ↑ 3.4 % |

| Solana (SOL) | ≈ $135.8 | ↓ 1.4 % |

| BNB (Binance Coin) | ≈ $903.10 | ↑ 0.8 % |

| XRP (Ripple) | ≈ $2.09 | ↓ 4.9 % |

Crypto markets were mixed this week, with total capitalization holding near $3.7 trillion but showing signs of cooling after several weeks of elevated activity. Trading volumes remained healthy, though positioning shifted as investors reassessed risk and rotated across sectors.

Bitcoin was roughly flat on the week, ending near $91,400 as volatility compressed following recent drawdowns. Ethereum outperformed the majors, rising about 3.4% to roughly $3,139 on steadier flows into staking and L2 activity. Solana slipped 1.4% to around $136, reflecting lighter risk appetite in higher-beta assets. BNB edged higher by 0.8% to about $903, while XRP declined 4.9% to approximately $2.09 after a stretch of strong inflows earlier in the quarter.

Sector performance diverged. The GMCI Layer-1 Index rose 0.9% to 152.39, supported by modest strength across several mid-cap smart contract platforms. DeFi lagged, with the GMCI DeFi Index falling 4.0% to 55.98 as liquidity rotated out of smaller protocols and into the majors.

Crypto News

Vanguard Opens the Door to Crypto ETFs

On December 3, 2025, Vanguard said it will allow clients to buy approved cryptocurrency ETFs on its platform, ending a long stretch of firm opposition. For years, Vanguard dismissed crypto as unsuitable for the kind of low-cost, long-horizon portfolios it promotes, keeping Bitcoin and Ethereum products off the menu even as BlackRock, Fidelity, and Morgan Stanley leaned into the space.

The shift marks a structural milestone. Vanguard’s endorsement signals that crypto ETFs have reached a level of regulatory maturity and market depth that even the most conservative asset managers can no longer ignore.

For the industry, the move has a downstream effect: millions of investors who never opened a crypto exchange account can now gain exposure through the same interface where they hold equities, bonds, and index funds. Advisors -many of whom rely on Vanguard for core allocations - gain a compliance-friendly mechanism to introduce Bitcoin and Ethereum exposure without rerouting clients through unfamiliar custody setups.

As access becomes standardized, digital assets begin to resemble other maturing asset classes that went through a similar progression, such as emerging-markets equities, high-yield credit, and REITs. Each started as a niche held mostly by specialists before gaining institutional acceptance and ultimately becoming part of mainstream portfolio construction.

Kalshi Raises Major Growth Round

Kalshi closed a significant growth round this week, backed by leading trading firms and long-only institutions. The $1B+ raise strengthens Kalshi’s position as the only fully CFTC-regulated event-contracts exchange in the United States. Founded by Tarek Mansour and Luana Lopes Lara, the company is benefiting from rising demand for structured ways to trade outcomes tied to politics, macro data, and real-world events.

The timing matters. Over the last few years, crypto-native platforms like Polymarket proved that markets can efficiently price expectations around major blockchain events.

Users routinely trade on questions such as whether the next Ethereum upgrade will ship on schedule, when a Bitcoin ETF will be approved, if stablecoin legislation will pass, or whether networks like Solana or Avalanche will hit specific user or activity milestones. These markets shaped a new style of trading, one built around probabilities rather than directional bets.

Kalshi’s expansion brings a regulated counterpart to that ecosystem. Institutions that avoided prediction markets because of compliance risks now have a venue operating under familiar rules, while crypto traders see the validation of a model they adopted early. The raise signals that event-driven trading is becoming part of mainstream financial architecture, not a niche experiment.

If Kalshi succeeds in scaling liquidity and broadening its product set, the line between TradFi prediction markets and crypto’s event-based venues will continue to blur.

Solana Rolls Out Local Fee-Market Upgrade

Solana shipped a new runtime update this week aimed at improving network reliability during periods of heavy demand. The upgrade refines how local fee markets allocate blockspace, allowing validators to price congestion at the level of individual accounts and program IDs rather than across the entire network. This isolates traffic spikes — mints, trading surges, or bot activity — so they don’t degrade performance for unrelated applications.

The timing is notable. SOL has pulled back recently after an extended run, and periods of volatility tend to expose the network’s weak points as activity clusters around liquid staking protocols, perps venues, and high-volume DEXs.

During the drawdown, validators reported more predictable transaction inclusion and fewer congestion spillovers under the new model, which helped stabilize the user experience even as trading intensity jumped.

For developers, the change reduces the randomness around transaction execution that used to appear during peak activity. For users, it means fewer dropped transactions and more consistent fees — a long-standing friction point during volatile market windows.

As Solana continues to attract high-throughput applications, these kinds of upgrades are essential: they let the network absorb traffic spikes driven by price swings without forcing the entire system into elevated fees or degraded performance.

Kraken and Deutsche Börse Announce Strategic Partnership

Kraken and Deutsche Börse announced a partnership this week that will connect Kraken’s regulated digital asset exchange and custody services with Deutsche Börse’s institutional client network. The collaboration centers on integrating Kraken’s spot crypto trading and licensed custody into the same access points European banks and asset managers already use for clearing, settlement, and market data through Deutsche Börse.

The agreement gives financial institutions a way to route crypto orders and hold digital assets without building new operational workflows. Deutsche Börse will distribute Kraken’s market data through its existing channels, and firms can rely on Kraken’s German-regulated custody entity rather than establishing their own wallet or key-management infrastructure.

This setup mirrors the structure institutions use for trading equities or derivatives, removing one of the main obstacles that slowed European adoption. The partnership also positions Deutsche Börse to expand its digital asset offering beyond its earlier tokenization pilots by adding live trading and custody through a regulated crypto venue.

For Kraken, it provides direct exposure to a large base of institutional clients that cannot—or will not—connect to exchanges outside established market operators.

This is a concrete step toward standardizing crypto access for European institutions: familiar routes, recognizable infrastructure, and fewer bespoke integrations

Token of the Week

Filecoin (FIL) remains one of the more distinctive networks in the crypto ecosystem because of its focus on decentralized data infrastructure. Rather than competing directly with smart-contract platforms, Filecoin was designed to store large datasets across a distributed network of operators, creating a permissionless alternative to centralized cloud storage.

Over time, that foundation has evolved into something broader: a platform aiming to support both data storage and the compute workloads that rely on that data. A major part of Filecoin’s long-term roadmap is decentralized compute — the ability to run AI inference, data processing, and other compute-heavy tasks directly on top of datasets already stored in the network.

This gives Filecoin a clear entry point into the expanding overlap between blockchain and artificial intelligence. Instead of relying on traditional cloud providers, applications can keep their data and computation within a verifiable environment, which is particularly relevant for enterprises concerned with provenance, auditability, or regulatory requirements around sensitive data.

FIL is down more than 80% this year, a reset that reflects how aggressively the market had priced in the “decentralized AI infrastructure” narrative earlier in the cycle. The drawdown hasn’t changed much about what’s being built: storage providers continue to expand capacity, more datasets are moving onto the network, and early-stage teams are still testing compute frameworks that sit on top of Filecoin’s storage layer.

For readers interested in areas of crypto that are not strictly financial, and that have real-world technical applications, Filecoin is a compelling case study. It sits at the intersection of data, compute, and trust-minimized infrastructure, and its evolving role in the AI stack makes it one of the more quietly important protocols to watch.

Closing Thoughts

The next version of Vester is being shaped around one idea: clearer market understanding through better visuals.

As we extend token coverage and bring in new datasets from both crypto and traditional markets, the goal is to give users a more immediate sense of how different parts of the ecosystem connect — whether it’s shifts in wallet behavior, changes in sector flows, or correlations that aren’t obvious at first glance.

These additions will make the interface feel more alive, with visuals that adapt as conditions change rather than waiting for static reports. Taken together, these updates move Vester toward a broader objective: presenting the full market in a way that feels coherent rather than scattered.