- The Vester Pulse

- Posts

- Tokenized Stocks, Hijacked Wallets, and $500M on Chain

Tokenized Stocks, Hijacked Wallets, and $500M on Chain

What Nasdaq, npm, and HashKey revealed about crypto’s next phase

This week’s edition of Vester Pulse is arriving later than planned. A full plate of priorities pushed us to Tuesday, but we’ll return to our regular Sunday evening schedule next week.

Vester Updates

No major headlines this week. We've been heads down refining our core product.

We're focused on improving the performance of our existing agents (on-chain, news and sentiment, and the newly-shipped quant) and rolling out a few UI and UX enhancements based on user feedback.

A larger update is coming soon. We expect to share something more substantial and exciting in the next couple of weeks. Stay tuned.

Market Updates

Market Overview — September 8, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.88 T | ↑ ≈ 0.8 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 95.9 | ↑ 9.4 % |

| Layer-1 (GMCI L1 Index) | 202.10 | ↑ 4.3 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $112,066 | ↑ ≈ 0.9 % |

| Ethereum (ETH) | ≈ $4,306 | ~ 0.0 % |

| Solana (SOL) | ≈ $214.23 | ↑ ≈ 3.8 % |

| BNB (Binance Coin) | ≈ $878.28 | ↑ ≈ 0.2 % |

| XRP (Ripple) | ≈ $2.97 | ↑ ≈ 3.2 % |

Crypto News

Crypto markets drifted lower this week, with total capitalization slipping to $3.88 trillion. Bitcoin fell 1.4% to ~$112K, and Ethereum hovered flat around ~$4.3K. Most majors followed a similar pattern, with BNB and XRP posting modest gains, while Solana led among risers with a 3.8% weekly jump.

Sector performance was more divided. The GMCI Layer-1 Index climbed 4.3% to 202.10, while the GMCI DeFi Index surged 9.4% to 95.9 - marking its strongest weekly gain in over a month.

Flows continue to favor selective narratives. Layer-1 protocols and DeFi leaders showed renewed strength, even as broader market momentum remained rangebound.

Nasdaq Files to Tokenize Equities

Nasdaq submitted a formal rule change to the SEC this week that would allow tokenized versions of listed stocks and ETFs to trade directly on its main exchange. This marks the first serious attempt to integrate blockchain-based securities into the core of the U.S. financial system, without requiring separate infrastructure or new market rules.

Under the proposal, tokenized shares would be fully fungible with their traditional counterparts. They would share the same ticker, CUSIP, and legal rights. Orders would be routed through Nasdaq’s existing systems and settled through the Depository Trust Company.

There would be no changes to how trades are matched, cleared, or reported. The only difference is how the asset is represented at the ledger level.

Traders could choose tokenized settlement on a per-order basis. That choice would not affect execution, priority, or pricing. All surveillance, reporting, and compliance mechanisms would remain in place. The goal is to add programmability and ledger transparency without altering the structure of the market.

This is not a sandbox or pilot. If approved, the rollout could begin as soon as late 2026. Nasdaq is not asking for exemptions or rewriting the rules. It is proposing to fold blockchain settlement into the system that already works for trillions in assets.

The move comes as regulators begin to formalize their stance on tokenized financial instruments. While private firms and offshore exchanges have launched tokenized equity products in the past, they have typically lacked legal equivalence or operated outside of U.S. jurisdiction. Nasdaq’s filing would change that, creating a compliant path to tokenization at scale.

NPM Supply Chain Attacks

On September 7, 2025, a major software supply chain attack compromised widely -used npm packages- exposing millions of crypto users to silent wallet hijacking through poisoned JavaScript dependencies.

The attack originated from a compromised maintainer of the Nx project. With access to their credentials, attackers published malicious updates to foundational packages like chalk, debug, and strip-ansi - utilities downloaded billions of times per week and embedded in everything from crypto dashboards to DeFi frontends.

Injected code targeted browser environments, monitoring for copied wallet addresses and replacing them with attacker-controlled ones. Users who pasted without verifying risked sending funds directly to malicious wallets.

Security teams at Ledger, MetaMask, and other infrastructure providers confirmed the breach’s scope. Ledger’s CTO called it “one of the most serious attacks we’ve seen - not for its complexity, but for how deeply these packages are integrated into the ecosystem.”

By the time it was discovered, at least 18 packages were compromised. Emergency patches were issued, repos locked down - but for many apps, the malicious code had already shipped.

This wasn’t just a JavaScript issue. It was a crypto-wide vulnerability - revealing how fragile the open-source foundation of Web3 can be. Expect urgent audits, hardened package controls, and heightened scrutiny of software supply chains going forward.

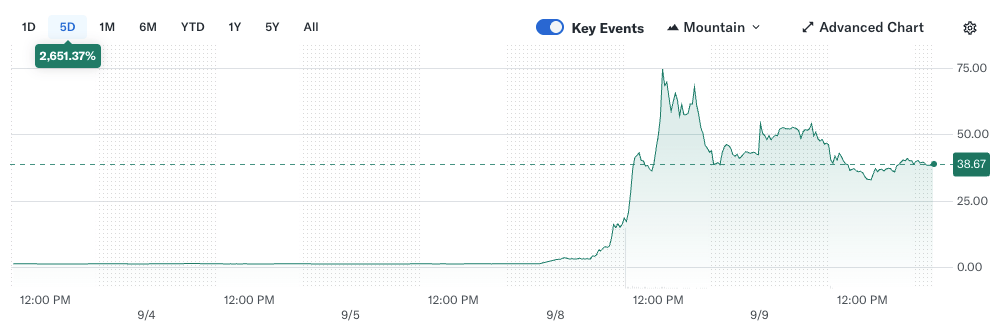

Worldcoin Surges after Acquisition

A landmark $270 million acquisition of Worldcoin (WLD) by Eightco Holdings triggered a massive rally this week, sending the token up nearly 50% in 48 hours.

The deal is far more than a simple investment; it involves a full rebrand of Eightco to "Orbs" and a complete strategic pivot to biometric identity. By establishing WLD as its primary treasury reserve, the newly formed Orbs is tying its financial stability directly to the success of the Worldcoin ecosystem.

The market's response was swift and decisive. Investors reacted enthusiastically not just to the size of the purchase, but to the deep operational integration it represents, which saw Eightco's own stock briefly surge by an astonishing 3,000%.

The move was further validated by the high-profile appointment of respected Wedbush analyst Dan Ives as chairman of the board. Ives, known for his influential coverage of tech giants, hailed the project as a foundational technology for AI-era authentication.

At its core, Worldcoin provides users a unique "IrisCode" ID after a physical eye scan, creating a secure and verifiable method for distinguishing humans from bots online. This mission is becoming increasingly critical in an internet saturated with AI-generated content and automated accounts.

The project has already onboarded over 16 million users globally and is pursuing an ambitious target of reaching 100 million by 2026.

Despite the bullish momentum, Worldcoin faces a significant hurdle in the form of regulatory scrutiny. Data privacy watchdogs in Europe and Africa have launched inquiries into how the project collects and handles sensitive biometric data.

However, the powerful investor response this week indicates a growing belief in Worldcoin's long-term utility and global reach, suggesting a conviction that the reward - a universally adopted digital identity system - may ultimately outweigh the risks.

HashKey Launches Treasury Fund

HashKey, Hong Kong’s largest licensed crypto exchange, announced the launch of a $500 million Digital Asset Treasury fund this week. The fund will focus on allocating long-term capital into Bitcoin and Ethereum, with an emphasis on institutional-grade custody and compliance infrastructure.

The strategy echoes MicroStrategy’s Bitcoin treasury model, but with a broader scope. HashKey plans to deploy capital across multiple mainstream assets and stablecoins, framing the initiative not as a bet on price, but as a structural shift toward holding crypto on corporate balance sheets.

The firm positioned the launch as a move to “anchor corporate treasury practices to the Web3 era,” offering a template for Asian companies looking to allocate into crypto in a regulated, defensible way.

Initial capital comes from a mix of internal reserves and outside partners. HashKey says it will manage the portfolio with daily liquidity and institutional custody standards, aiming to bridge the gap between traditional treasury models and on-chain assets.

The launch adds to Hong Kong’s broader efforts to position itself as a regulated hub for crypto capital formation. With the DAT fund, HashKey is effectively building a new benchmark - one where digital assets are treated not as speculative tools, but as core treasury components.

Token of the Week

We're starting a new section to spotlight under-the-radar tokens and projects.

While most of our coverage focuses on the top 30, there's a lot more happening across the crypto stack that deserves attention.

Pendle is worth mentioning as a protocol that lets users tokenize and trade future yield, creating a yield curve for on-chain assets. As interest rates climb and staking demand grows, Pendle allows users to lock in yield, speculate on forward APYs, or buy assets at a discount to their future returns.

TVL recently passed $400 million, fueled by ETH staking flows and growing institutional interest. With crypto’s fixed income layer starting to take shape…

Pendle may be positioned to capture that narrative, though like any emerging protocol, it carries risk.

Closing Thoughts

Crypto continued to move forward this week, as both a form of investment and as an ecosystem.

We help users track developments in real time, and make sense of the subsequent impact on the market. As mentioned we hope to share a major update or two next week!

See you this Sunday.