- The Vester Pulse

- Posts

- Coinbase Goes “Everything,” Markets Go Quiet

Coinbase Goes “Everything,” Markets Go Quiet

Stocks and prediction markets launch as crypto prices cool into year-end

Vester Updates

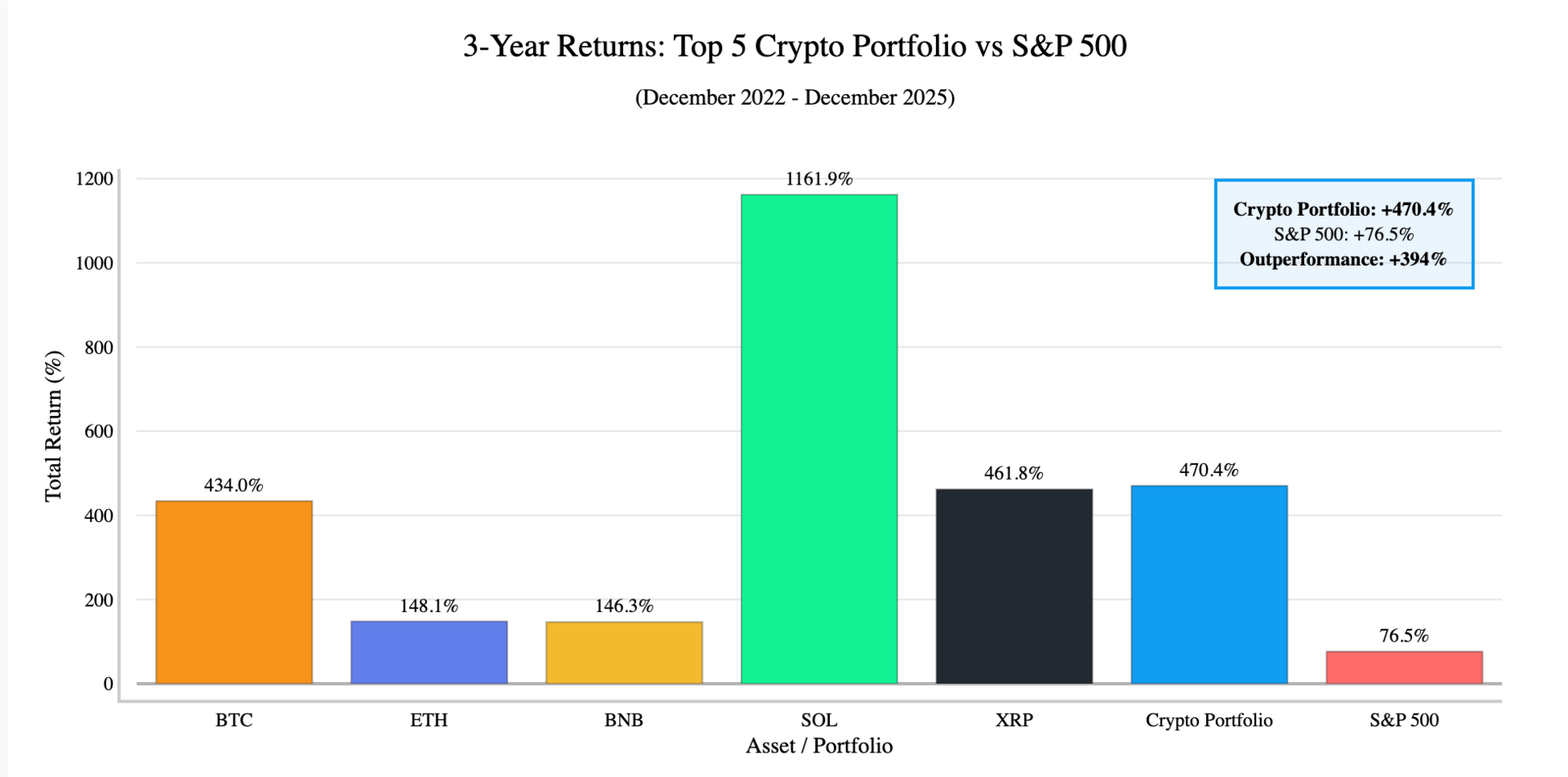

We’re continuing to expand Vester’s ability to generate clear, high-quality market visuals directly from user questions. Recent updates allow Vester to create structured, comparative charts that place crypto assets and portfolios alongside familiar traditional market benchmarks, helping users quickly understand relative performance and long-term context.

This moves Vester beyond simple price views and toward on-demand market interpretation, where users can explore how different assets, sectors, or portfolios have behaved across full market cycles without relying on prebuilt dashboards.

Example prompts to try:

• “How has a diversified Layer-1 crypto basket performed over the last three years compared to U.S. equities?”

• “Compare long-term returns of major crypto sectors versus traditional asset classes.”

• “What does a risk-weighted crypto portfolio look like relative to the S&P 500 across a full cycle?”

• “Show the performance difference between holding BTC only versus a diversified crypto allocation since 2021.”

• “How do drawdowns and recoveries in crypto compare to equities over multi-year periods?”

More exciting news to follow!

Market Updates

Market Overview — December 21, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.7 T | ↓ 2.9 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 48.7 | ↓ 8.8 % |

| Layer-1 (GMCI L1 Index) | 143.2 | ↓ 3.0 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | ≈ $88,300 | ↓ 0.6 % |

| Ethereum (ETH) | ≈ $3,000 | ↓ 3.6 % |

| Solana (SOL) | ≈ $125.3 | ↓ 4.3 % |

| BNB (Binance Coin) | ≈ $851.0 | ↓ 3.9 % |

| XRP (Ripple) | ≈ $1.9 | ↓ 4.6 % |

Crypto markets softened this week, with total market capitalization holding near $3.7 trillion but continuing to cool after several weeks of elevated activity. Trading volumes declined modestly across most venues, and positioning shifted more defensively as investors reduced exposure to higher-beta segments and reassessed near-term risk.

Bitcoin was slightly lower on the week, ending near $88,300 as volatility compressed further and price action remained range-bound. Ethereum underperformed, falling roughly 3.6% to around $2,980 as broader market weakness outweighed steady staking-related demand. Solana declined more sharply, down about 4.3% to roughly $125, reflecting reduced risk appetite in higher-beta Layer-1 assets. BNB slipped 3.9% to approximately $851, while XRP fell 4.6% to around $1.90 after giving back gains from earlier in the quarter.

Sector performance weakened across the board. The GMCI Layer-1 Index declined 3.0% to 143.23, driven by drawdowns across major smart contract platforms. DeFi saw the sharpest pullback, with the GMCI DeFi Index falling 8.8% to 48.65 as liquidity rotated out of smaller protocols and speculative activity continued to unwind.

Crypto News

JPMorgan Launches Tokenized Money Market Fund

JPMorgan has launched its first tokenized money market fund, My OnChain Net Yield (MONY), marking a significant expansion of the firm’s digital asset strategy inside traditional asset management. The fund is built on Ethereum and was initially seeded with approximately $100 million of JPMorgan capital before being opened to eligible outside investors.

MONY is structured to behave like a conventional institutional money market fund. It invests primarily in short-dated U.S. Treasurys and fully collateralized repurchase agreements, targeting capital preservation and low-volatility yield.

The difference is in how ownership and settlement are handled. Instead of traditional fund shares, investor ownership is represented by on-chain tokens, with subscriptions, redemptions, and dividend mechanics managed through blockchain infrastructure.

The fund is available to qualified institutional and high-net-worth investors and is distributed through JPMorgan’s existing fund platforms rather than a standalone crypto interface. Investors can subscribe using cash or stablecoins, and yield accrues daily, with the tokenized structure allowing for faster settlement and more granular fund operations compared to legacy systems.

This is not JPMorgan’s first foray into blockchain, but it is one of the clearest examples of a mainstream asset manager moving a core financial product fully on-chain. Rather than experimenting with pilot programs or proofs of concept, the firm is applying tokenization to a familiar, low-risk product that already sits at the center of institutional cash management.

The launch adds to a growing list of tokenized Treasury and money market products from large financial institutions, but JPMorgan’s scale and distribution make this a notable milestone.

HashKey Raises ~$206M in Hong Kong IPO

HashKey has raised approximately $206 million through its initial public offering in Hong Kong, pricing shares at HK$6.68 and selling roughly 240 million shares. The deal priced near the top of the marketed range and represents one of the largest public capital raises by a crypto exchange in Asia in recent years.

HashKey is a Hong Kong–based digital asset financial services company founded in 2018. Its core business is operating a fully licensed virtual asset exchange under Hong Kong’s Securities and Futures Commission framework.

In addition to spot trading, the company offers fiat on- and off-ramps, brokerage services, custody, asset management, and tokenization infrastructure, positioning itself closer to a regulated financial institution than a pure crypto-native trading venue.

Demand for the IPO was strong across both retail and institutional tranches, with the local retail book heavily oversubscribed. The raise provides HashKey with additional regulatory capital and balance sheet flexibility as it scales trading volumes, expands its product suite, and deepens its presence within Hong Kong’s licensed digital asset market.

The offering underscores that public investors remain willing to fund crypto businesses when the model is compliant, revenue-oriented, and tied to regulated market infrastructure rather than speculative activity alone.

SoFi Launches SoFiUSD Stablecoin

SoFi has announced the launch of its own U.S. dollar–backed stablecoin, SoFiUSD, expanding the firm’s push into digital assets beyond brokerage access and into on-chain financial infrastructure. The stablecoin is issued 1:1 against U.S. dollars held in custody and is backed by cash and cash-equivalent assets, aligning it closely with existing regulated stablecoin models.

SoFiUSD is being positioned as a native extension of SoFi’s broader financial ecosystem rather than a standalone crypto product. The company already operates a regulated bank, brokerage, and payments stack, and the stablecoin is designed to integrate directly into those rails. Initial use cases center on internal transfers, payments, and settlement, with broader functionality expected to roll out over time.

From a product standpoint, this moves SoFi closer to being a full-stack financial platform where dollars can move seamlessly between traditional accounts and blockchain-based systems. Unlike crypto-native issuers, SoFi brings an existing retail customer base, regulated banking relationships, and established compliance infrastructure into stablecoin issuance from day one.

The launch places SoFi alongside a growing list of financial institutions experimenting with or deploying dollar-backed digital currencies, but it stands out as one of the few consumer-facing fintechs issuing a stablecoin directly. Rather than targeting crypto traders, the focus appears to be on embedding programmable dollars into everyday financial activity.

At minimum, SoFiUSD adds another regulated entrant to the stablecoin landscape.

Bitcoin ETF Inflows Stay Positive Heading Into Year-End

Over the past week, spot Bitcoin ETFs continued to record net positive inflows, even as Bitcoin traded in a tight range and overall crypto volumes moderated. Products from BlackRock and Fidelity accounted for the majority of new capital, extending a pattern of steady allocation rather than momentum-driven buying.

Historically, the final weeks of the year tend to bring thinner liquidity across crypto markets as trading desks de-risk, leverage resets, and discretionary activity slows. In prior cycles, this environment has often produced softer volumes and choppier price action, even when longer-term demand remained intact.

Flows during the week were front-loaded and uneven, with subscriptions clustering earlier in the period and fading as volatility compressed. This aligns with a year-end market structure where capital is deployed deliberately rather than reactively, favoring scheduled allocations over short-term positioning.

As spot and derivatives activity continues to cool into the holidays, ETF inflows are increasingly representing the marginal source of demand for Bitcoin.

Coinbase Expands Platform

Coinbase announced a broad expansion of its platform, adding stock trading, prediction markets, and additional market access alongside its existing cryptocurrency products. The update represents one of the most significant shifts in Coinbase’s product lineup since its early focus on spot crypto trading.

The stock trading rollout allows U.S. users to buy and sell equities and exchange-traded funds directly within the Coinbase app. Users can manage stock positions using the same account, interface, and funding rails they already use for crypto, with trades settling alongside existing cash and digital asset balances.

Coinbase is also introducing prediction markets, enabling users to trade contracts tied to real-world outcomes such as economic data releases, elections, and other measurable events. These contracts allow users to express views on probabilities rather than price direction, with positions opening and settling based on whether a specific outcome occurs.

Beyond stocks and prediction markets, the company outlined plans to broaden access to additional trading products, including expanded derivatives offerings and easier access to decentralized markets. This includes simplified futures-style products designed for retail users, as well as improved connectivity to on-chain liquidity venues for trading newly launched tokens.

Taken together, the expansion significantly broadens the range of instruments available on Coinbase, moving it closer to a multi-asset trading venue rather than a crypto-only exchange. The focus of the announcement is on access and consolidation, allowing users to interact with traditional financial assets, event-based contracts, and digital assets within a single platform.

Token of the Week

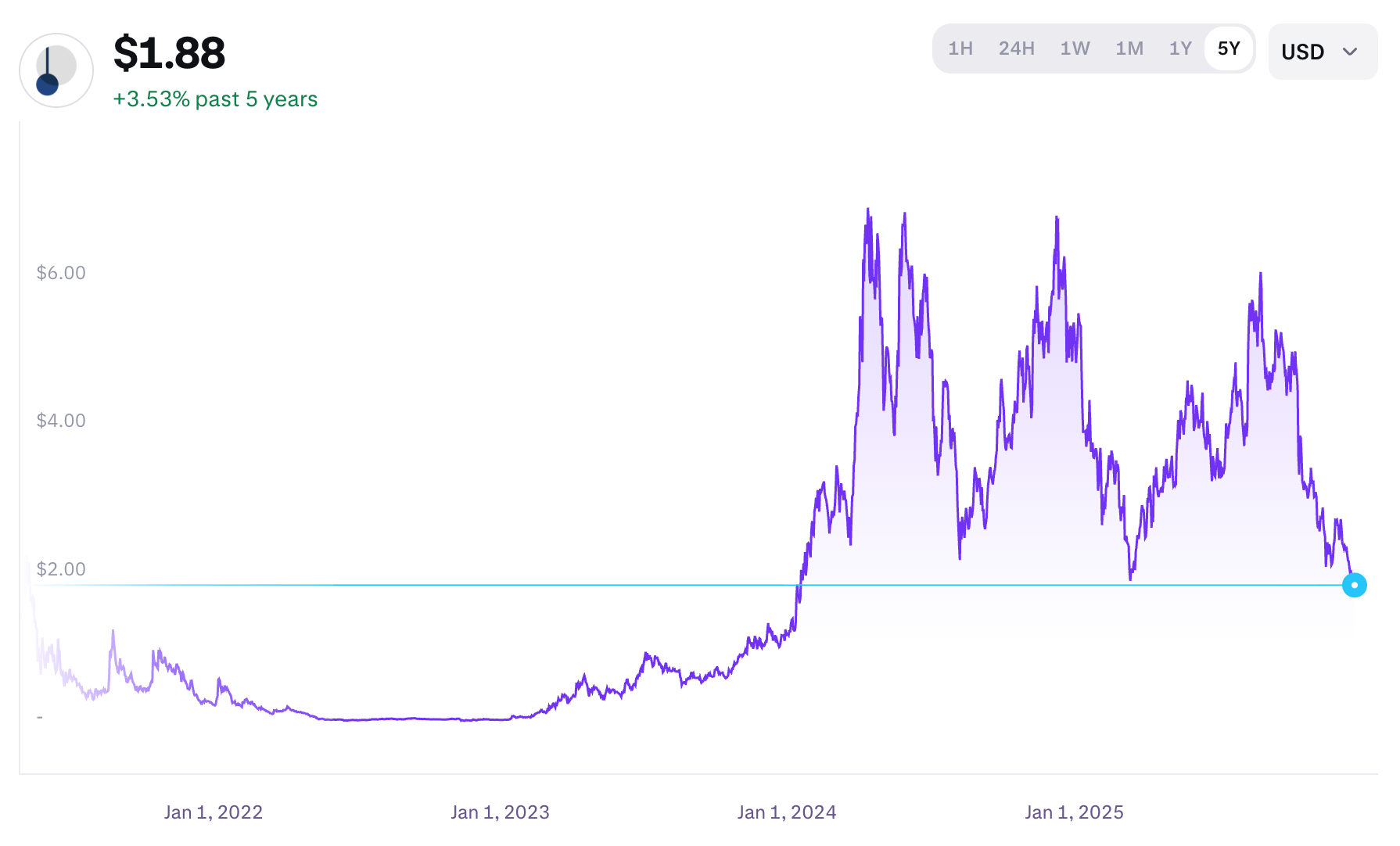

Pendle is a protocol focused on yield trading rather than spot price speculation. It allows users to split yield-bearing assets into two components: principal and yield. Those components can then be traded independently, giving markets a way to price future yield directly instead of bundling it into asset price movements.

What makes Pendle relevant right now is its exposure to the growing on-chain yield stack. As tokenized Treasurys, money market funds, liquid staking tokens, and structured yield products expand, the ability to separate and trade yield becomes more useful. Pendle has quietly become a venue where forward yield expectations are expressed, particularly around ETH staking and DeFi-native rate products.

Pendle sits in an interesting middle ground. It’s not a base layer or a consumer app, but it plays a role in how on-chain capital is structured and priced. As crypto markets mature and yield becomes a larger part of portfolio construction, protocols that let users isolate and manage yield exposure may continue to gain relevance quietly rather than explosively.

Closing Thoughts

The next version of Vester is being shaped around one idea: clearer market understanding through better visuals.

As token coverage expands and new datasets from both crypto and traditional markets come online, the focus is on giving users faster intuition for how different parts of the ecosystem connect. That includes shifts in wallet behavior, changes in sector flows, and relationships that aren’t obvious when looking at assets in isolation.

These updates make the interface feel more responsive to market conditions, with visuals that adjust as the data changes rather than relying on static snapshots. Taken together, they move Vester toward presenting the market as a connected system rather than a collection of disconnected charts.