- The Vester Pulse

- Posts

- TradFi Is Building the Rails This Time

TradFi Is Building the Rails This Time

The line between Wall Street and Web3 just got thinner

Vester Updates

This week, we introduced one of our most requested features — the ability to share Vester dashboards. Users can now send fully interactive dashboards directly to others, allowing anyone to view live charts, data summaries, and token analyses without leaving their browser.

It’s a major step toward making Vester collaborative, turning individual research into something that can be discussed, compared, and built on in real time.

Public and social media sharing are coming soon, enabling dashboards to be posted seamlessly across platforms and shared with the broader community.

Market Updates

Market Overview — November 2, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.82 T | ↓ 1.3 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 70.4 | ↓ 10.4 % |

| Layer-1 (GMCI L1 Index) | 191.3 | ↓ 5.8 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $110,264 | ↓ 3.8 % |

| Ethereum (ETH) | ≈ $3,876 | ↓ 7.1 % |

| Solana (SOL) | ≈ $186.5 | ↓ 7.0 % |

| BNB (Binance Coin) | ≈ $1,081.8 | ↓ 5.1 % |

| XRP (Ripple) | ≈ $2.5 | ↓ 5.2 % |

Crypto markets declined this week, with total capitalization slipping to roughly $3.82 trillion, down 1.3% from the previous week. The pullback followed renewed profit-taking across major assets and softer risk sentiment globally, as investors rotated out of higher-volatility crypto positions amid mixed macro signals.

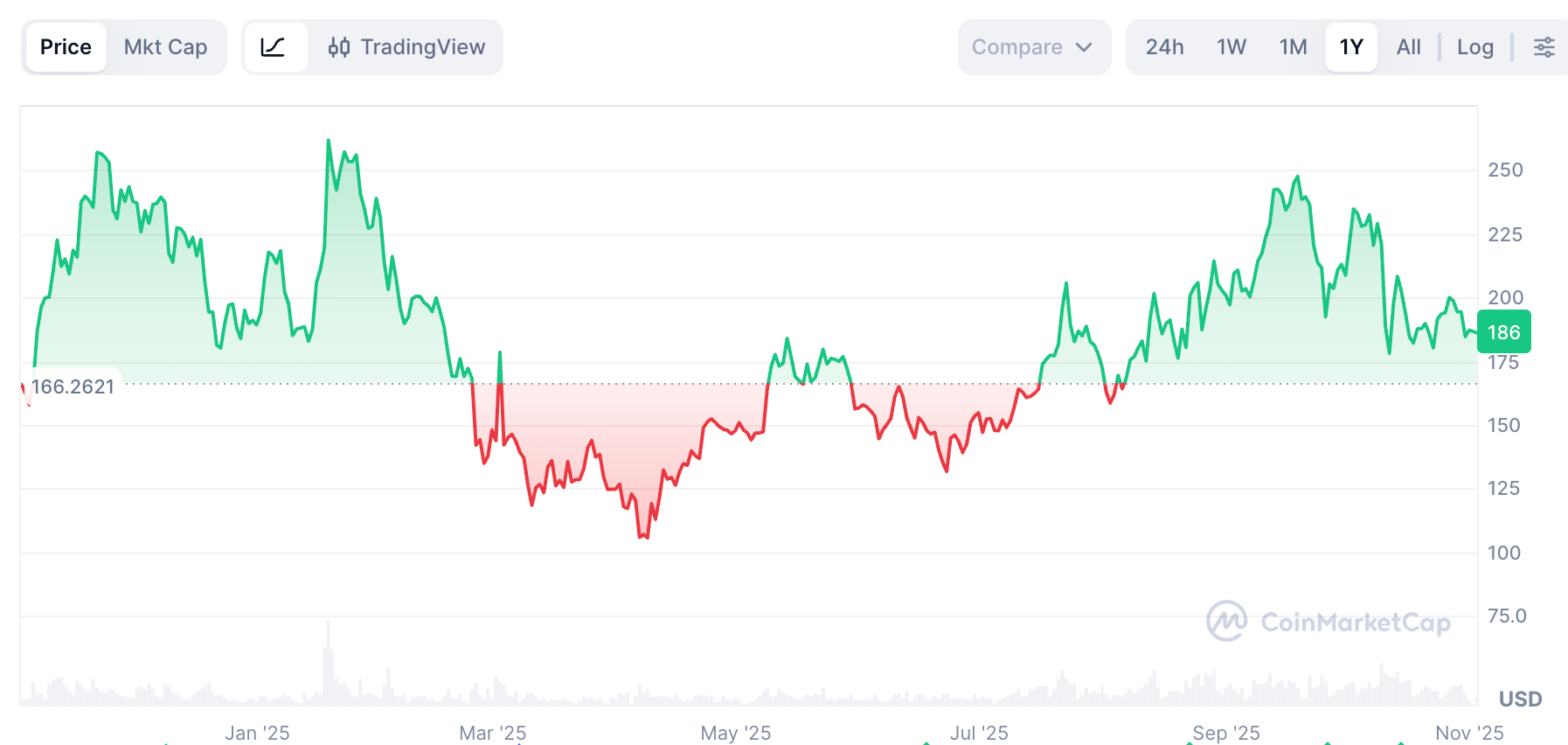

Bitcoin fell 3.8% to around $110,264, while Ethereum declined 7.1% to trade near $3,876. Solana retreated 7.0% to $186.5, reflecting broad weakness in Layer-1 ecosystems, while BNB slid 5.1% to $1,081.8 after several weeks of relative stability. XRP dropped 5.2% to $2.5, giving back part of its recent gains as trading volumes normalized.

Sector indices also moved lower. The GMCI Layer-1 Index fell 5.8% to 191.3, weighed down by weakness in Ethereum and Solana. The GMCI DeFi Index declined 10.4% to 70.4, as governance tokens and on-chain lending assets faced renewed selling pressure following several weeks of strong inflows.

Overall, markets entered a brief consolidation phase after October’s sharp recovery, with investors taking profits and repositioning ahead of upcoming macro data and regulatory developments.

Crypto News

Securitize to Go Public in SPAC Deal

The tokenization of real-world assets (RWAs) took a decisive step into mainstream finance this week after Securitize announced plans to go public through a $1.25 billion merger with Cantor Fitzgerald’s SPAC, Cantor Equity Partners II. The deal marks the first time a regulated tokenization platform will enter public markets, giving investors direct exposure to one of crypto’s most promising bridges to traditional finance.

The transaction is expected to close in the first half of 2026 and will raise roughly $469 million in gross proceeds, including $225 million from a private investment round and $244 million held in the SPAC trust. Once completed, the combined company will trade on Nasdaq under the ticker SECZ.

Securitize has quietly become the dominant player in the RWA infrastructure space, processing more than $4 billion in tokenized assets to date. The firm has partnered with major institutions - including BlackRock, KKR, and Apollo Global Management - to tokenize fund shares, private credit, and alternative assets. In a first-of-its-kind move, Securitize also plans to tokenize its own equity as part of the listing, allowing a portion of its public shares to exist on-chain.

The company projects the total addressable market for tokenized securities at $19 trillion across equities, fixed income, and alternatives. The listing provides one of the clearest benchmarks yet for the RWA sector’s institutional adoption. What began as a DeFi experiment is now being formalized into the capital markets framework.

Solana ETFs Attract Nearly $200 Million in First Week of Trading

The first U.S. spot Solana exchange-traded funds launched to heavy demand, pulling in almost 200 million dollars in net inflows during their opening week.

The two funds, Bitwise’s BSOL and Grayscale’s GSOL, began trading at the start of the week and quickly drew institutional interest. Signaling that appetite for exposure to Solana’s ecosystem extends beyond direct token purchases.

Bitwise’s BSOL accounted for the majority of inflows, attracting over 190 million dollars across the first several sessions. Grayscale’s GSOL, which converted from an existing Solana trust, brought in roughly two million dollars over the same period. Combined assets under management for the two funds now exceed 500 million dollars.

Both ETFs include staking components, allowing investors to capture Solana’s native yield without managing the technical complexity of on-chain participation. BSOL passes through staking rewards directly, while GSOL retains a portion as part of its management structure. This feature gives the products a yield advantage over most other spot crypto ETFs currently available in the United States.

The strong debut came even as the price of Solana’s native token fell about eight percent during the week (see below), suggesting inflows were driven by longer-term positioning rather than speculative trading.

Trading volumes were among the highest for any non-Bitcoin crypto ETF launch to date, with early flows coming from a mix of institutional desks and retail brokerage accounts.

After years of focus on Bitcoin and Ethereum, capital is now beginning to flow into other blockchain networks through traditional investment vehicles.

EU Set to Expand Supervision of Stock and Crypto Exchanges

The European Union is preparing to grant the European Securities and Markets Authority (ESMA) direct oversight over major stock exchanges and crypto platforms operating across member states, marking one of the most significant regulatory shifts since the introduction of MiCA.

Under the plan, ESMA would assume supervisory authority over “systemically important” trading venues, clearinghouses, and crypto-asset service providers (CASPs) that operate cross-border. The move is designed to reduce regulatory fragmentation within the bloc, and strengthen investor protection by unifying standards under a single European regulator.

Currently, each member state regulates crypto firms licensed under MiCA, with local authorities responsible for compliance and enforcement. The new proposal, expected to be formally introduced in early 2026, would centralize oversight within ESMA for entities whose activities extend beyond national borders. This would bring major exchanges such as Bitstamp, Kraken Europe, and Binance’s EU operations under ESMA’s direct supervision.

France and Germany have pushed strongly for the change, arguing that centralization is necessary to improve market integrity and competitiveness against the United States and Asia. Smaller jurisdictions such as Malta and Luxembourg have voiced opposition to the proposal. Their regulators argue that transferring authority to ESMA could weaken national innovation hubs and create additional layers of bureaucracy.

For the crypto industry, the implications are substantial. Centralized supervision would raise compliance expectations, likely ending the era of regulatory arbitrage between EU member states.

Mastercard to Acquire Zero Hash

Mastercard is finalizing an agreement to acquire Zero Hash, a Chicago-based crypto infrastructure provider, in a deal valued between $1.5 billion and $2 billion. The acquisition would bring one of the industry’s most established settlement and tokenization platforms directly under the Mastercard umbrella, expanding the company’s reach into digital asset infrastructure at a global scale.

Founded in 2017, Zero Hash provides the underlying plumbing that allows fintechs, brokerages, and banks to offer crypto and stablecoin services. Its APIs enable clients to handle everything from crypto trading and custody to stablecoin settlement and on-chain transfers without managing the regulatory burden themselves. The company holds money transmitter and virtual currency licenses across nearly every U.S. jurisdiction and powers operations for firms including Stripe, Interactive Brokers, and Robinhood.

Mastercard’s integration of Zero Hash would give it the ability to natively support blockchain-based settlement, bridging its existing card network with stablecoin and tokenized payment flows.

The acquisition builds on Mastercard’s broader expansion into blockchain services over the past several years. The company has developed its Multi-Token Network initiative and partnered with major stablecoin issuers to test cross-border settlements using on-chain infrastructure.

Zero Hash has raised over $100 million in funding to date and processed billions in monthly transaction volume. Its platform already supports more than 50 digital assets and multiple blockchains, allowing for conversion and settlement between fiat and crypto in real time. Bringing that capability in-house would allow Mastercard to offer its institutional partners and merchants instant settlement options.

If completed, the acquisition would mark one of the largest deals in crypto infrastructure history. While positioning Mastercard as a leader among legacy payment networks adapting to digital asset settlement.

Founder of Thodex Found Dead in Turkish Prison

Faruk Fatih Ozer, the founder of the defunct Turkish cryptocurrency exchange Thodex, was found dead in his cell at Tekirdag F-Type High Security Prison on November 1, 2025. Prison officials discovered Ozer during morning rounds and confirmed his death shortly after. Authorities are treating the case as a suspected suicide, though a formal investigation has been launched by the Tekirdag Chief Public Prosecutor’s Office.

Ozer had been serving an 11,196-year sentence after being convicted on multiple charges including aggravated fraud, money laundering, and leading a criminal organization. His conviction stemmed from one of Turkey’s largest financial scandals, in which the Thodex exchange abruptly halted withdrawals in April 2021 and Ozer fled the country. Leaving roughly 400,000 investors unable to access funds valued at more than 2.5 billion dollars. He was later captured in Albania in 2022 and extradited to Turkey the following year.

During his trial, Ozer claimed that the platform’s collapse was the result of hacking and liquidity problems rather than deliberate fraud. Turkish courts rejected his defense following extensive forensic analysis of exchange records. His siblings, who also held managerial positions at Thodex, were convicted alongside him on related charges.

Turkey ranks among the highest in global crypto adoption, with millions of citizens using digital assets as a hedge against inflation. Despite this widespread participation, regulatory oversight remains fragmented, and several domestic exchanges have drawn scrutiny for poor governance and weak internal controls.

Token of the Week

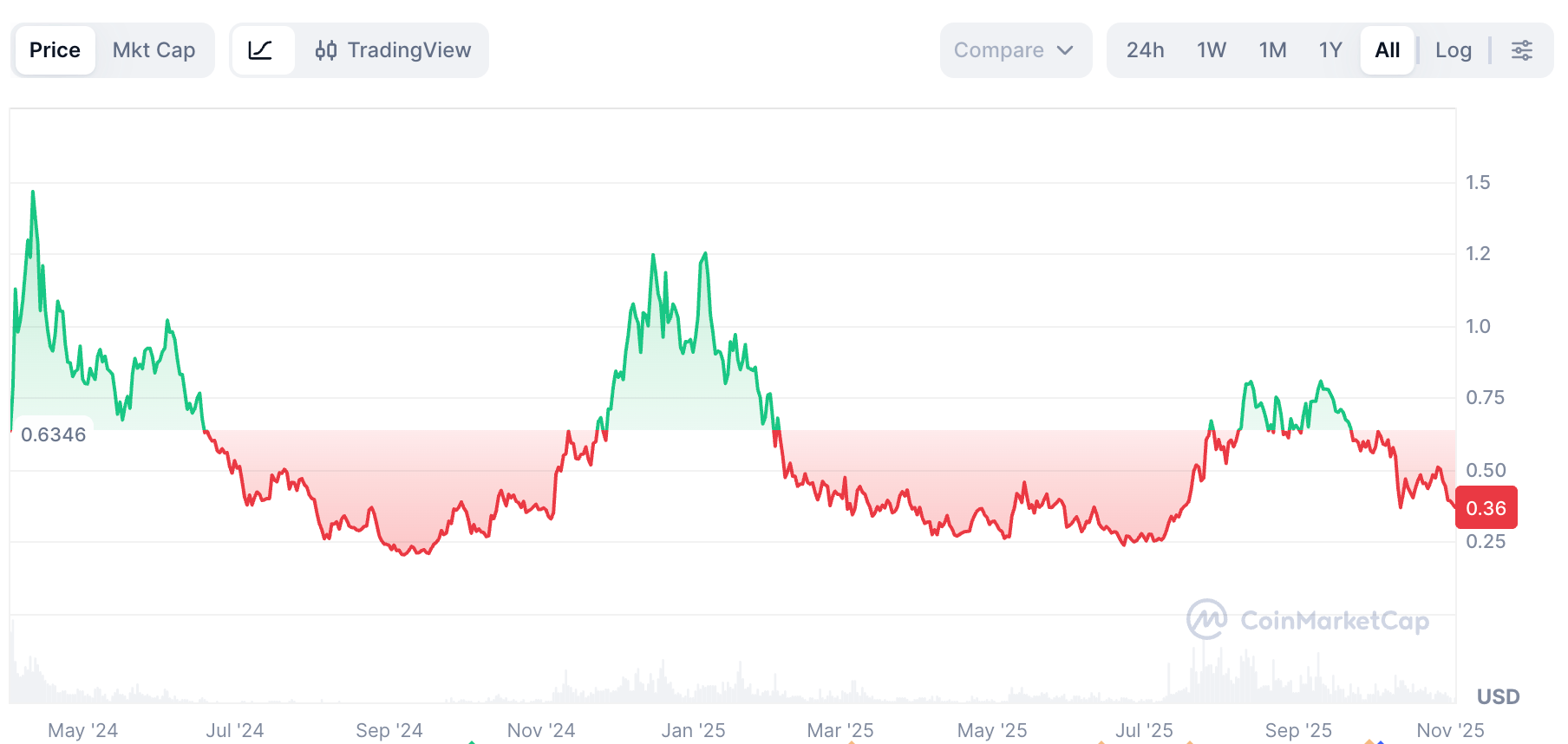

Ethena’s native token, ENA, has reemerged as one of the most actively traded assets in the infrastructure layer of crypto.

Ethena was built to create a fully collateralized on-chain dollar that is not dependent on traditional banking systems. Its flagship stablecoin, USDe, is backed by delta-hedged positions across centralized and decentralized venues, generating a yield from funding rate differentials rather than reserve assets. The model has drawn comparisons to algorithmic stablecoins of prior cycles, but with far more transparent risk management and liquid on-chain hedging.

The ENA token sits at the center of this design. It governs the protocol, accrues staking rewards, and is used to capture a portion of fees generated from USDe issuance. Circulating supply now stands above seven billion tokens, with a total cap of fifteen billion. Despite the increase, Ethena’s rapid growth in market share has offset dilution concerns. USDe’s supply has expanded to more than twelve billion dollars, making it one of the largest synthetic stablecoins in the market.

For investors, Ethena represents a new direction for yield-bearing stablecoin infrastructure. It aims to merge the liquidity and transparency of decentralized finance with the stability and composability of traditional dollar products.

Closing Thoughts

Try our product, and provide our team with feedback. Reach out to the founding team if you have any questions, comments, or feedback