- The Vester Pulse

- Posts

- Crypto Crosses the Margin Line

Crypto Crosses the Margin Line

The CFTC’s move to treat crypto like institutional collateral

Market Updates

Market Overview — December 14, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.6 T | ↓ ~4.0 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 53.24 | ↓ 4.53 % |

| Layer-1 (GMCI L1 Index) | 147.65 | ↓ 3.05 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $88,606 | ↓ 3.07 % |

| Ethereum (ETH) | ≈ $3,093 | ↓ 1.47 % |

| Solana (SOL) | ≈ $130.35 | ↓ 4.02 % |

| BNB (Binance Coin) | ≈ $882.96 | ↓ 2.19 % |

| XRP (Ripple) | ≈ $1.98 | ↓ 5.00 % |

Crypto markets softened this week, with total market capitalization holding near $3.7 trillion but continuing to cool after several weeks of elevated activity. Trading volumes remained active, though positioning shifted more defensively as investors reduced exposure to higher-beta assets and rotated toward relative safety within the majors.

Bitcoin declined over the week, ending near $88,606, down 3.1%, as volatility compressed and risk appetite faded. Ethereum also moved lower, falling 1.5% to roughly $3,093, though it continued to hold up better than most large-cap peers amid steady staking participation. Solana underperformed, sliding 4.0% to about $130.4, reflecting broader pressure on higher-beta assets. BNB fell 2.2% to approximately $883, while XRP dropped 5.0% to around $2.0 after a strong run earlier in the quarter.

Sector performance continued to diverge. The GMCI Layer-1 Index declined 0.9% to 147.7, showing modest resilience relative to the broader market. DeFi lagged again, with the GMCI DeFi Index falling 2.3% to 53.2, as liquidity rotated out of smaller protocols and speculative positions were further unwound.

Crypto News

CFTC Deepens Crypto Push With Approval of Derivatives Collateral

On December 8, 2025, the U.S. Commodity Futures Trading Commission approved a pilot framework allowing certain digital assets to be used as collateral in regulated derivatives markets. Under the program, Bitcoin, Ether, and USDC are now eligible to be posted as margin for futures and swaps, provided firms meet enhanced custody, reporting, and risk management standards. The announcement was led by Acting Chair Caroline Pham and framed as part of a broader effort to modernize market infrastructure while keeping activity inside a regulated perimeter.

The approval directly affects major market participants already active in U.S. derivatives. Futures Commission Merchants such as CME Group clearing members, Coinbase Derivatives Exchange, and Bakkt are positioned to benefit from the change, as it allows institutional traders to post crypto-native collateral instead of converting positions back into cash or Treasuries.

Circle’s USDC was explicitly named as an eligible stablecoin, reinforcing its role as a regulated settlement asset. While Bitcoin and Ethereum gain further legitimacy as balance-sheet collateral rather than purely speculative instruments.

Custody and risk controls remain central to the framework. Firms accepting digital asset collateral must rely on qualified custodians and demonstrate clear segregation, daily valuation, and stress testing processes. Large crypto custodians and infrastructure providers such as Anchorage Digital, BitGo, and Coinbase Custody are expected to play a key role in supporting compliance, given their existing regulatory footprints and integration with institutional trading desks.

The decision also aligns with broader moves across traditional finance to tokenize and modernize collateral management. By opening the door to crypto collateral alongside tokenized Treasuries and money market funds, the CFTC is signaling that digital assets are increasingly being treated as programmable financial instruments rather than edge-case risks. For hedge funds, proprietary trading firms, and market makers that operate across both crypto and traditional derivatives, the change improves capital efficiency.

Tether’s bid for Juventus Denied

Tether has submitted a €1.1 billion all-cash bid to acquire a controlling stake in Juventus, offering €2.66 per share for the roughly 65% stake held by Exor, the Agnelli family’s holding company. The offer represents a premium to Juventus’s recent trading price and would be followed by a tender offer for the remaining publicly traded shares at the same valuation if approved.

Tether already owns approximately 11–12% of the club after building its position earlier this year, which made this a move from minority investor to would-be majority owner rather than a cold approach.

The proposal also included a commitment to inject up to €1 billion of additional capital into the club over time, aimed at balance sheet support and long-term investment rather than short-term financial engineering. From Tether’s perspective, the bid positions Juventus as a flagship global asset tied to one of the most widely used dollar-denominated financial instruments in the world. Juventus offers global brand reach, deep fan engagement, and predictable media exposure that few assets outside major sports franchises can match.

Exor rejected the bid, reiterating that Juventus is not for sale, but the attempt itself is notable. It highlights how large stablecoin issuers are beginning to think beyond crypto-native acquisitions and toward real-world, brand-heavy assets that operate entirely outside the blockchain ecosystem. The bid underscores the scale Tether now operates at and how capital generated from stablecoin infrastructure is increasingly capable of competing directly with traditional institutional buyers for marquee assets.

Binance Advises Pakistan Ahead of Stablecoin Launch

Pakistan is moving toward a more formal digital asset framework, with Binance advising the government on plans to tokenize roughly $2 billion in assets as the country prepares to launch a sovereign-aligned stablecoin. The initiative sits at the intersection of payments modernization and capital markets reform and reflects an effort to use blockchain infrastructure to address core inefficiencies rather than treating crypto as a side system.

The sequencing matters. By starting with a stablecoin rail, Pakistan is anchoring tokenization efforts to a liquid unit-of-account that can support settlement, remittances, and on-chain payments. In an economy where dollar access and cross-border flows remain constrained, stablecoins provide a practical bridge to global liquidity. Asset tokenization then builds on that foundation, enabling faster settlement and broader participation without rebuilding the full market stack.

Binance’s role goes beyond name recognition. The exchange is acting as a technical and strategic advisor, drawing on experience working with regulators and institutions across multiple jurisdictions. That includes guidance on custody models, compliance frameworks, and on-chain market structure. It reflects a broader shift in Binance’s position, from a retail trading platform to an infrastructure partner helping governments design crypto-native financial rails that can operate at national scale.

LI.FI and Real Finance lead busy Funding Week

Over the past week, venture capital activity in crypto picked up meaningfully, with a cluster of infrastructure-focused startups raising fresh rounds despite uneven price action across digital assets. Across roughly a dozen deals, investors committed close to $180 million, pushing total crypto venture funding for the year further above the $25 billion mark. The capital is flowing less toward consumer-facing speculation and more toward the plumbing that supports how assets move, settle, and scale.

Two of the more notable raises came from LI.FI and Real Finance, which together secured about $58 million. LI.FI raised $29 million to expand its cross-chain liquidity and routing infrastructure, which is increasingly used by wallets, DeFi protocols, and applications that need to abstract away the complexity of moving assets across blockchains.

Real Finance also raised $29 million as it builds a Layer-1 blockchain designed specifically for compliant tokenization and institutional use cases. The project is positioning itself around regulated market access, predictable execution, and support for real-world assets, reflecting a broader trend of infrastructure being built with financial institutions in mind rather than retrofitted later.

The investor roster across these rounds included familiar names such as Pantera Capital, Coinbase Ventures, and Digital Currency Group, reinforcing that large funds remain active even as markets consolidate. Taken together, the funding activity points to a market that is still building beneath the surface.

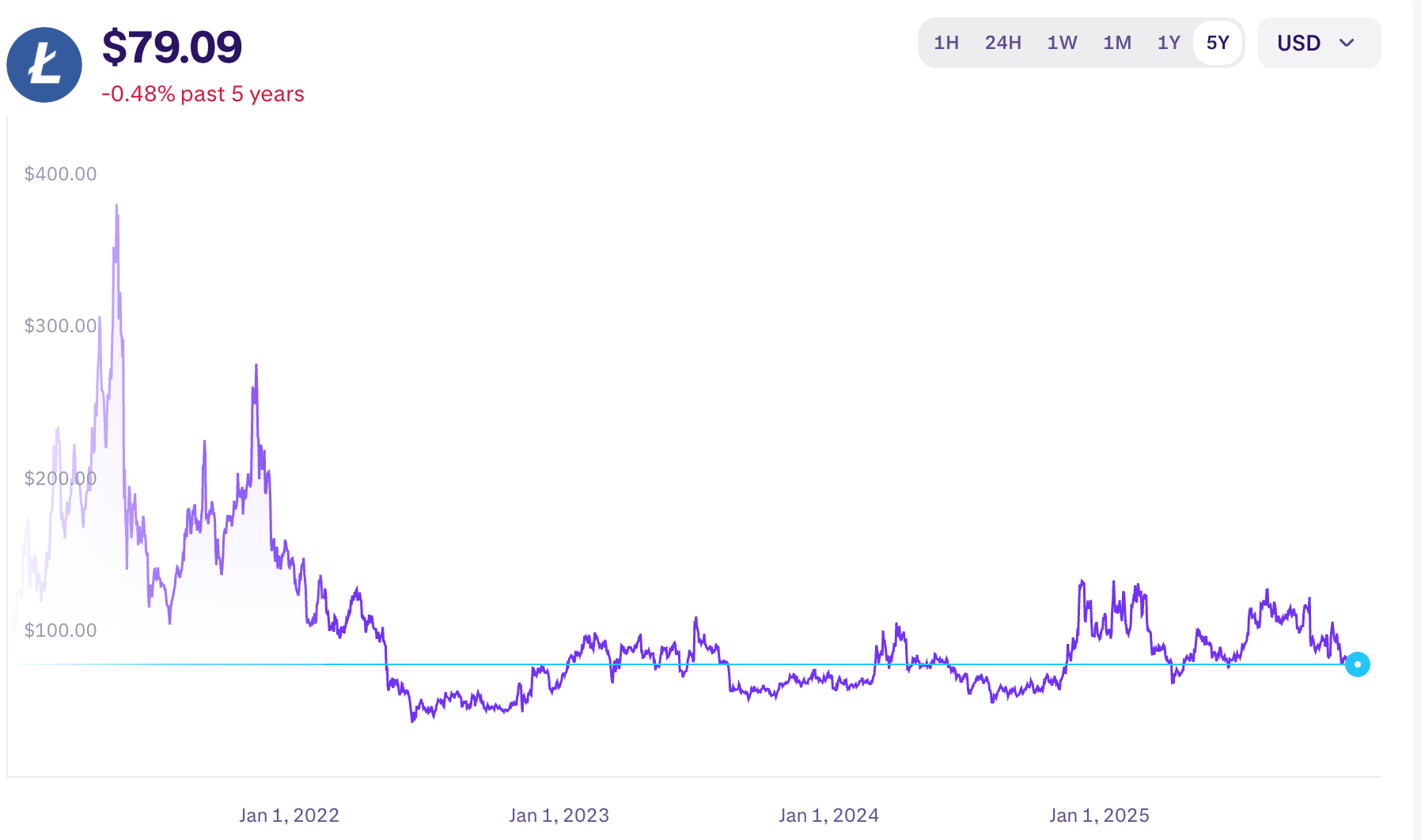

Token of the Week

Litecoin (LTC) is one of the oldest and most straightforward networks in crypto, and that simplicity is increasingly the point. Designed as a faster and cheaper complement to Bitcoin, Litecoin has remained focused on payments and settlement rather than expanding into complex smart-contract functionality. Blocks settle roughly four times faster than Bitcoin, fees remain low, and the network has maintained near-perfect uptime for over a decade.

What keeps Litecoin relevant is not innovation headlines, but reliability. It continues to process real economic activity, particularly in payments and remittances, and is widely supported by exchanges, payment processors, and merchant services. Litecoin has also served as a testing ground for Bitcoin upgrades, including SegWit and Taproot-style improvements, reinforcing its role as a conservative but functional extension of Bitcoin’s design philosophy.

Price-wise, LTC has lagged newer narratives, which has kept it out of speculative cycles driven by DeFi, AI, or memecoins. That underperformance has also reduced volatility relative to smaller assets, making Litecoin behave more like a utility network than a growth token. For investors, it occupies an unusual middle ground: not a growth story, but not a novelty either.

For readers looking to understand crypto beyond narratives and hype, Litecoin offers a useful reminder of what durable infrastructure looks like. It prioritizes uptime, predictable fees, and simplicity, and in an ecosystem that often optimizes for novelty, that consistency is its differentiator.

Closing Thoughts

The next edition of the Vester Pulse will include an end of the year update on our company, product, and what 2026 holds.