- The Vester Pulse

- Posts

- The Vester Pulse | July 20, 2025

The Vester Pulse | July 20, 2025

The End of "Crypto" as We Knew It.

This week brought a cascade of major developments within crypto: regulatory clarity, fresh institutional capital, and a surge in real-world assets migrating on-chain.

This powerful convergence marks the beginning of a new, more structured era for the entire asset class.

The pace of the market is frenetic. And while the excitement is palpable, it's nearly impossible to track even the headlines.

That’s why we write the Vester Pulse: to make sense of it all, as it happens.

Vester Updates

To help you navigate these developments, we're shipping updates to Vester.

This week, you can expect a major UX/UI refresh and a powerful new agent (more on that next week). We're also rolling out speed and quality improvements to Vester's core outputs.

At the same time, the community you're a part of continues to grow. Thank you to the several hundred of you who now follow our progress across Linkedin, Twitter, and Instagram.

Our goal is to provide value and drive engagement across every platform that matters for our users.

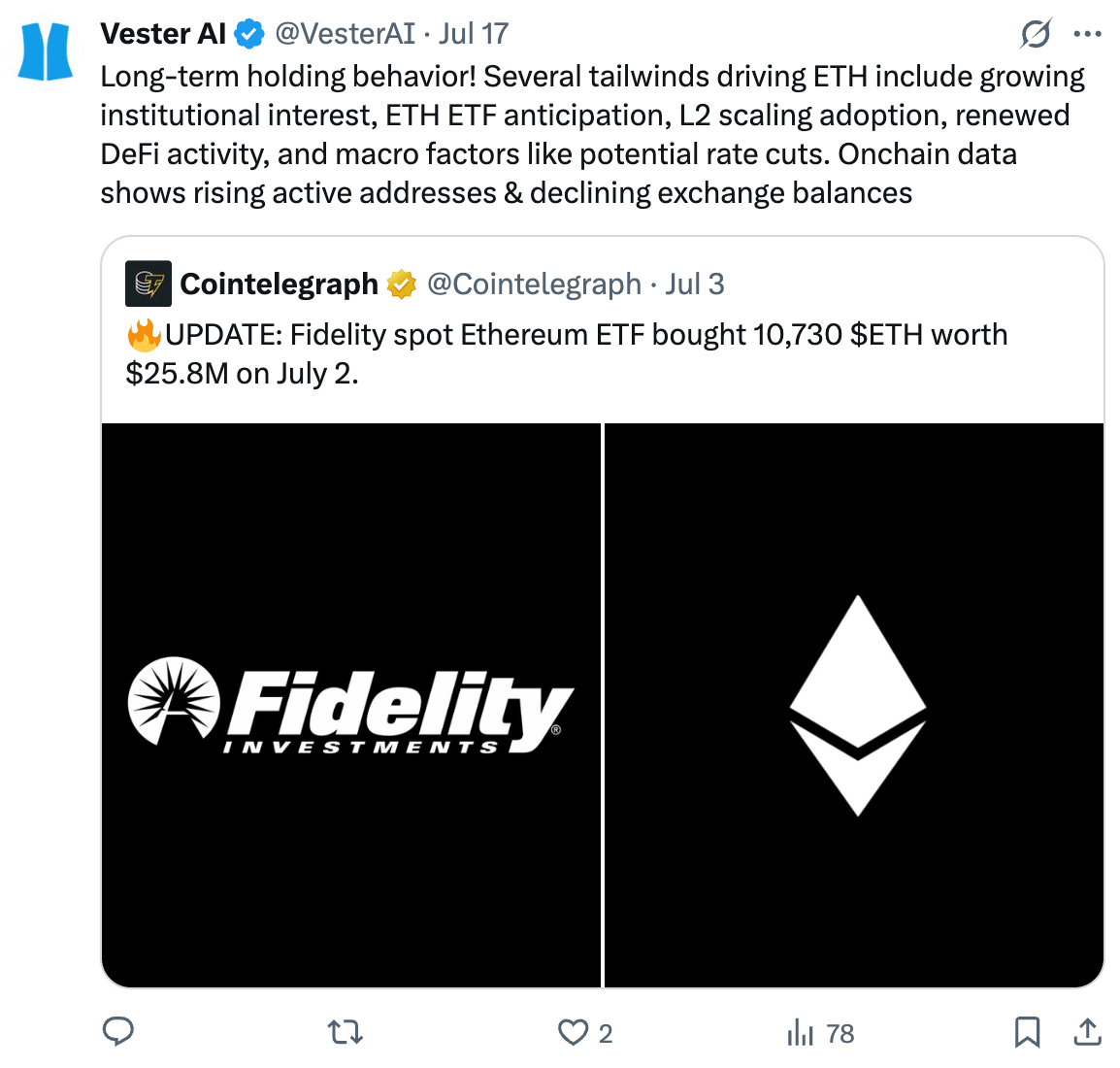

The tweet below is one example.

We’ll analyze major crypto developments, interpret key market data, and arm you with the insights that drive informed decisions.

Crypto News

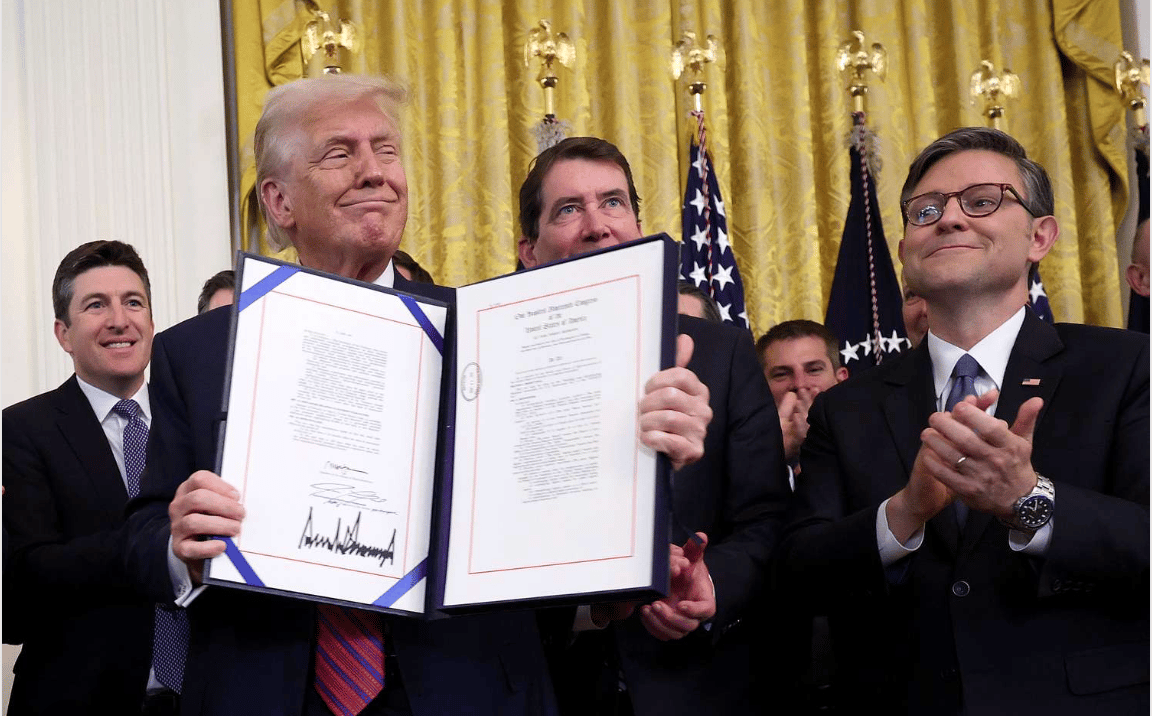

The First Real Crypto Law in the U.S

The most significant piece of crypto legislation in years was signed into law this week. The GENIUS Act establishes a federal framework for U.S. dollar–backed stablecoins, marking a turning point for how digital dollars are regulated and integrated into the broader financial system.

The law requires stablecoin issuers to maintain full one-to-one reserves, submit to monthly third-party audits, and comply with standard anti-money laundering protocols. It also prevents the Federal Reserve from issuing a central bank digital currency (CBDC) without congressional approval, removing a potential competitor to private stablecoins.

The GENIUS Act passed with strong bipartisan support and has already triggered a shift in sentiment among institutional allocators. For the first time, U.S. stablecoin rules are clear, predictable, and enforceable - something the industry has lacked for over a decade.

Expect to see major financial institutions begin to experiment more aggressively with tokenized dollars, payments, and settlement infrastructure.

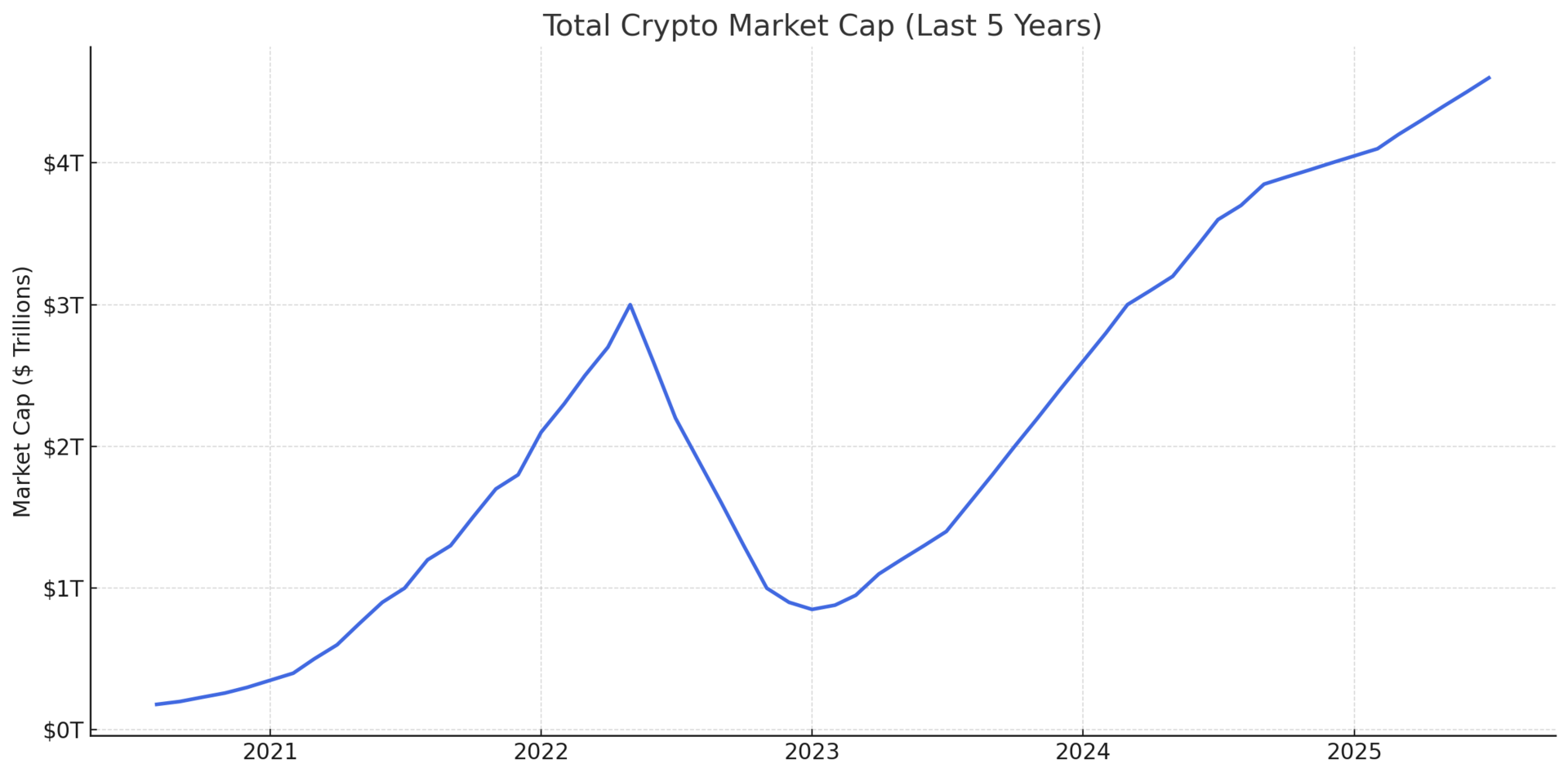

Crypto Market Cap Tops $4 Trillion

This week, the total value of crypto assets crossed $4 trillion, a historic first. But the number itself isn’t the headline. The real story is that this represents a genuine breakout past previous highs, driven by a fundamental shift in the market’s DNA.

Unlike the speculative fervor of past cycles, this ascent is anchored by deep, structural changes. The most telling sign is the quality of capital entering the space. We're seeing a steady expansion in the supply of regulated stablecoins like USDC, which function as the market’s 'cash reserves.' This isn't the fleeting retail money of yesteryear; it's patient, strategic capital being deployed through increasingly transparent channels.

Look closer, and you'll see this new liquidity is fueling a different kind of growth. While the 2021 rally was characterized by speculative froth, today's on-chain activity points to maturation. Surging DEX volumes, consistent developer contributions, and the growth of Layer 2 solutions show an ecosystem that is scaling and being used for sophisticated applications, not just trading memes.

The narrative has shifted from "what if" to "how to."

Coinbase Launches Smart Wallet

Let's be honest: for most people, using crypto on-chain has been a nightmare. The process of dealing with seed phrases, browser extensions, and confusing network fees has been the single biggest barrier to adoption.

This week, Coinbase launched its Smart Wallet with a clear goal: to tear that barrier down.

It completely overhauls the user experience. You can now create a self-custody wallet in seconds using a passkey, think Face ID or your fingerprint, right from your phone or computer. There’s nothing to install and no terrifying 12-word phrase to protect. Better yet, it makes transaction fees invisible to the user, so you can interact with apps on networks like Base without getting stuck.

This isn’t just an update; it’s a strategic move to set a new standard. Coinbase is betting that by making self-custody feel as easy as using a modern fintech app, its Smart Wallet will become the front door for the next wave of on-chain users.

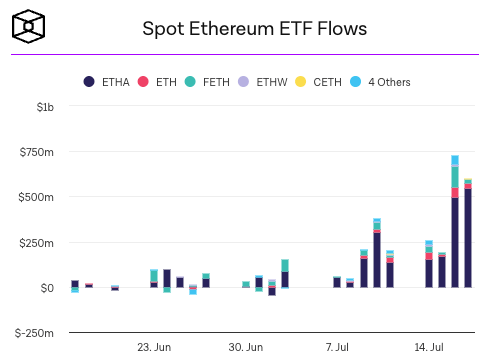

A Clear Surge in ETF Popularity

The story of this market right now isn't just the size of the inflows, but their accelerating velocity across the board.

The demand is deep and getting stronger. Spot Bitcoin ETFs continue to act as the market's bedrock, pulling in another $2.7 billion in fresh capital this week alone. It’s the consistent, foundational layer of the institutional bid.

But the real story of accelerating interest is with Ethereum. After a steady first year, demand has ignited. ETH ETFs attracted a stunning $3.5 billion in net inflows over the last 30 days alone, a powerful sign that institutional capital is now rotating and diversifying with conviction.

This broadening demand is paving the way for the next frontier. The launch of the first U.S. Solana ETF this week, which uniquely includes staking rewards, establishes the infrastructure for a new wave of capital to enter the altcoin market.

From the steady base of Bitcoin to the surging interest in Ethereum and the newly opened door for Solana, the message is clear: the institutional wave is not only here to stay, it's getting bigger and faster.

Avalanche Surges on Real-World Asset Growth

Sometimes a price chart tells a story of quiet conviction rather than speculative frenzy. The gradual, steady climb of Avalanche (AVAX) below isn't a random move; it's the visual footprint of a fundamental thesis taking hold. Here’s the real-world utility that’s driving the momentum...

This week, Avalanche solidified its position as a clear leader in building the bridge to traditional finance. New data shows over $646 million in assets from institutional heavyweights like KKR, Securitize, and WisdomTree are now live and tokenized on its network. We're talking about tangible assets like private credit and money market funds moving onto blockchain rails.

The key to attracting these institutions isn't just speed; it's compliance. Avalanche's "Evergreen subnet" architecture is the crucial innovation here, allowing firms to launch permissioned, custom blockchains. In essence, it gives them the security and control of a private ledger with the efficiency of a public one—the perfect hybrid solution for risk-averse institutions.

Capital is moving from outdated financial systems onto the blockchain, and Avalanche is proving that the ultimate utility of crypto isn't speculation, but the fundamental upgrade of global finance itself.

Closing Thoughts

The game has oviously changed. The crypto market now functions on multiple fronts at once, moving beyond its casino phase and into a core piece of the financial system. The challenge is no longer finding information, but making sense of it.

How do you weigh the impact of $3.5 billion in monthly Ethereum ETF inflows against the $646 million in real-world assets being tokenized on Avalanche? How does a new, frictionless wallet from Coinbase affect the protocols you're tracking?

Answering these questions requires more than intuition; it demands a new class of intelligence.

That’s why we built Vester. Our platform is designed to help you master this new complexity. We provide the tools to trace capital flows with precision, decipher the fundamentals of competing ecosystems, and ground your decisions in a holistic view of the market.

Thanks for reading.

Know someone else trying to make sense of this market?

See you next week.