- The Vester Pulse

- Posts

- The Chainlink Effect

The Chainlink Effect

Reliable inputs for a world moving toward programmable assets

Thank you for bearing with us over the last couple of weeks; our team has been extremely busy, and we apologize for the delay in delivering recent editions of the Vester Pulse.

We hope everyone reading this had a wonderful Thanksgiving! We wanted to deliver a special edition focused on a token that is very near and dear to our hearts. Regular programming will return on schedule moving forward.

The Problem Blockchains Could Not Solve

Blockchains were built to be secure, verifiable, and autonomous. But they were never built to talk to the outside world. They can confirm ownership, execute logic, and enforce rules within their network, but they cannot see real-world prices, settlement events, off-chain data feeds, or messages between institutions. Without a way to bridge this gap, blockchains are functionally isolated. Every use case that requires external input collapses without reliable data.

In early DeFi, this limitation wasn’t theoretical. Liquidations failed because protocols pulled price data from a single API. Collateral ratios broke. Stablecoins depegged. Tokenized assets couldn’t settle without manual confirmation. The need was obvious. Smart contracts needed a way to trust external data with the same confidence they trusted on-chain code.

Where Chainlink Began

Sergey Nazarov saw this problem earlier than most. A serial entrepreneur with experience in peer-to-peer systems and early crypto infrastructure, he believed smart contracts would never scale until they could integrate with real-world data in a trustless way. Steve Ellis, a software engineer from Pivotal Labs, joined as cofounder to architect the technical foundations.

Together, they launched Chainlink in 2017. Their thesis was simple but radical. Decentralization should not stop at consensus. If a smart contract depends on price feeds, reserve audits, FX rates, or weather indexes, that data must come from a network of independent providers, not a single server or spreadsheet.

Chainlink was designed to be a middleware oracle network that could bring real-world data on-chain - accurately, verifiably, and without centralized trust.

This wasn’t about speed. It was about reliability. Chainlink was built not for speculation but for financial contracts with high-value collateral and strict risk requirements.

How it Works

Chainlink’s oracle system consists of three steps:

Sourcing

Independent node operators pull data from regulated data vendors, institutional APIs, off-chain systems, and traditional market feeds. These nodes often partner directly with the data provider itself, not just an aggregator.

Aggregation

Multiple sources are combined using an on-chain contract to generate a consensus price. This aggregation prevents any single node or provider from skewing the result. Malicious or faulty nodes are penalized through economic incentives and reputation systems.

Delivery

The final verified value is posted on-chain at defined intervals. Smart contracts read this value directly, triggering settlements, margin calls, yield updates, or cross-chain communication.

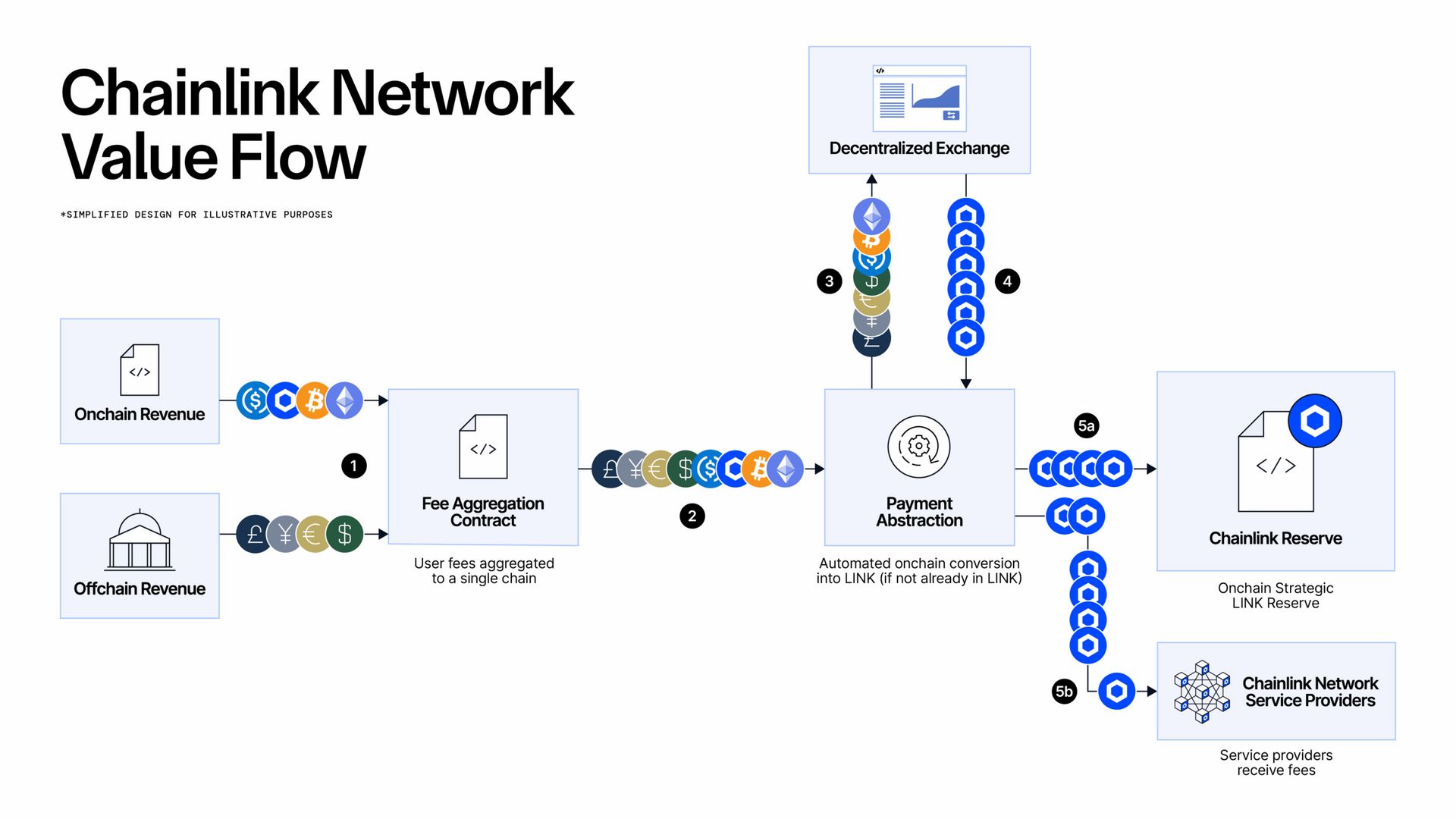

Over time, this simple architecture expanded. Chainlink now includes Proof of Reserve, Cross-Chain Interoperability Protocol (CCIP), automation layers, and data streams for RWAs. But the core idea remains the same: verified external data must be delivered on-chain without creating a centralized choke point.

Where Chainlink Fits in the Financial System

As traditional finance begins to explore blockchain-based settlement, tokenized assets, and programmable money markets, it runs into the same fundamental need: external data feeds that can be trusted by automated contracts. Chainlink serves this need across several key areas:

Tokenized funds need net asset values, interest rates, and custodian attestations

Lending and margin platforms require price feeds and liquidation thresholds

Stablecoins require real-time reserve proofs from banks and custodians

Cross-border payment rails require FX conversions and settlement confirmations

Institutions are not looking for a DeFi oracle. They are looking for a data layer that mirrors existing financial workflows - but with fewer reconciliation points, deterministic settlement, and full auditability. Chainlink provides that translation layer. It connects secure on-chain execution with trusted off-chain data in a format that meets compliance requirements and internal controls.

Momentum driven by Partnership

Over the last two years, it has quietly become the default testing partner for major infrastructure pilots in tokenized finance. These are not DeFi integrations. These are real-world systems being restructured around blockchain rails.

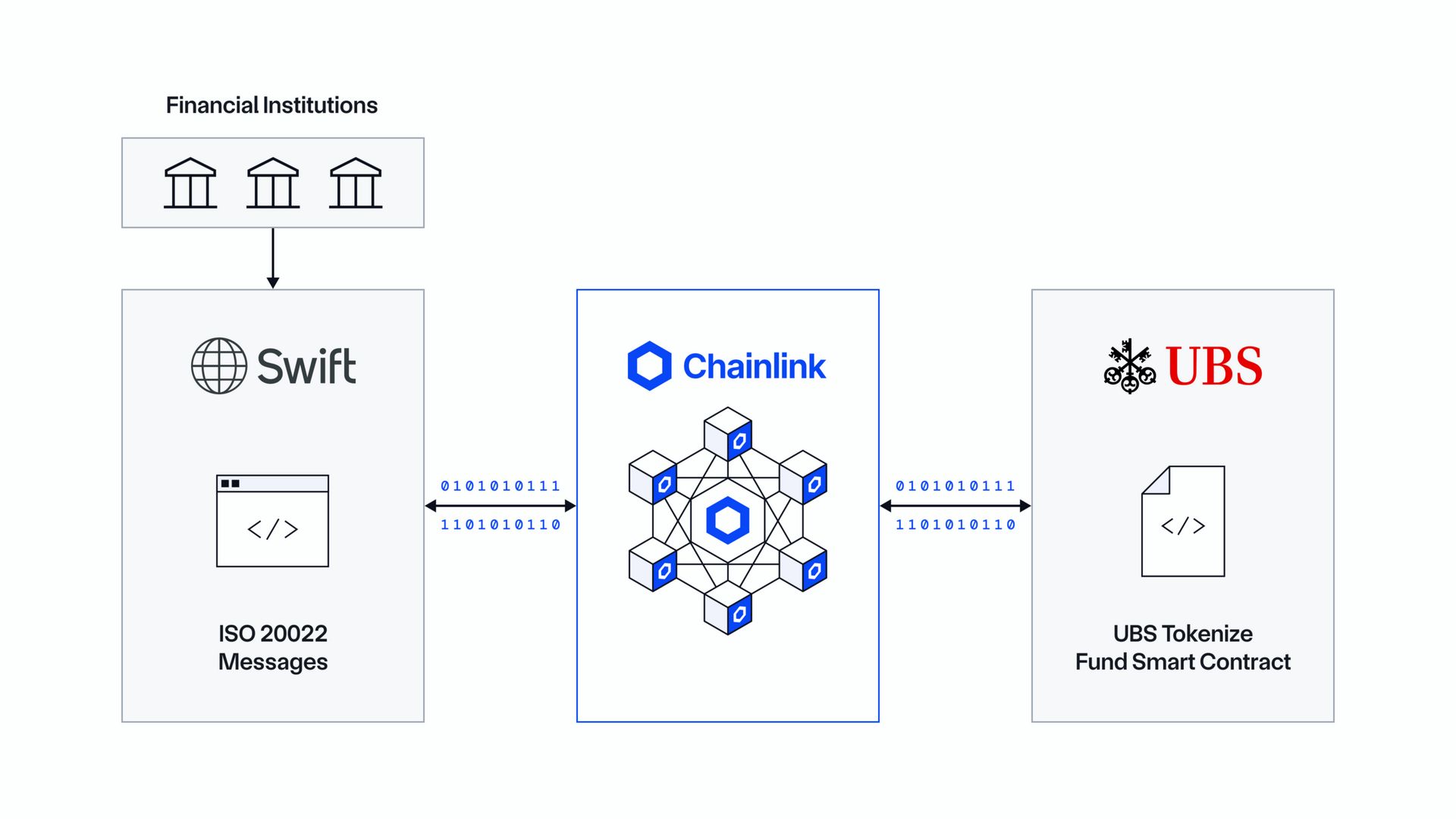

Swift and Chainlink (2023–2024)

Swift partnered with Chainlink and multiple financial institutions—including BNP Paribas, BNY Mellon, Citigroup, and Euroclear—to test cross-chain messaging for tokenized asset transfers. The pilot demonstrated how a Swift message, sent through existing channels, could trigger asset movement across both public and private blockchains. Chainlink’s CCIP handled routing and verification across networks, allowing banks to use familiar tools to access unfamiliar ecosystems.

ANZ and Chainlink (2023)

ANZ, one of Australia's largest banks, used Chainlink to execute cross-chain settlement of tokenized assets. Using CCIP, the bank transferred stablecoins and digital assets between Ethereum-compatible and Avalanche-compatible environments. This proved that real-time gross settlement can happen across chains without manual confirmation or escrow intermediaries.

Traditional Data Providers

Chainlink feeds are now sourced from firms like Morningstar, CF Benchmarks, DXFeed, and other regulated entities. These benchmark providers use Chainlink to publish on-chain versions of their indexes, including interest rates, asset valuations, and derivatives pricing, so that tokenized contracts can refer to verifiable sources without counterparty risk.

The scope of these partnerships is important. They do not reflect marketing exercises. They reflect institutional infrastructure experiments with billions in assets under custody and tightly governed risk systems.

A Network Advancing Ahead of Market Pricing

For years, Chainlink’s adoption far outpaced its token performance. While Chainlink became the default oracle in DeFi and the go-to partner for tokenization pilots, the $LINK token lagged behind broader market cycles.

During the 2020–2021 bull run, LINK reached an all-time high near $52. It was one of the earliest altcoins to break out in that cycle. But over the next two years, despite new products like CCIP and major institutional pilots, the token bled down to under $6.

There were reasons. Utility demand for LINK was still limited. CCIP was still in early rollout. Staking only launched in late 2022, and even then at limited scale. Market participants questioned the token's role beyond securing price feeds.

In late 2023 and 2024, sentiment shifted. Staking expanded. CCIP integrations accelerated. On-chain revenue from Chainlink services began to grow. And critically, institutional narratives began to center around tokenized RWAs and cross-chain settlement, both of which used Chainlink infrastructure as a default layer.

LINK broke out of its downtrend and reclaimed a mid-range around $15–20, depending on macro conditions. While still well below ATHs, the token has begun to reflect the fundamental value of a protocol sitting at the intersection of TradFi and on-chain automation.

Chainlink’s Role in a Tokenized Future

The future of tokenized assets requires:

trusted price data

verified net asset values

validated settlement events

proof of reserves

cross-network messaging

standardized pipelines connecting banks and blockchains

Every one of these functions depends on reliable oracles. As more institutions build tokenized money markets, collateral systems, funds, lending products, and cross-border settlement workflows, the data layer becomes the most important part of the stack.

The more Chainlink standardizes how information moves between traditional and on-chain markets, the more transparent and interpretable this ecosystem becomes. That clarity improves everything built on top, from analytics to risk tools to investor decision support. We believe this infrastructure play makes Chainlink an essential component of the coming tokenized world.