- The Vester Pulse

- Posts

- Trust the Oracle. Follow the Token.

Trust the Oracle. Follow the Token.

Chainlink brings the state on-chain. Trump brings CRO to the masses.

Happy Labor Day, the team at Vester hopes that you have had an excellent long-weekend with friends and family.

Some massive developments hit crypto this week - none bigger than the U.S. government’s move to publish official economic data directly on-chain through Chainlink ($LINK) and Pyth ($PYTH).

In this edition of Vester Pulse, we break down the stories that shaped the market and why they signal a shift in how crypto and institutions now interact.

Vester Updates

No major product drops this week, but we’ve spent the last couple of weeks planning what the rest of the year will look like at Vester. Over the next few weeks, we’ll be outlining the next phase of the product, reconnecting with early users, and having some important conversations around how we scale what we’ve built.

If you’ve been following along quietly, now’s a good time to lean in - exciting things are taking shape, and we’ll have more to share soon.

Market Updates

Market Overview — September 1, 2025

| Segment | Current Value | Change (7D) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.88 T | ↓ ≈ 1.3 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 91.9 | ↓ 3.2 % |

| Layer-1 (GMCI L1 Index) | 199.9 | ↓ 1.1 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $109,601 | ↓ 2.1 % |

| Ethereum (ETH) | ≈ $4,471 | ↓ 3.5 % |

| Solana (SOL) | ≈ $203.2 | ↑ 0.4 % |

| BNB (Binance Coin) | ≈ $864.0 | ↑ 0.1 % |

| XRP (Ripple) | ≈ $2.83 | ↑ 4.6 % |

Crypto News

Crypto markets eased modestly over the past week, with total capitalization slipping to $3.88T (−1.3%). Bitcoin declined 2.1% to ~$109.6K, while Ethereum dropped 3.5% to ~$4.47K. Among majors, Solana (+0.4%) and BNB (+0.1%) held steady, while XRP led gains with a 4.6% increase.

Sector performance was mixed. The GMCI DeFi Index declined to 91.91 (−3.15%) amid continued drawdowns in major protocols, while the GMCI Layer-1 Index edged slightly lower to 199.86 (−1.14%), reflecting muted strength across base-layer assets.

Overall, activity remains selective. While some majors showed resilience, DeFi weakness and waning momentum point to a consolidating environment heading into September.

Make CRO Great Again

In its most audacious move yet, Trump Media & Technology Group is diving headfirst into digital assets with a $6.4 billion partnership centered on Crypto.com's native token, $CRO. A newly formed entity, Trump Media Group CRO Strategy, Inc., will manage a treasury holding one billion dollars in $CRO, backed by $200 million in cash, equity warrants, and a massive $5 billion credit line.

The initiative is built for the long haul, with core stakeholders like Trump Media, Crypto.com, and their SPAC partner, Yorkville, agreeing to a one-year lockup on their holdings. After that, their assets will unlock in phases over three years. The sheer scale and structure of this deal make it one of the largest corporate investments ever into an altcoin.

The most critical piece, however, is the integration. CRO won't just sit on the balance sheet; it's set to become the lifeblood of the Truth Social platform. The token will be woven into the site’s rewards programs, subscription payments, and digital wallet tools. This strategy directly links media engagement with the token's real-world use.

The goal is to create a powerful economic flywheel. As users earn and spend CRO on the platform, they drive up demand for the token. In turn, the value of Trump Media's own holdings grows, allowing equity holders to capture the upside. It's a hybrid of token monetization and what could be called an ideological capital market.

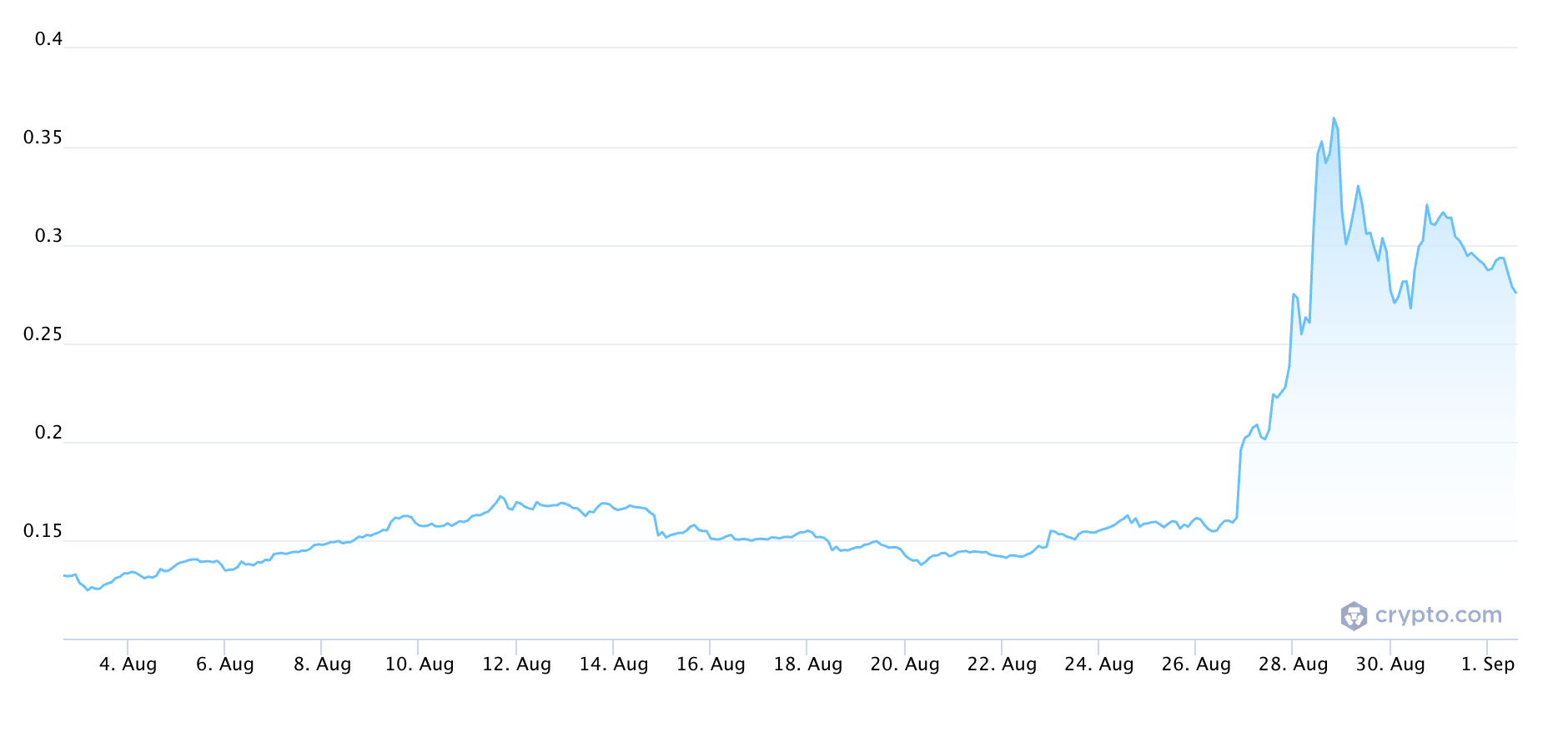

This move doesn't come out of nowhere. It builds on the Trump family's increasing involvement in crypto, which includes a reported $2 billion Bitcoin reserve strategy and an exploration of stablecoins. With the CRO initiative, Trump Media is signaling a clear shift from simply commenting on crypto to building real infrastructure around it. The effect on the price of $CRO was immediate as you can see below, although it has come back to earth in the last 24 hours.

The implications for the crypto world are significant. This is the clearest sign yet that tokens are evolving into tools for brand building and political identity. Corporate altcoin treasuries, once limited to crypto-native companies, could become common in media and culture, especially when tied to powerful distribution networks. CRO is being repositioned from a simple utility token into the monetization engine for a digital nation.

While traditional finance debates Bitcoin ETF allocations, Trump Media is embedding token economics directly into the user experience. If this model succeeds, it won't just change the perception of altcoins; it could fundamentally redefine how influence is bought and sold in a tokenized world.

U.S. Government is On-Chain

The U.S. government has started publishing its official economic data directly onto public blockchains. Key stats like Real GDP and the PCE price index are now live on-chain, verified and distributed by Chainlink and Pyth.

For the first time, government-verified numbers are available directly to smart contracts across networks like Ethereum, Solana, Avalanche, and Optimism.

Chainlink is handling six key metrics, including headline levels and percent changes, all published in real time. Pyth is focusing on GDP, offering live feeds and five years of historical data. Both are collaborating directly with the Department of Commerce’s Bureau of Economic Analysis, which sees this as a move toward making economic data universally accessible and tamper-proof.

This isn't about token pumps or branding; it's about fundamental infrastructure. With economic data on-chain, DeFi protocols can now use real-world metrics in lending markets, automated trading, or structured products.

Smart contracts can be tied to actual inflation rates, and Treasury-backed stablecoins can automatically adjust their yields. Prediction markets can now resolve based on official data, not unreliable APIs or delayed indexes.

The move also signals a major shift in the government's approach. The U.S. isn’t just regulating crypto; it’s participating in the ecosystem. Chainlink and Pyth are no longer just startups experimenting with oracles; they're becoming critical middleware for government-to-protocol communication. The market took notice. Chainlink’s token rose modestly, while Pyth spiked over 50%.

This could be the beginning of programmable macroeconomics, where code doesn't just react to price, but to policy, growth, and inflation. With Chainlink and Pyth acting as the rails, the next economic data release may not just move markets; it might execute them.

Raising from a Position of Power

This week, newly released Q2 funding data confirmed that venture capital is still flowing into crypto - but it’s flowing differently. According to Outlier Ventures, Web3 startups raised $9.6 billion globally last quarter, making it the second-highest quarter on record. That’s up sharply from Q1, and nearly double the same period last year.

What’s changed isn’t just the amount, but the focus. The largest deals went to infrastructure-heavy companies: platforms for real-world asset tokenization, regulated stablecoin issuers, Ethereum scaling tech, and custody solutions. Investors are prioritizing compliance, interoperability, and institutional readiness over consumer-facing hype.

U.S.-based companies featured prominently. One custody provider closed a $400 million Series C backed by Fidelity and BNY Mellon. A regulated stablecoin platform raised $250 million in a growth round led by Sequoia and Franklin Templeton. These aren’t early-stage experiments. They’re mature raises tied to institutional product pipelines.

The timing matters. These deals were signed during a quarter shaped by regulatory uncertainty, macro tension, and a reset in retail volumes. But that didn’t slow capital allocation. If anything, legislation like the GENIUS Act gave U.S. investors and builders the green light to go bigger. With a clearer regulatory path, capital is now aligning behind companies positioned to serve banks, enterprises, and public market infrastructure.

The UK is in Crypto Purgatory

The UK is facing growing pressure to regulate stablecoins. This week, over 50 crypto executives, including leaders from Coinbase, Kraken, and Fireblocks, sent an open letter to Chancellor Rachel Reeves demanding clear rules. Their message was blunt: without a regulatory path, the UK risks its future in digital finance.

This warning is timely, as other regions are already moving forward. The U.S. has passed the GENIUS Act, creating a legal framework for dollar-backed stablecoins. Similarly, the EU has already approved its first euro-denominated stablecoin, EURAU, under its MiCA rules. These are not just symbolic gestures; they are shifting significant financial volume.

Currently, the stablecoin market is dominated by the U.S. dollar, with USDT and USDC making up roughly 90% of the market and settling over $700 billion monthly. The euro is also gaining ground following the EU's MiCA rollout.

In contrast, the UK is being left behind. Pound-backed stablecoins account for less than 0.01% of the total supply because the necessary infrastructure and framework don't exist.

This has serious consequences. Every pound used in the crypto market must be converted into dollars or euros, forcing UK users to rely on foreign currencies and regulations. Britain isn't just losing relevance; it's losing control over the financial foundation of its own fintech ecosystem.

Ironically, the UK still promotes itself as a fintech leader, but that claim is beginning to ring hollow. Regulation is no longer about appearances; it's about access. The message from the industry is clear: if the UK doesn't act quickly, it won't just be late to stablecoins, it will be locked out of the next generation of financial infrastructure.

Closing Thoughts

The U.S. government publishing economic data onchain might read as a technical update - but the long-term implications are anything but minor. It marks a shift in how institutions interact with crypto: not just regulating it, but using it as a delivery mechanism for information that markets depend on.

When official data feeds are available directly to smart contracts, new capabilities emerge. Lending terms can adjust with inflation. Derivatives can settle on GDP. Market logic starts reacting to trusted inputs, not stale reports or third-party APIs.

More importantly, it suggests that blockchains aren’t just financial tools - they’re becoming part of how the world communicates facts. This isn’t about token prices or headlines. It’s about what happens when core economic signals live inside systems designed for composability, transparency, and automation.

Thank you for reading, see you next week.