- The Vester Pulse

- Posts

- The CZ Pardon Wasn’t About CZ

The CZ Pardon Wasn’t About CZ

Washington just showed how it plans to play the next chapter

Vester Updates

If you haven’t used Vester in the past few weeks, now’s the perfect time to take another look.

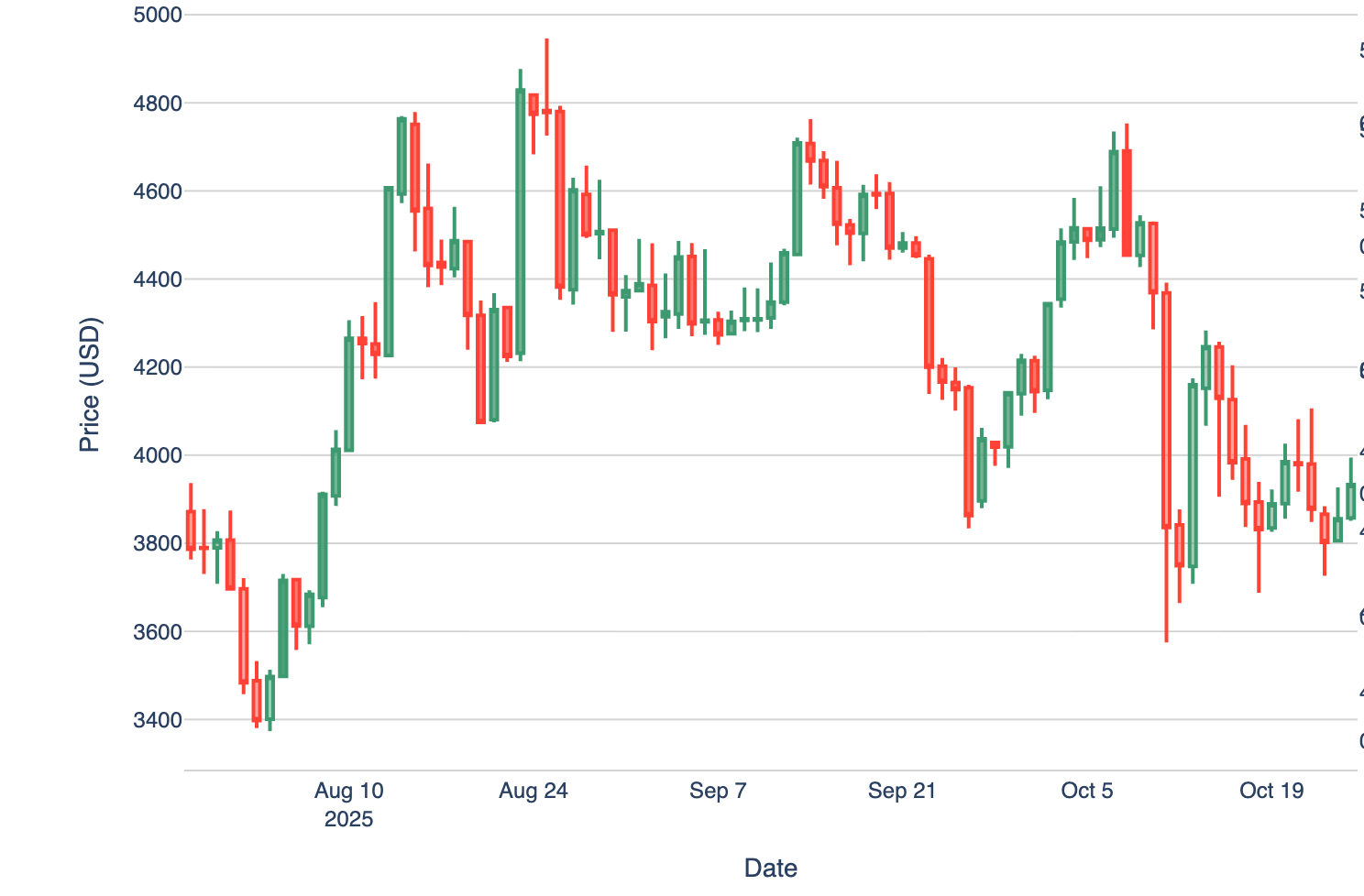

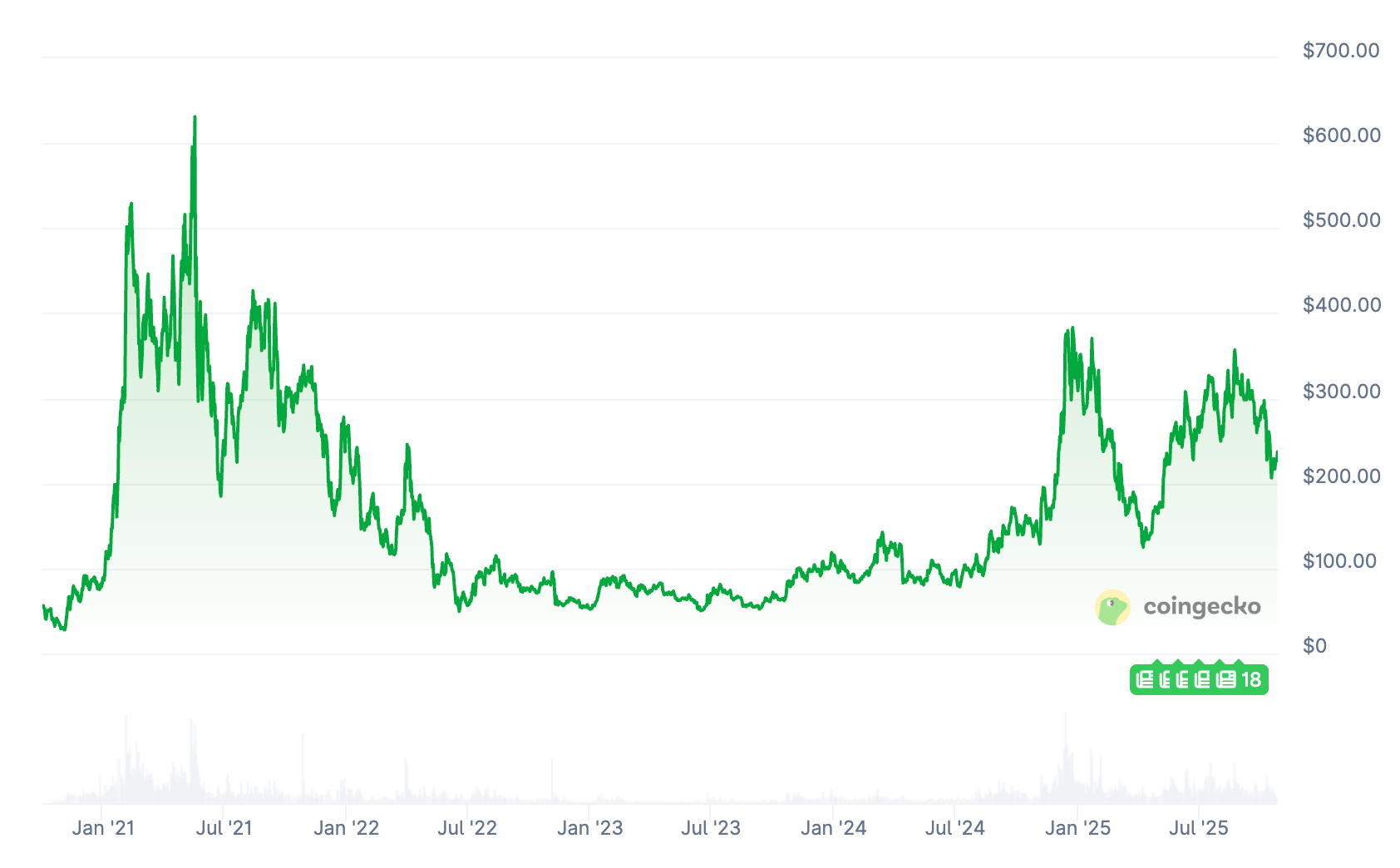

The team has made major improvements to our visualization engine, with clearer, faster, and more accurate outputs. A little taste of our new candle outputs below for an ETH related prompt.

We’ve also expanded the range of visualizations available and are continuing to extend token coverage to deliver broader insights across the market.

Market Updates

Market Overview — October 26, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.84 T | ↑ 1.77 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 77.2 | ↑ 4.6 % |

| Layer-1 (GMCI L1 Index) | 200.2 | ↑ 1.8 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $113,577 | ↑ 4.2 % |

| Ethereum (ETH) | ≈ $4,067 | ↑ 2.0 % |

| Solana (SOL) | ≈ $198.7 | ↑ 5.3 % |

| BNB (Binance Coin) | ≈ $1,126 | ↑ 0.8 % |

| XRP (Ripple) | ≈ $2.6 | ↑ 8.8 % |

Crypto markets rebounded this week, with total capitalization climbing back to roughly $3.84 trillion, up 1.77% from the previous week. The recovery followed easing macro pressures and renewed institutional inflows, helping major assets stabilize after several weeks of volatility.

Bitcoin rose 4.23% to around $113,577, while Ethereum gained 2.00% to trade near $4,067. Solana led large-cap performance with a 5.3% increase to $199, driven by rising activity in liquid staking and DeFi protocols. BNB inched higher by 0.8% to $1,126, holding its post-pardon gains, while XRP advanced 8.8% to $2.6, extending its steady uptrend.

Sector indices also showed strength. The GMCI Layer-1 Index climbed 1.8% to 200, supported by continued capital rotation into high-throughput blockchains. The GMCI DeFi Index rose 4.6% to 77, reflecting a modest rebound in governance tokens and growing confidence across on-chain lending markets.

Crypto News

Changpeng Zhao Receives Presidential Pardon

Changpeng Zhao, widely known as “CZ,” has once again taken center stage in the crypto world after receiving a full presidential pardon from Donald Trump, overturning his prior conviction related to Binance’s compliance failures. The decision has sent ripples through both political and financial circles, sparking intense debate about the future of U.S. crypto policy and its enforcement direction.

The market’s response was immediate. Binance’s native token, BNB, saw a sharp uptick in trading activity as investors reacted to the news, interpreting the pardon as a potential catalyst for Binance’s reentry into U.S. markets and a broader thawing of regulatory tensions.

Zhao had pleaded guilty in 2023 to failing to maintain adequate anti–money laundering controls at Binance, resulting in a $4.3 billion settlement with U.S. authorities — the largest in crypto history. He stepped down as CEO and served several months in custody before returning to the private sector. Despite the conviction, Zhao remained a defining figure in the digital asset industry and one of the central architects of the modern exchange ecosystem.

The pardon is widely viewed as a signal that the Trump administration intends to reset the United States’ approach to digital assets. Officials close to the administration have indicated a desire to pivot from heavy-handed enforcement toward policies that promote innovation, competitiveness, and collaboration between regulators and private firms.

Supporters see the move as a pragmatic shift that could repair the strained relationship between Washington and the crypto sector, arguing that consistent rules, not sporadic enforcement actions, are what the industry needs to thrive. Critics counter that it undermines progress in financial crime prevention and could embolden firms to loosen compliance standards.

For Binance, the pardon removes one of the industry’s most visible legal overhangs and restores a measure of credibility in global markets. Under new leadership, the exchange may now rebuild institutional partnerships and reestablish its U.S. presence.

Crypto Dot Com Applies for Federal OCC Charter

Crypto.com has filed an application with the Office of the Comptroller of the Currency for a National Trust Bank charter, aiming to become one of the first federally regulated crypto institutions in the United States. If approved, the charter would allow the company to operate under a single national regulatory framework rather than the current mix of state-level licenses.

The proposed trust bank would focus on digital asset custody, staking-related services, and administration for ETF issuers and corporate clients. Crypto.com has said its existing New Hampshire–chartered trust company will remain operational during the OCC review process, ensuring continued service to institutional partners.

The move aligns Crypto.com with a growing list of major digital asset firms - such as Coinbase, Circle, and Stripe’s Bridge division - seeking to operate under federal oversight. Each of these firms aims to provide institutional-grade infrastructure within the guardrails of traditional banking regulation.

A successful charter approval would bring them under the same governance, capital, and compliance standards as national banks, likely setting a precedent for others pursuing similar routes.

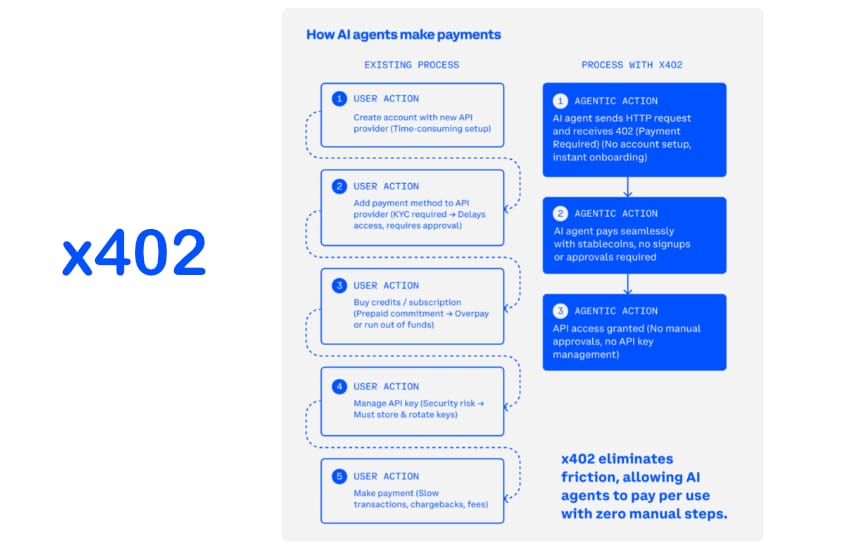

Coinbase Protocol Powers 4,300% Surge in AI Payments

A new Coinbase-developed payments protocol, internally referred to as x402, has seen a 4,300% jump in transaction volume over the past week as developers and AI platforms begin using it to facilitate automated, on-chain payments between digital agents.

The protocol allows AI systems to initiate and complete payments autonomously using crypto rails, effectively bridging large language models and decentralized finance infrastructure.

Unlike typical API-based payment systems, x402 operates natively on blockchain networks, allowing transactions to settle transparently and autonomously. It enables AI agents to send and receive stablecoins, pay for compute power, and exchange digital assets without requiring any human involvement.

Developers have described it as the foundation for an “agentic economy,” where intelligent systems can own wallets, manage funds, and coordinate financial activity on-chain in real time. The explosion in activity was driven by a surge of integrations from AI startups experimenting with peer-to-peer machine payments for data access, inference costs, and shared compute. Early users have cited the protocol’s low latency and native blockchain settlement as key advantages over existing payment rails.

For the broader industry, the rise of x402 illustrates the next frontier of crypto utility - beyond trading and speculation - where blockchain becomes the financial backbone for autonomous digital systems.

SWIFT Expands Blockchain Infrastructure Globally

SWIFT has announced the rollout of a new blockchain-based infrastructure layer that connects over 200 financial institutions across 120 countries, marking one of the most significant integrations of distributed ledger technology into the global banking system to date.

The network expansion allows participants to transfer and settle tokenized assets, stablecoins, and central bank digital currencies (CBDCs) across borders using existing SWIFT messaging rails.

The initiative follows successful pilot programs conducted with more than a dozen major banks, including HSBC, Citi, BNP Paribas, and Deutsche Bank. By embedding blockchain interoperability into its core infrastructure, SWIFT is tackling one of digital finance’s most persistent prob.ms. The upgrade is designed to bridge fragmented networks and align incompatible token standards across global institutions.

Under the new model, SWIFT serves as the messaging backbone connecting blockchains and traditional payment systems. It allows regulated institutions to transfer value seamlessly without directly holding crypto assets. The system supports settlement for tokenized securities, real-world assets, and wholesale CBDCs.

Rather than competing with blockchain networks, SWIFT is positioning itself as the neutral interoperability layer that connects them.

Japan Set to Let Banks Trade and Hold Crypto

Japan’s Financial Services Agency (FSA) is preparing to allow the country’s largest banking groups to offer cryptocurrency trading and custody services, marking one of the most significant policy shifts in Japan’s financial history. The proposal would lift restrictions that have long prevented banks from engaging directly with digital assets and would also permit them to hold cryptocurrencies such as Bitcoin as part of their investment portfolios.

The new framework would enable securities and trust subsidiaries of major banks to register as crypto asset service providers under the Banking Act, bringing them under the same regulatory umbrella that governs traditional financial institutions. Regulators are also considering reclassifying digital assets as “financial products” under the Financial Instruments and Exchange Act, signaling a move toward mainstream integration within Japan’s financial system.

Officials have described the change as part of a broader effort to modernize Japan’s banking infrastructure and maintain its leadership in global financial innovation. With stricter capital and compliance requirements than typical exchanges, bank-led crypto operations are expected to set a new standard for security and transparency in digital asset management.

Japan’s track record of measured but forward-thinking financial innovation makes this moment especially significant. Nearly a decade after becoming one of the first countries to recognize Bitcoin in the wake of the Mt. Gox collapse, Japan is once again taking the lead. This time by preparing to let banks trade, custody, and hold crypto directly. If successful, the initiative could transform Japan into the first major economy where digital assets coexist seamlessly with traditional banking.

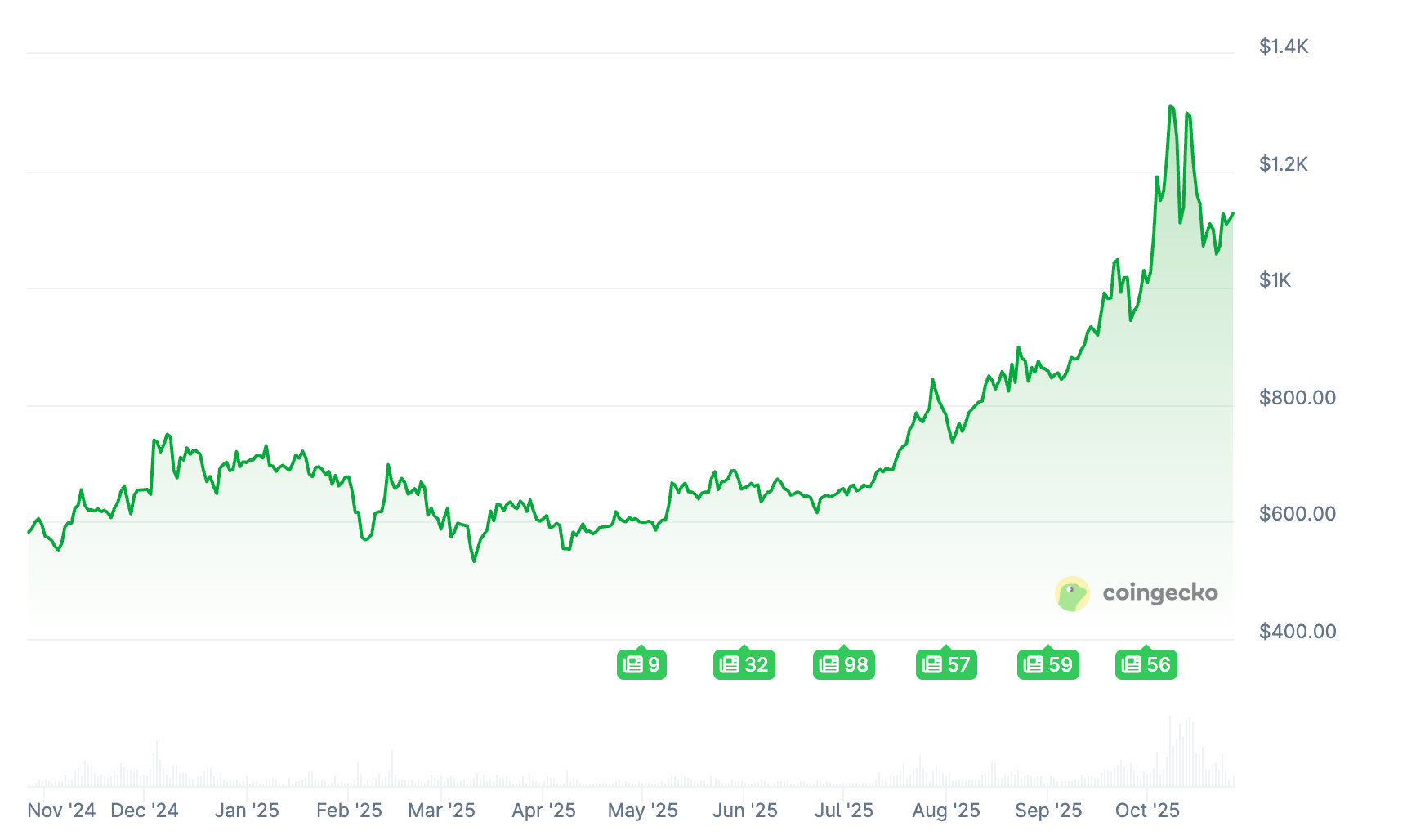

Token of the Week

Aave has been one of the most consistent performers in decentralized finance this year, as on-chain lending and real-world asset tokenization gain momentum. The protocol’s native token, AAVE, has traded between $90 and $150 for most of the past month, consolidating after a strong rally in the first half of the year.

Aave began as a simple lending platform but has evolved into one of DeFi’s most versatile liquidity engines. Users can supply assets to earn interest, borrow against collateral, or mint GHO, Aave’s native overcollateralized stablecoin. The upcoming Aave V4 upgrade will unify liquidity across multiple chains, streamline risk management, and make capital usage more efficient.

The token itself serves as the protocol’s governance and safety mechanism. Holders can stake AAVE into the Safety Module, earning yield while helping to insure the protocol against liquidity shortfalls. As institutional adoption of DeFi accelerates, Aave’s transparent governance structure and conservative approach to risk management have made it a preferred partner for permissioned liquidity initiatives and real-world asset pilots.

Closing Thoughts

This week underscored how quickly crypto is merging with the global financial system. Japan’s regulators are preparing to let banks trade and hold digital assets. SWIFT is embedding blockchain into its global settlement network. Crypto.com has applied for a federal banking charter.

Crypto is becoming part of the same financial infrastructure that powers traditional markets. What once operated on the edges of finance is now being absorbed into its core - regulated, integrated, and built for scale.

It’s happening in the United States, Japan, the European Union, the United Kingdom, and virtually every other economy of consequence.

Very cool to see.