- The Vester Pulse

- Posts

- Crypto ETFs Are Just Getting Started

Crypto ETFs Are Just Getting Started

What 2026 will and won’t change

We hope you had a great Christmas and New Year with friends and family. This week’s Vester Pulse focuses on crypto ETFs — why they exist, what they actually allow, and why they’re likely to matter far more in 2026 than most investors expect.

A Brief History of Crypto ETFs

Crypto ETFs were not approved because regulators became crypto-native.

They were approved because market structure, surveillance, custody, and legal precedent evolved to a point regulators could tolerate.

This has been an incremental, asset-by-asset expansion - not a blanket endorsement of crypto markets (though that seems to be changing).

Timeline

2013

The Winklevoss twins file the first Bitcoin ETF proposal with the SEC, arguing Bitcoin should trade like gold. It is rejected.

2017–2020

Multiple ETF proposals are denied due to concerns around market manipulation, custody standards, and the absence of robust surveillance-sharing agreements.

October 2021

The first U.S. Bitcoin futures ETF launches, offering exposure via CME-traded futures rather than spot Bitcoin.

2022–2023

Futures ETFs expand, but persistent tracking error and roll costs reinforce institutional demand for spot exposure. Meanwhile, Canada, Europe, and other jurisdictions approve spot crypto ETFs and ETPs.

January 2024

U.S. regulators approve the first spot Bitcoin ETFs following adverse court rulings that constrained the SEC’s prior rejection framework.

Mid–Late 2024

Spot Ethereum ETFs are approved, extending the ETF model beyond Bitcoin under tighter structural constraints.

2025

The U.S. ETF landscape expands beyond BTC and ETH through carefully structured, exchange-listed spot products for select additional assets, while remaining narrow, conservative, and highly conditional.

Present Day

As you can see it has been a long road, that is finally coming to fruition.

Current Regulatory Reality

Crypto ETFs operate within a narrow, asset-specific perimeter. Approval reflects regulator comfort with liquidity, custody, surveillance, and legal posture, not enthusiasm for crypto broadly.

Assets with U.S.-listed spot ETF products

Bitcoin (BTC)

Approved first due to its long operating history, deep liquidity, mature CME derivatives market, and institutional custody infrastructure.Ethereum (ETH)

Approved with additional constraints. Spot exposure is permitted, but staking, yield, and protocol participation are excluded.Solana (SOL)

Now accessible via U.S.-listed spot exchange-traded products, reflecting growing regulatory comfort with its liquidity profile, market depth, and custody standards.XRP

Now accessible through U.S.-listed spot exchange-traded products following improved legal clarity and demonstrated secondary-market liquidity. As with Solana, exposure is limited to price movements and excludes any network participation.

As you can see, spot crypto exposure in the U.S. is no longer limited exclusively to BTC and ETH, but expansion remains selective rather than general.

What crypto ETFs still cannot do

No self-custody or on-chain interaction

ETF holders do not control private keys, transfer tokens, or interact with smart contracts.No staking or yield passthrough

Even for proof-of-stake networks, protocol rewards are not distributed to ETF holders.No broad baskets or index-style crypto ETFs

Multi-asset crypto ETFs remain largely unapproved in the U.S.No generalized altcoin access

Most tokens remain ineligible regardless of adoption or market capitalization.Trading-hour mismatch

ETFs trade during market hours while crypto markets operate continuously, creating off-hours tracking gaps.

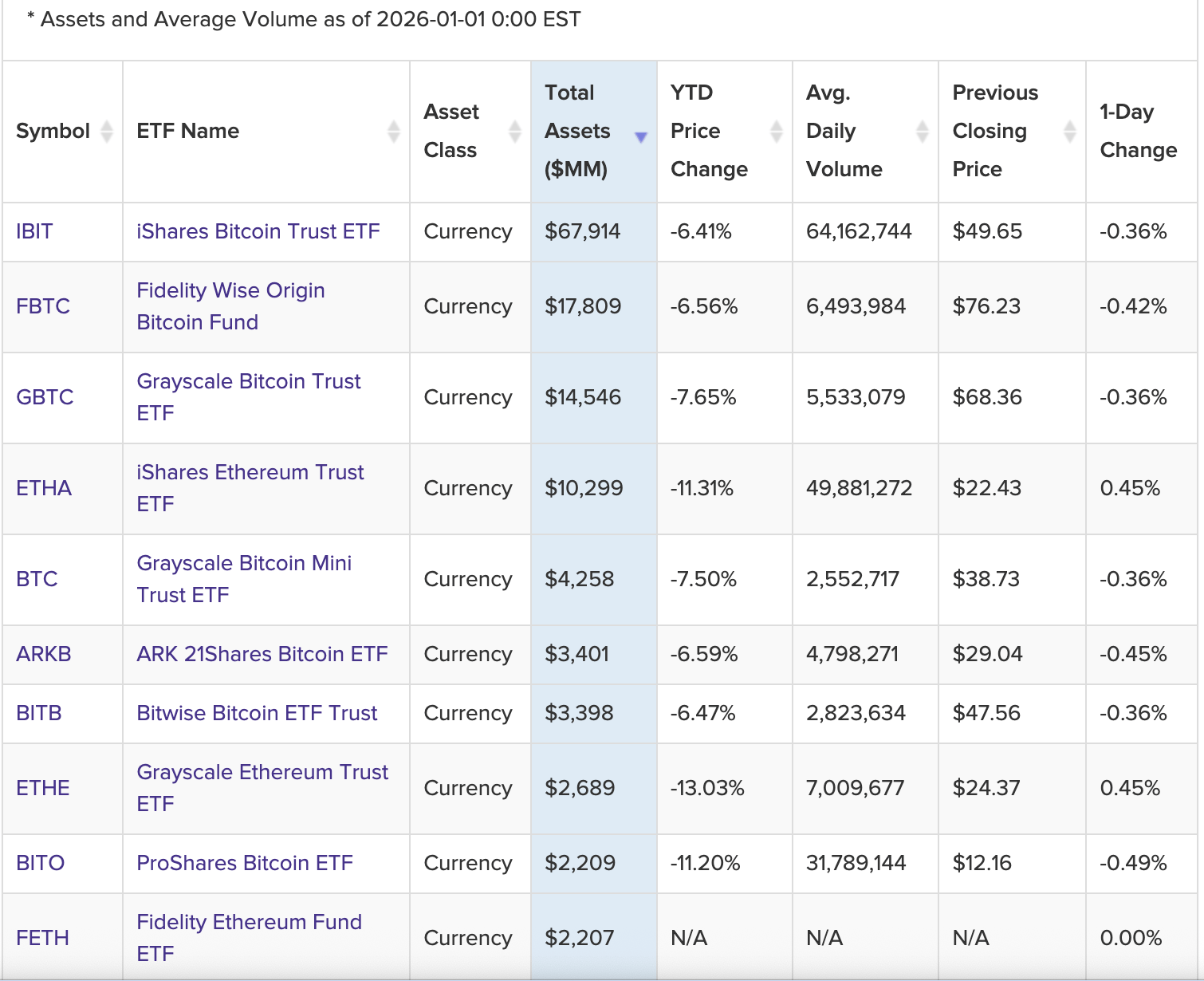

Prominent Crypto ETFs

iShares Bitcoin Trust (IBIT)

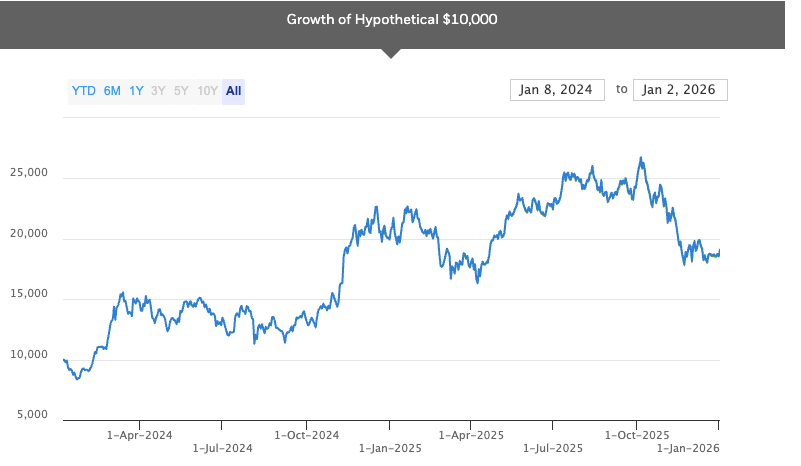

Launched in January 2024, IBIT has become the flagship spot Bitcoin ETF and the primary vehicle through which institutional capital accesses BTC.

With typical daily trading volume in the $1 to $3 billion range and assets under management in the tens of billions, IBIT now ranks among the most actively traded ETFs in the United States across all asset classes. Its scale and liquidity have effectively standardized how Bitcoin is introduced into traditional portfolios.

Fidelity Wise Origin Bitcoin Fund (FBTC)

Also launched in January 2024, FBTC is IBIT’s closest peer and benefits from deep distribution across Fidelity’s brokerage, wealth management, and retirement platforms.

Daily trading volumes generally range from $500 million to $1.5 billion, with assets under management in the high single-digit to low double-digit billions. FBTC reinforces Bitcoin’s shift from a speculative instrument to a recognized institutional allocation.

iShares Ethereum Trust (ETHA)

Introduced in mid-2024, ETHA extended the ETF framework to Ethereum, though under more restrictive conditions than Bitcoin.

The fund provides direct price exposure to ETH but excludes staking rewards and any form of protocol participation. As a result, Ethereum ETFs broaden access while compressing Ethereum’s economic model into a simple price proxy.

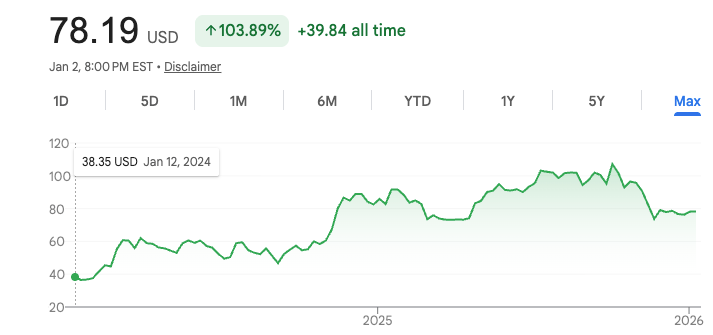

Franklin Solana ETF (SOEZ)

Launched in late2025, SOEZ represents one of the first U.S.-listed spot exchange-traded products to provide direct exposure to Solana. Its approval signals a growing willingness by regulators to move beyond Bitcoin and Ethereum on a case-by-case basis.

Grounded in comfort with Solana’s liquidity profile, custody solutions, and market structure. Like its predecessors, SOEZ excludes staking, governance, and on-chain interaction, expanding access while remaining firmly within the conservative ETF wrapper.

What the Future Holds

In 2026, crypto ETFs will matter less because they evolve, and more because they get widely used. The real shift will be distribution across brokerages, retirement accounts, and advisory platforms.

Expansion will remain selective and incremental.

More assets, not many

Any additional approvals will be asset-specific and favor networks with deep liquidity, mature custody, and strong surveillance. Broad altcoin access is unlikely.Index and basket ETFs come late

Multi-asset products remain structurally complex and are likely to appear only after individual assets establish spot precedent, and even then with limited constituents.Yield stays out of the wrapper

Staking and protocol rewards conflict with ETF mechanics. Price exposure will remain the norm.Tracking improves, gaps remain

Pricing and liquidity will improve, but ETFs will never fully mirror 24/7 crypto markets.

Crypto ETFs will continue to serve as a gateway, offering familiar access and portfolio compatibility, while stopping short of true participation.