- The Vester Pulse

- Posts

- Crypto's Next Chapter Is Institutional

Crypto's Next Chapter Is Institutional

Real products, real players, and real use cases are stacking

Vester Updates

Following last week’s major product update, we’ve been closely tracking performance and user feedback. Early signs are positive.

Latency is lower, visual output is more stable, and multi-agent interactions are running smoothly.

User feedback and query data are shaping where we go next. You can expect much more from the Vester team throughout the rest of the year, along with some exciting announcements ahead.

Check it out: vesterai.com

Market Updates

Market Overview — September 28, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.78 T | — |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | $86.4 | ↓ 10.2 % |

| Layer‑1 (GMCI L1 Index) | $201.9 | ↓ 9.4 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $110,665 | ↓ 4.2 % |

| Ethereum (ETH) | ≈ $4,043.99 | ↓ 9.7 % |

| Solana (SOL) | ≈ $206.74 | ↓ 12.9 % |

| BNB (Binance Coin) | ≈ $981.17 | ↓ 6.6 % |

| XRP (Ripple) | ≈ $2.84 | ↓ 4.6 % |

Crypto markets extended their decline this week, with total capitalization sliding to approximately $3.78 trillion. The pullback reflects a broader wave of consolidation across digital assets, following an extended period of speculation, rotation, and volatility.

Bitcoin dropped 4.2% to around $110,665, while Ethereum sold off more sharply, falling 9.7% to approximately $4,044. Solana was the week’s weakest large-cap performer, declining 12.9%. BNB also moved lower, shedding 6.6% to close around $981, and XRP retraced 4.6%, giving back prior gains.

Sector performance was broadly negative. The GMCI Layer‑1 Index fell 9.4% to $201.9, as weakness in alt-L1s weighed on the complex despite relative support from larger platforms. The GMCI DeFi Index declined 10.2% to $86.4, continuing a multi-week slump as volumes and risk appetite remained suppressed across lending, DEX, and yield protocols.

While fundamentals like institutional flows and developer activity remain intact, the near-term backdrop is decisively cautious

Crypto News

Google Launches Payment Protocol

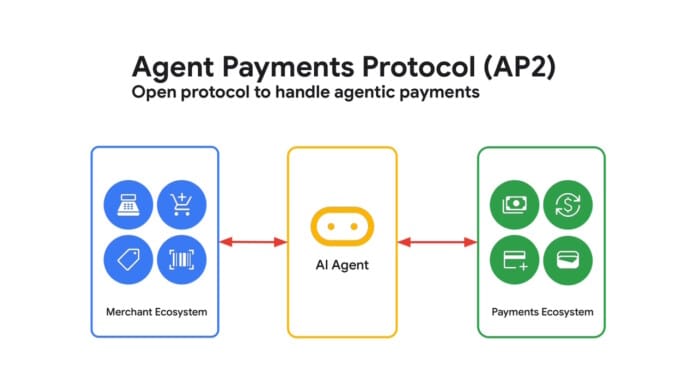

Google has unveiled a new blockchain-enabled transaction standard called the Agent Payments Protocol (AP2). A framework that allows autonomous AI agents to initiate and complete payments, including those using crypto and stablecoins.

The protocol supports both fiat and token-based rails and is designed to handle authentication, authorization, and auditable execution for agent-driven workflows. It introduces the concept of an “Agent Mandate,” a programmable set of permissions that governs what an agent can do with funds across wallets, exchanges, and APIs.

AP2 is being developed under Alphabet’s internal AI & Payments group and is currently being piloted by firms like Coinbase, PayPal, and Mastercard. The protocol is designed to be open source and modular, enabling companies to plug in their preferred custody, compliance, and payment infrastructure.

Rather than launching a standalone wallet or custodial product, Google is positioning AP2 as a neutral middleware layer for the next generation of agent-based applications - similar to how OAuth standardized access to identity services in Web2.

The project represents one of the first real attempts by a major tech platform to bridge AI-native workflows with financial infrastructure, using crypto as a core settlement option rather than a parallel system.

VanEck Launches ETH Staking Yield ETF in Europe

VanEck has launched a new Ethereum exchange-traded fund (ETF) in Europe that offers exposure to both the price of ETH and its staking yield, marking the first regulated vehicle of its kind.

The fund holds physical Ethereum and stakes the assets via professional infrastructure providers. Staking rewards are distributed back to investors after fees, creating a yield-enhanced product that tracks both the asset and its income stream. The ETF is passported under UCITS and will be available on multiple European exchanges.

It’s designed for investors seeking native crypto yield without the technical complexity or custody risk of self-staking. It is increasingly easier to position a Crypto ETF to traditional investors as the gap between digital assets and traditional finance blurs.

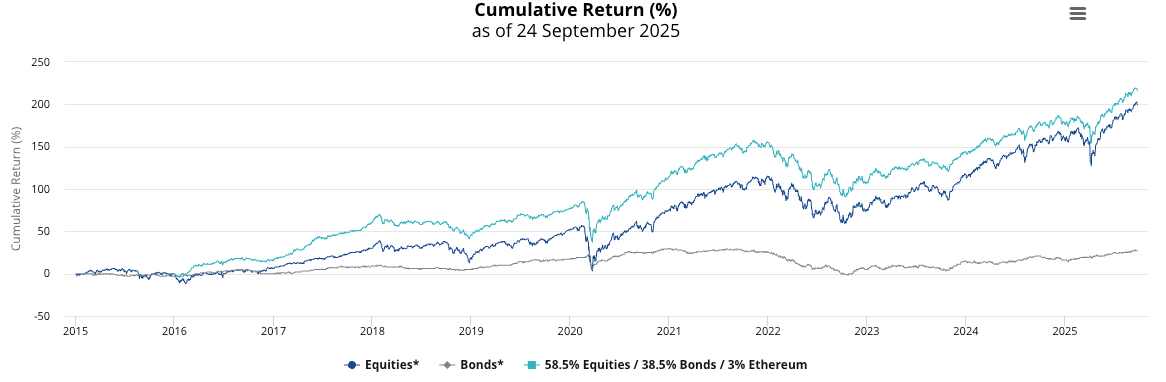

The chart below, sourced from VanEck, shows the cumulative return performance of a traditional 60/40 portfolio (58.5% equities / 38.5% bonds), compared to variants that include a 3% allocation to Ethereum.

VanEck has emphasized transparency and institutional-grade custody, working with regulated partners for both asset storage and validator operations. The fund also includes detailed disclosures on validator performance, slashing risk, and net yield projections.

While the product is only available to European investors for now, it sets an important precedent. It demonstrates that ETH’s yield-bearing nature can be incorporated into traditional financial wrappers, and that regulated pathways for staking exposure are becoming increasingly viable.

If adopted widely, this format could influence future U.S. ETF filings and reshape how institutional capital allocates to proof-of-stake assets, turning yield into a core differentiator in crypto-native fund products.

Morgan Stanley Taps Zero Hash for Crypto Push

Morgan Stanley is set to introduce cryptocurrency trading on its E*Trade platform through a newly announced partnership with crypto infrastructure firm Zerohash. The offering, revealed on September 23, is expected to go live in the first half of 2026 and will initially support trading for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Zerohash will serve as the backend provider, handling custody, liquidity, and settlement. This allows Morgan Stanley to integrate crypto trading directly into E*Trade without operating its own wallets or building native infrastructure. The model also ensures that digital assets remain fully segregated and compliant with regulatory standards, with Zerohash providing licensed rails behind the scenes.

The move brings one of Wall Street’s largest banks directly into the retail crypto market. E*Trade users will be able to trade digital assets alongside traditional securities within the same account. Unlike pure-play crypto exchanges, this setup preserves existing investor protections, account structures, and tax reporting tools, making crypto access feel like just another asset class.

Morgan Stanley has also taken an equity stake in Zerohash, which recently closed a $104 million funding round at a reported $1 billion valuation. This investment signals a longer-term strategic alignment and may pave the way for future product integrations, including staking, tokenized assets, or additional chain support.

This rollout sets the stage for widespread crypto integration across legacy brokerage platforms. Wealth managers and financial advisors will soon be able to offer digital asset exposure without overhauling existing systems or retraining clients.

European Banks Unite to Launch Euro Stablecoin

Nine major European banks have announced the formation of a new joint venture, to launch a euro-denominated stablecoin under the EU’s MiCA framework. The initiative was made public on September 25 and includes ING, UniCredit, CaixaBank, SEB, Danske Bank, Raiffeisen Bank, KBC, DekaBank, and Banca Sella.

The group has registered a new company in the Netherlands and plans to apply for an e-money institution license, positioning the stablecoin as a regulated instrument with full reserve backing and transparent oversight. Launch is targeted for the second half of 2026, pending regulatory approval.

The stablecoin will be designed for cross-border payments, real-time settlement, and programmable financial workflows. Issuance will be centralized through the consortium. However, each participating bank will independently provide custody, wallet infrastructure, and integrate the stablecoin natively across its own retail and institutional platforms.

The project is notable in that it seeks to provide a euro-backed alternative to dollar-dominated stablecoins. By anchoring the offering within the banking system and tying it to European regulatory infrastructure, the group aims to support digital euro use cases without relying on the European Central Bank.

Token of the Week

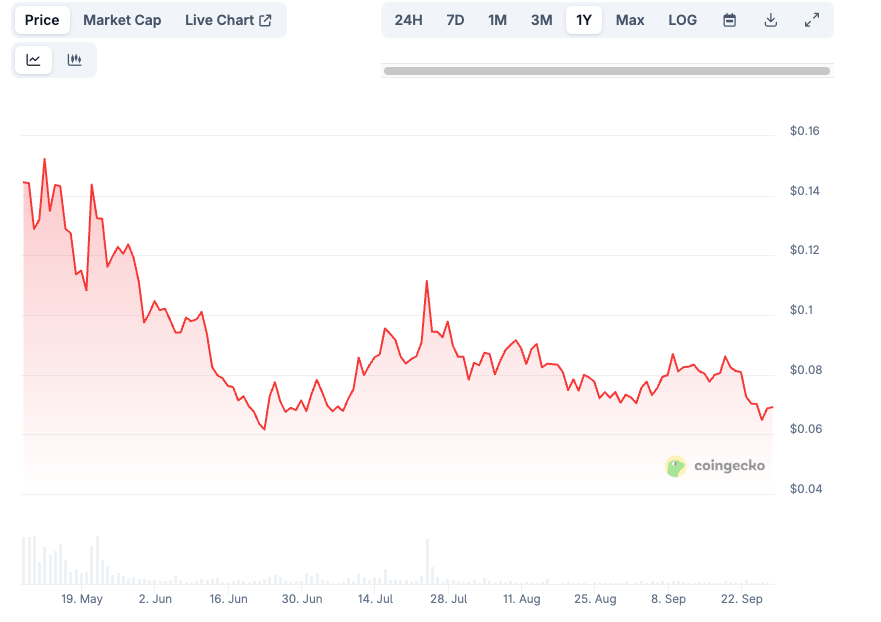

Space and Time (SXT) is the native token powering a decentralized data platform designed to bring verifiable computation to off-chain data. The protocol enables smart contracts, AI agents, and other applications to query off-chain datasets using SQL while generating cryptographic proofs that the results are accurate. This is often referred to as "Proof of SQL."

The platform has gained traction as protocols increasingly rely on external data but require guarantees of correctness and auditability. Space and Time goes beyond traditional oracles by providing a full stack of data warehousing, compute, and zero-knowledge proofs. This enables developers to query and verify complex datasets without relying on centralized trust.

SXT is used to pay for queries, incentivize node operators, and secure the network through staking. The token accrues value as demand for verifiable data increases across use cases like on-chain finance, agent-based automation, and modular rollups.

This week, Space and Time saw increased developer activity and deeper integrations with cloud platforms and Layer-2 ecosystems.

The biggest challenge will be scale. Competing in a crowded data space requires balancing performance, decentralization, and cost efficiency, all while building strong developer tools.

But for teams building intelligent agents or automated protocols, Space and Time offers a novel foundation for high-integrity, off-chain interaction.

Closing Thoughts

A lot moved on the institutional front this week. Morgan Stanley is bringing crypto to E*Trade. VanEck launched a staking-enabled ETH ETF in Europe. A consortium of major banks is building a euro stablecoin.

These aren’t isolated updates, they’re signals that digital assets are becoming part of the financial system.

The TAM is massive, the opportunity is real, and consumer interest continues to grow. Infrastructure is catching up to demand, not the other way around.

As institutions expand access and infrastructure, the market becomes more complex and harder to track. Our goal is to equip users with the tools they need to understand, analyze, and navigate it with clarity.