- The Vester Pulse

- Posts

- Not All Tokens Are Created Equal

Not All Tokens Are Created Equal

As tokenization goes mainstream, investors must learn to look beyond the label.

A New Wrapper for Old Assets

Tokenization is the process of taking traditional financial assets - like treasuries, funds, or equities - and issuing them as digital tokens on blockchain-based infrastructure. These tokens can represent direct ownership or synthetic exposure, and may include features like instant settlement, composability, or built-in compliance logic. The goal isn’t to create new assets - it’s to repackage existing ones in a more flexible, interoperable format.

Early efforts were limited. In 2018, the World Bank issued a blockchain-based bond in Australia. Santander followed in 2019 with a tokenized bond issuance settled on Ethereum. JPMorgan’s Onyx platform began settling repo trades using tokenized collateral in 2020. These were infrastructure experiments. Composed of closed environments, no secondary market, no public token layer.

That changed in 2023. Franklin Templeton launched the first SEC-registered fund to use public blockchain infrastructure. Its OnChain U.S. Government Money Fund was initially built on Stellar and later mirrored to Ethereum. It offers exposure to short-duration U.S. Treasuries but uses tokenized shares as the delivery mechanism. Ownership is recorded on-chain. Transfers and redemptions are processed through smart contract logic. The structure is conservative, but the infrastructure is not.

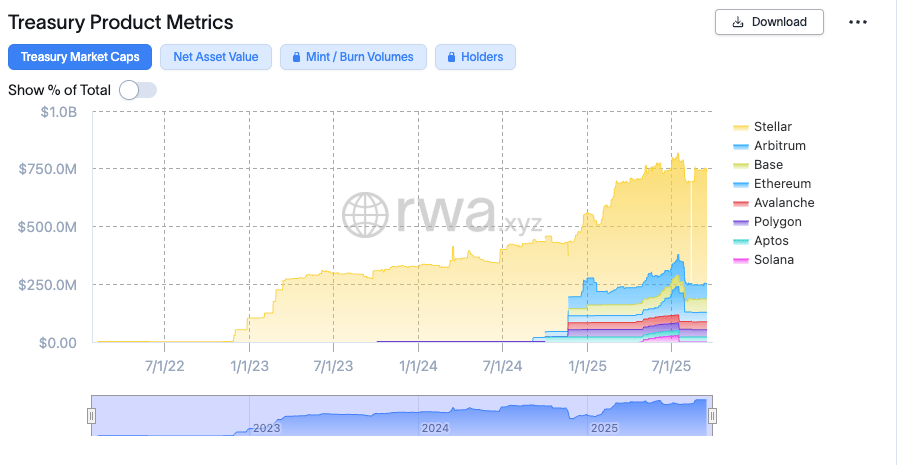

Franklin dominated the category for nearly a year. By late 2023, its fund had crossed $500 million in assets. By mid-2024, it peaked near $800 million -making it the largest tokenized Treasury product by a wide margin (below).

That dominance is now being challenged. Other entrants have started to appear on chains like Arbitrum, Base, and Avalanche. These products are smaller, but the direction is clear - tokenized fixed income is no longer a single-issuer market. Infrastructure is evolving, and competition is starting to form around it.

Which brings us to Nasdaq.

Building the Institutional Rails

On September 5, Nasdaq launched its Digital Assets platform. It supports identity-linked issuance, compliant settlement, and integration with qualified custodians.

The platform is designed for institutions to issue tokenized versions of existing financial products using infrastructure that aligns with current market standards. It works across public and private chains and includes support for built-in compliance logic.

This is not a consumer product. It is infrastructure meant to power regulated tokenized products behind the scenes. Nasdaq’s goal is not to change how capital markets function, but to provide the tools for market participants to shift underlying systems toward a tokenized format without changing the regulatory perimeter.

By focusing on core infrastructure rather than consumer-facing products, Nasdaq is positioning itself as a trusted backbone for the next phase of digital asset growth. It is enabling financial institutions to adopt blockchain-based models while preserving the safeguards, roles, and workflows they already rely on.

A Contrasting Model: The Synthetic Approach

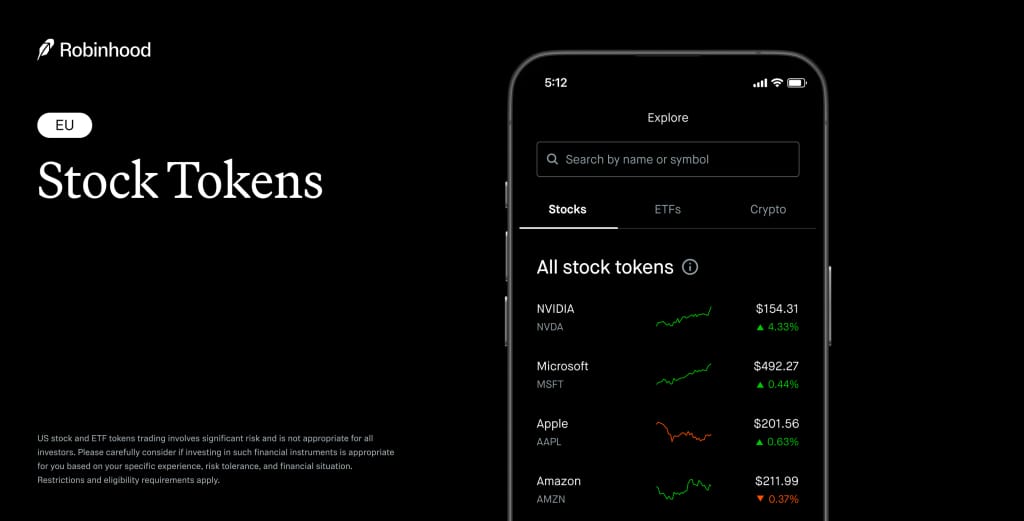

In July, Robinhood began offering tokenized U.S. equities and ETFs to users in the European Union. These tokens are issued on Arbitrum and include both public and private companies, such as OpenAI and SpaceX. The listings are not authorized by the companies themselves. Instead, they offer synthetic exposure, structured through third-party issuers operating offshore.

OpenAI publicly denied any involvement. Legal observers raised concerns around intellectual property, disclosure, and the risk of retail users mistaking derivative products for direct equity ownership. Despite this, the tokens remain live and tradable.

The contrast with Nasdaq is direct. One is focused on enabling regulated institutions to tokenize existing products within the boundaries of current law. The other is testing the limits of what can be distributed publicly through synthetic wrappers on-chain. Both fall under the umbrella of tokenization - but the models, incentives, and liabilities are very different.

A Fragmented Structure Emerges

Tokenized assets are no longer a single category. What’s emerging is a layered system with sharp differences across structure, collateral, issuer involvement, and legal clarity.

Some products, like Franklin’s or BlackRock’s funds, are fully collateralized and structured to fit within existing securities laws. They use tokenization as a backend improvement, not a marketing angle. They have defined redemption processes, registered custodians, and clear disclosures.

Others, like HSBC’s institutional bond issuances, operate within permissioned networks. There’s no retail access and no open market listing. The value is operational - faster settlement, automated compliance - not speculative.

Then there are synthetic offerings. These mimic asset exposure without issuer participation or legal registration. They offer UX improvements and broader access, but they abstract away the protections, rights, and recourse that usually come with owning the real asset.

This divergence is not temporary. It is becoming structural. Tokenization now describes a growing number of incompatible formats. On the surface, they might look the same, sharing common tickers, prices, and performance metrics. Yet they are fundamentally different in how they behave, how they are governed, and what they actually represent.

The Path Forward

Tokenization is introducing structural variation that most investors won’t see. Assets with the same label may differ in collateral, custody, legal status, or redemption mechanics. That complexity won’t be captured by surface-level metrics like price or ticker. It will sit in the wrapper, the issuer, and the infrastructure beneath.

This shift is directly aligned with Vester’s roadmap.

We’re building toward a product that helps users understand not just what they hold, but how it's structured. Whether an asset is synthetic or custodial. Whether it’s registered, redeemable, or offshore. Whether it behaves like a fund, a derivative, or something in between.

We're not surfacing all of that yet. But this is the direction.

As tokenized markets continue to fragment, the need for clear interpretation will only grow. Vester will serve as the layer between the portfolio and the protocol, built to help users track not just exposure, but structure, risk, and context.

The regular Pulse returns Sunday.