- The Vester Pulse

- Posts

- The Week Crypto Crashed

The Week Crypto Crashed

Tariffs sparked the drop, but adoption and inflows tell a different story

Vester Updates

We took a brief pause on The Pulse last week while the team was heads down meeting with investors, users, and early partners. The conversations have been energizing - they’re shaping where we take the product next and how to maximize the value we provide to users.

More to come on that soon…

Market Updates

Market Overview — October 12, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.9 T | ↓ 7.2 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | $75.3 | ↓ 16.4 % |

| Layer-1 (GMCI L1 Index) | $212.7 | ↓ 5.3 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $115,274.57 | ↓ 6.3 % |

| Ethereum (ETH) | ≈ $4,123.56 | ↓ 8.5 % |

| Solana (SOL) | ≈ $196.75 | ↓ 13.8 % |

| BNB (Binance Coin) | ≈ $1,289.43 | ↑ 10.9 % |

| XRP (Ripple) | ≈ $2.54 | ↓ 14.5 % |

Crypto markets crashed this week, with total capitalization falling to roughly $3.93 trillion. The selloff was triggered by renewed macro uncertainty after the United States imposed 100% tariffs on Chinese technology imports, sparking a broad risk-off move across global markets. The announcement drove a rapid unwinding of leveraged positions and triggered one of the largest liquidation waves in recent months.

Bitcoin fell 6.3% to about $115,275, while Ethereum declined 8.5% to around $4,124. Solana was hit hardest, dropping 13.8% to $196.75, as risk appetite evaporated across high-beta tokens. BNB managed to rise 10.9% to $1,289, supported by exchange-related demand and liquidity rotation, while XRP sank 14.5% amid broader weakness in large-cap altcoins.

Sector performance mirrored the market downturn. The GMCI Layer-1 Index slid 5.3% to $212.7, while the GMCI DeFi Index plunged 16.4% to $75.3, reflecting steep drawdowns in DeFi governance tokens and liquidity pools. Volumes across major DEXs fell sharply as traders de-risked and shifted to stablecoin positions.

Crypto News

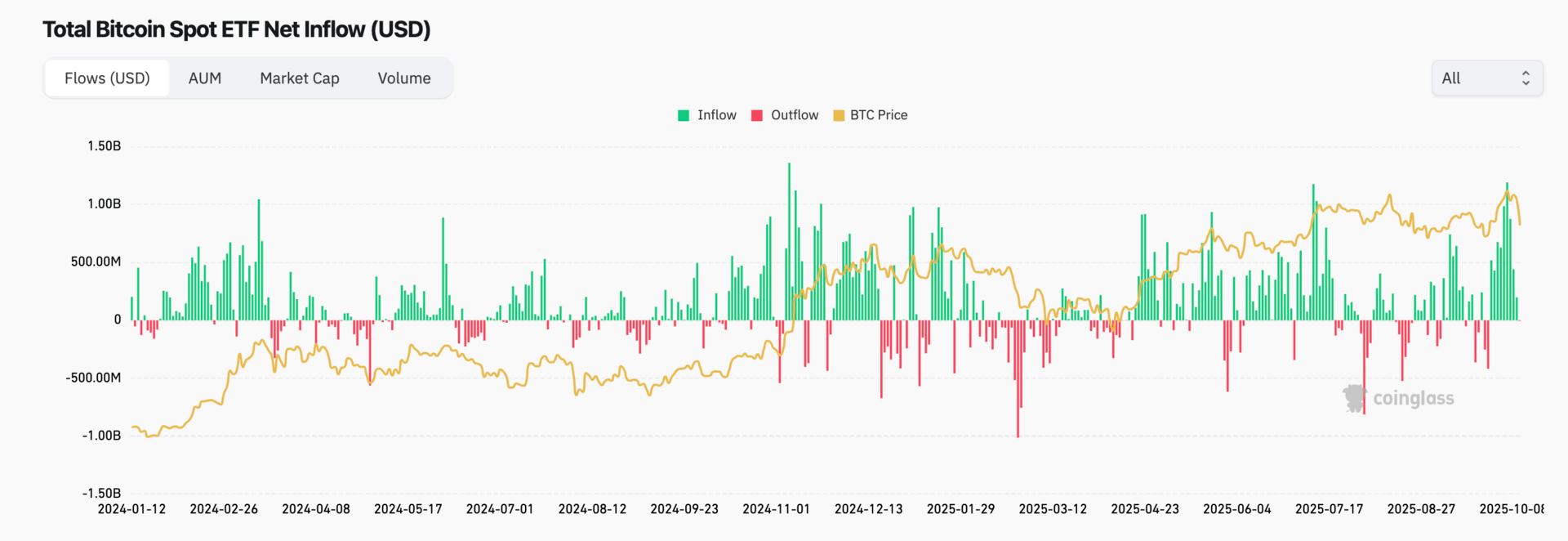

Record ETF Inflows Hit New Highs

Global crypto exchange-traded funds attracted record inflows during the week ending October 4, 2025, pulling in nearly $5.95 billion in new capital. The largest single-week total since ETFs entered the market. The majority of the inflows came from the United States, which accounted for roughly $5 billion, followed by Switzerland with $563 million and Germany with $312 million. The surge in demand coincided with Bitcoin reaching a new all-time high above $126,000, before it began to crash following the tariff news.

The continued growth of ETF participation reflects the deepening institutionalization of the market.

Traditional asset managers, pension funds, and wealth advisors are now actively allocating through regulated products, which are viewed as more secure and transparent than direct exchange exposure. The presence of multiple issuers across several regions suggests that adoption is expanding globally rather than being concentrated in U.S. markets.

Flows were led by BlackRock’s IBIT, which continues to dominate trading volumes among crypto ETFs and remains a preferred vehicle for institutional investors. Other issuers, including Fidelity, Bitwise, and VanEck, also saw sustained participation. Analysts note that inflows of this scale can have near-term impacts on liquidity and price discovery, especially as market makers hedge exposure through spot and futures markets.

While periods of heavy inflow have occasionally preceded short-term volatility, the broader takeaway is that ETF demand has become a structural feature of the crypto ecosystem. These vehicles now function as steady onramps for long-term capital, bridging the gap between traditional finance and digital assets through compliance, custody standards, and transparency.

As regulated fund flows continue to expand, tracking weekly inflows has become a key indicator of broader investor appetite and liquidity conditions across the crypto market.

S&P Launches Digital Markets 50 Index

S&P Dow Jones Indices has introduced a new benchmark called the Digital Markets 50, designed to measure the combined performance of digital assets and publicly traded companies operating in the blockchain and crypto ecosystem. The index includes 15 leading cryptocurrencies and 35 equities linked to the digital asset economy, providing investors with a diversified view of how both sectors move together.

Constituents on the equity side include firms such as Coinbase, Nvidia, MicroStrategy, Marathon Digital, and Block, while the crypto portion covers major assets like Bitcoin, Ethereum, Solana, and Avalanche. The index uses a hybrid weighting approach that adjusts for liquidity, market capitalization, and trading volume.

S&P has positioned the benchmark as a tool for asset managers seeking regulated exposure to the broader digital economy without the complexity of directly holding tokens.

A tokenized version of the index is also in development through a partnership with Dinari, allowing investors to access the benchmark on-chain in fractional form. This is one of the first instances of a major financial index being bridged directly to blockchain infrastructure.

By combining both on-chain and equity-based components, S&P is effectively treating blockchain and crypto as interdependent parts of the same investment universe.

ICE to invest up to $2 Billion in Polymarket

Intercontinental Exchange, the parent company of the New York Stock Exchange, has announced plans to invest up to $2 billion in Polymarket, the leading blockchain-based prediction market platform.

The partnership is structured as both a capital investment and a strategic collaboration focused on expanding regulated access to on-chain information markets. Polymarket allows users to trade shares representing outcomes of real-world events, from elections and policy decisions to financial market movements and sports.

Prices in each market reflect the aggregated probability of an event occurring, creating what many view as a decentralized forecasting tool. The platform currently operates on Polygon, with settlement handled through stablecoins.

ICE’s investment marks one of the most significant institutional endorsements of prediction markets to date. The exchange operator intends to leverage its regulatory experience, clearing infrastructure, and data network to help Polymarket scale to a broader audience while remaining compliant with existing financial laws. Sources familiar with the deal have noted that ICE will explore integrating prediction market data into its own analytics and index products over time.

By merging traditional exchange infrastructure with decentralized event contracts, ICE is effectively acknowledging that real-time prediction data could serve as a new category of financial signal. If executed successfully, this model could extend beyond entertainment or politics into areas like macro forecasting, credit risk assessment, and economic data prediction.

India to Pilot Deposit Tokenization

The Reserve Bank of India (RBI) has announced a pilot program to explore deposit tokenization, a move that could modernize the country’s banking infrastructure by introducing programmable, token-based representations of bank deposits.

The initiative will begin with a small group of commercial banks and aims to test how deposit tokens can be used for faster settlement, improved liquidity management, and more efficient interbank transfers.

Under the framework, banks will issue digital tokens backed one-to-one by customer deposits held at the institution. These tokens can be transferred between banks and financial platforms instantly, without the need for traditional payment rails such as RTGS or NEFT. The pilot will operate within a closed regulatory sandbox, ensuring that all tokens remain within the supervised banking network and are fully redeemable for fiat currency at par value.

The project represents a significant step in India’s broader digital finance strategy. While the RBI has already rolled out pilots for its central bank digital currency (CBDC), deposit tokenization differs in that it is commercial bank-led rather than central bank-issued. This structure allows for programmability and integration with decentralized platforms, while maintaining existing oversight mechanisms and balance sheet backing.

If successful, deposit tokenization could enable new use cases such as programmable payroll, automated trade settlement, and on-chain financial contracts that settle in tokenized rupees. It could also reduce settlement times from hours to seconds, streamline compliance reporting, and lower reconciliation costs for banks.

India’s pilot joins a growing list of global initiatives exploring tokenized banking assets, following similar experiments in Singapore, Switzerland, and the United Kingdom.

Morgan Stanley Expands Crypto Access

Morgan Stanley has announced that it will expand cryptocurrency investment access across its entire client base, allowing both retail and institutional accounts to allocate to digital assets through managed portfolios and approved funds. Previously, exposure was restricted to high-net-worth individuals with over $2 million in investable assets and a risk tolerance designation permitting alternative investments.

The new framework introduces tiered exposure limits based on investor profile. For retail and advisory clients, allocations to crypto-related assets are capped at 2–3% of total portfolio value, while institutional accounts may allocate up to 5–7%, depending on investment mandate and suitability assessment. The firm will continue to limit direct spot purchases but will offer exposure through spot ETFs, structured notes, and actively managed digital asset funds.

In its internal communication to advisors, Morgan Stanley described crypto as a strategic diversifier that can enhance long-term portfolio efficiency without materially increasing risk when capped at single-digit allocations. The firm emphasized the importance of regulated vehicles, custody security, and robust due diligence when constructing crypto-inclusive portfolios.

This expansion follows the bank’s ongoing partnerships with ETF issuers and crypto custodians, and comes amid increasing demand from clients seeking exposure to Bitcoin and Ethereum within traditional wealth management accounts.

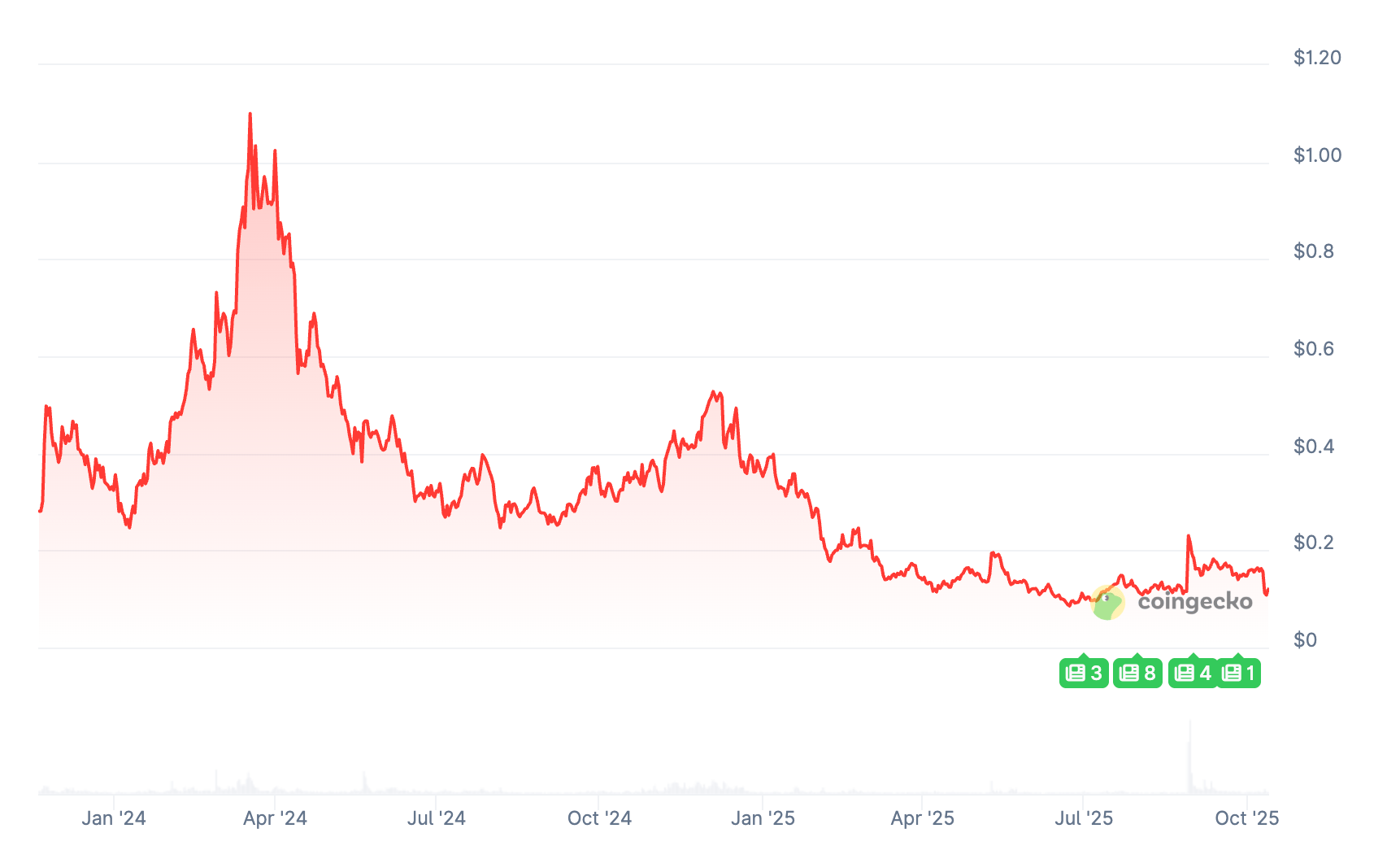

Token of the Week

Pyth Network (PYTH) is the native token powering one of the fastest-growing oracle networks designed to deliver high-frequency, real-world market data directly on-chain. The protocol aggregates price feeds from institutional data providers such as trading firms, exchanges, and market makers, and publishes them to more than 50 blockchains through its cross-chain messaging system, Wormhole.

Unlike traditional oracle networks that rely on off-chain aggregators, Pyth sources data directly from the origin, ensuring lower latency and higher data integrity. Its architecture is designed for applications requiring sub-second updates, including derivatives trading, perpetuals, and algorithmic market-making.

PYTH is used to govern the network, reward publishers, and fund the protocol’s data distribution system. Demand for the token scales with the number of data consumers using Pyth’s feeds, particularly as DeFi protocols and structured product platforms integrate its price updates to improve accuracy and transparency.

This week, Pyth saw increased integration activity, adding new data categories for equities, commodities, and foreign exchange. The expansion into traditional asset coverage highlights the protocol’s ambition to serve as a unified data layer for both crypto-native and institutional applications.

The main challenge for Pyth will be maintaining data quality and consistency as the number of publishers and supported chains grows. However, its focus on verifiable, low-latency information has positioned it as a core infrastructure component for next-generation on-chain finance.

Closing Thoughts

Morgan Stanley’s move to open crypto access across its full client base is a landmark moment for digital assets. It signals once and for all that crypto is no longer a side market for early adopters or high-net-worth clients.

It’s becoming part of the same portfolios that hold ETFs, bonds, and equities. As traditional firms extend access, a new wave of everyday investors and financial advisors will enter the space for the first time.

As the lines between traditional and digital finance blur - Vester’s platform is designed to simplify research, surface meaningful data, and translate crypto’s complexity into actionable understanding.

Our goal is to equip every investor - not just institutions - with the same level of insight and analytical power once reserved for the largest funds.

The Morgan Stanley announcement will have to be followed by all big wealth management firms before long in order to remain competitive.

Vester will be ready to help the wave of new investors seeking allocation within digital assets for the first time.