- The Vester Pulse

- Posts

- Banks, Laws, and Layers

Banks, Laws, and Layers

A week spent laying the groundwork for a more mature market.

Vester Updates

Vester’s social presence continues to expand, now surpassing 600 total followers across platforms. Engagement has grown steadily as more users discover and share our updates.

Expect to see more consistent posting across all platforms, with improved quality and depth in every piece of content.

We’re preparing for the full-scale launch of our product and will be announcing the official launch date soon, we hope you are as excited for that as the Vester team.

Market Updates

Market Overview — October 19, 2025

| Segment | Current Value | Change (7d) |

|---|---|---|

| Global Market Cap | ||

| Total Crypto Market | ≈ $3.73 T | ↓ 5.2 % |

| Sector Performance (GMCI) | ||

| DeFi (GMCI DeFi Index) | 70.7 | ↓ 6.8 % |

| Layer-1 (GMCI L1 Index) | 197.2 | ↓ 7.4 % |

| Top Coins (Tracker) | ||

| Bitcoin (BTC) | $108,980 | ↓ 4.9 % |

| Ethereum (ETH) | $3,983 | ↓ 3.6 % |

| Solana (SOL) | $189.1 | ↓ 3.5 % |

| BNB (Binance Coin) | $1,118.1 | ↓ 13.7 % |

| XRP (Ripple) | $2.4 | ↓ 5.8 % |

Crypto markets declined sharply this week, with total capitalization falling to roughly $3.7 trillion. The downturn followed renewed global uncertainty after the United States imposed 100% tariffs on Chinese technology imports, triggering a wave of deleveraging and risk-off sentiment across both traditional and digital markets. The announcement prompted one of the largest liquidation events in months, as leveraged traders exited positions amid surging volatility and tightening liquidity.

Bitcoin fell 4.9% to $108,980, with trading volumes climbing more than 13% as liquidations accelerated across perpetual futures markets. Ethereum declined 3.6% to $3,983, holding up relatively better thanks to continued strength in Layer-2 network activity.

Solana slipped 3.5% to $189, extending its recent underperformance as speculative flows into higher-beta assets continued to unwind. BNB dropped 13.7% to $1,118, reversing prior gains from exchange-driven inflows, while XRP fell 5.8% to $2.40, tracking broader weakness across large-cap altcoins.

Sector indices also posted notable declines. The GMCI Layer-1 Index fell 7.4% to 197.19, weighed down by weakness in Solana, Ethereum, and BNB. The GMCI DeFi Index dropped 6.8% to 70.67, reflecting sustained drawdowns in governance tokens and liquidity pool assets.

Volumes across major decentralized exchanges (DEXs) declined, while stablecoin inflows rose as investors rotated toward defensive positions.

Crypto News

BlackRock launches bitcoin-linked fund for UK investors

BlackRock is preparing to launch its first bitcoin-linked exchange-traded product (ETP) in the United Kingdom, giving British investors regulated access to digital assets for the first time. The fund will trade on the London Stock Exchange and will be available to sophisticated retail and institutional investors, marking a significant step in the UK’s changing approach to crypto.

The move follows the Financial Conduct Authority’s recent decision to lift its ban on crypto-backed ETPs, a reversal that comes as London seeks to strengthen its position as a competitive global financial hub after Brexit. The regulator’s shift signals a willingness to bring digital assets into the mainstream through controlled, transparent investment vehicles rather than leaving them to unregulated markets.

BlackRock’s ETP will be physically backed, holding bitcoin through regulated custodians, and priced to mirror spot market benchmarks. This structure provides a higher level of security and transparency while aligning with the UK’s investor protection standards.

The launch builds on BlackRock’s success in the United States, where its iShares Bitcoin Trust has become the fastest-growing spot ETF in history, drawing billions of dollars in inflows and helping to establish bitcoin as a legitimate portfolio asset.

For the UK, this development represents both a regulatory milestone and a signal that traditional finance intends to play an active role in shaping the future of digital asset adoption.

Palmer Luckey’s Erebor Bank receives regulatory approval

Erebor Bank, a new financial institution co-founded by tech entrepreneur Palmer Luckey, has received preliminary approval from the U.S. Office of the Comptroller of the Currency (OCC) to operate as a federally chartered bank. The approval marks a major milestone for a venture that aims to blend traditional banking infrastructure with digital asset and advanced technology lending.

Erebor’s mission is to provide financial services to technology-driven companies and individuals, with an emphasis on sectors such as crypto, AI, and defense manufacturing. The bank will reportedly allow clients to borrow against unconventional assets, including digital currencies and high-end hardware, filling a gap left by traditional banks that have largely avoided the space.

The conditional approval does not yet grant Erebor full operational status; the bank must still secure Federal Deposit Insurance Corporation (FDIC) insurance and meet several regulatory requirements before opening. The OCC’s decision nonetheless represents one of the clearest signals yet that U.S. regulators are becoming more open to digital-asset-focused banking models, provided they meet the same standards of safety and soundness as conventional institutions.

Erebor’s backers include several high-profile Silicon Valley investors, including Peter Thiel and Joe Lonsdale, adding to its credibility within the tech and venture ecosystem. For the broader market, the move points to a gradual normalization of crypto within regulated banking, potentially paving the way for other startups to pursue similar charters.

If fully approved, Erebor could become one of the first U.S. banks to operate under a federal charter while offering services directly tied to crypto and emerging technology industries.

U.S. seizes $14 billion in bitcoin

U.S. authorities have charged Cambodian businessman Chen Zhi (below), chairman of Prince Holding Group, for his alleged role in a vast crypto-driven fraud and human trafficking network that laundered more than $14 billion through bitcoin.

The case, one of the largest crypto seizures in history, highlights how digital assets continue to serve as both an innovation frontier and a vehicle for large-scale financial crime.

According to the Department of Justice, the operation used crypto wallets, shell companies, and offshore exchanges to obscure the flow of funds from “pig butchering” scams - investment schemes that lure victims through social media or messaging apps and funnel deposits into interconnected crypto accounts. Blockchain forensics firms traced thousands of transactions across multiple blockchains, ultimately leading investigators to wallets directly tied to Chen’s organization.

Roughly 250,000 bitcoin were confiscated in the raid, alongside luxury real estate and other assets, underscoring how deeply embedded crypto has become in global money flows, both legitimate and illicit.

The case also demonstrates how law enforcement’s ability to trace blockchain activity has improved dramatically in recent years, turning crypto’s transparency into an enforcement advantage rather than a liability.

The seizure adds urgency to calls for stronger Know-Your-Customer (KYC) enforcement and international coordination around on- and off-ramp compliance. While most crypto activity remains lawful, regulators note that the same tools enabling open, borderless finance can be exploited by coordinated bad actors operating across jurisdictions.

Ethereum Layer-2 activity hits record highs

Ethereum’s Layer-2 ecosystem is recording historic highs in both transaction throughput and total value locked (TVL), marking a clear inflection point in how the network scales.

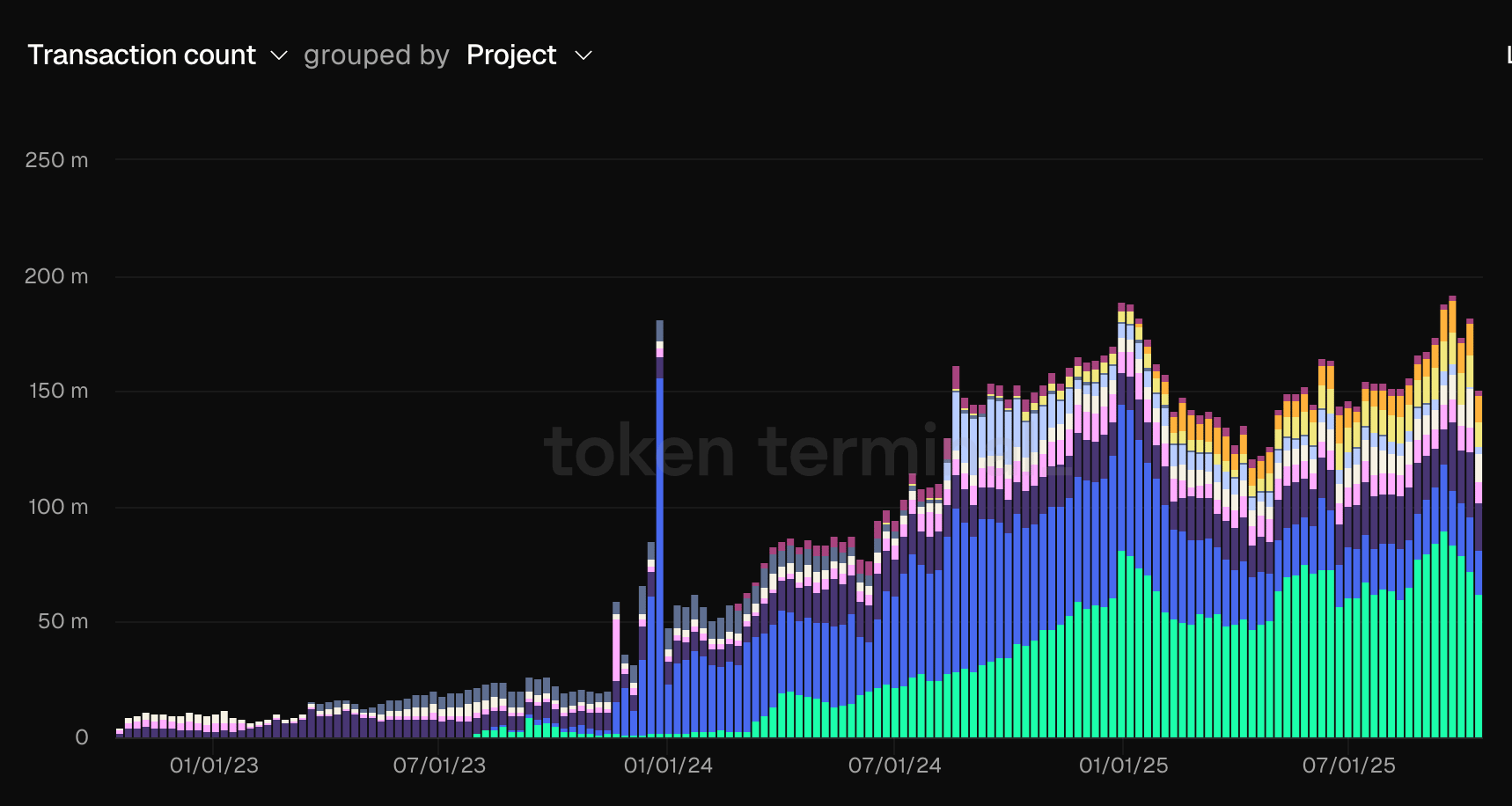

According to data from L2Beat, combined Layer-2 transactions have consistently surpassed Ethereum mainnet’s volume, now averaging more than 200 million transactions per month across networks such as Arbitrum, Base, Optimism, and zkSync.

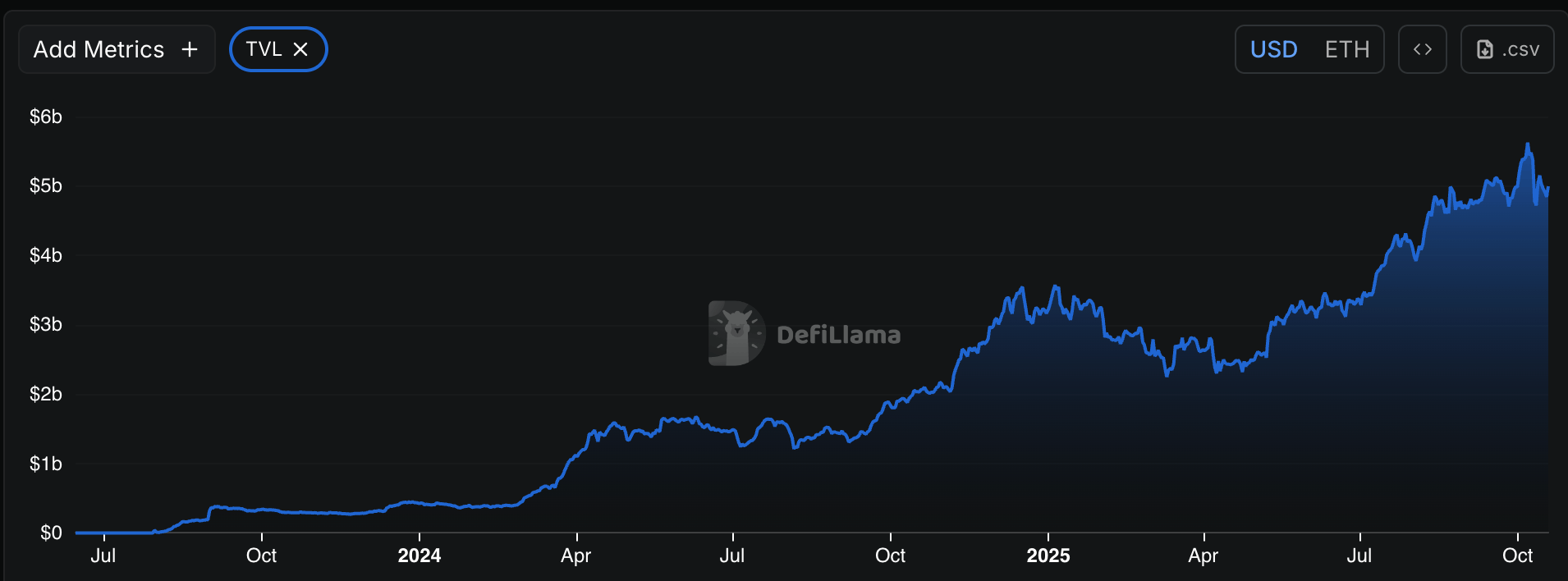

Aggregate TVL across these networks has climbed above $40 billion, up nearly 60% since January. A move driven by strong inflows to Arbitrum and Base. Arbitrum remains the dominant Layer-2 by value, holding roughly 40% of total deposits, while Base has seen the fastest user growth thanks to Coinbase’s integration and consistent on-chain campaign activity.

Optimism continues to benefit from developer adoption through its “Superchain” initiative, which connects compatible rollups under one unified ecosystem.

Part of the momentum comes from rising gas fees on mainnet, which have pushed traders and developers to migrate toward cheaper rollup environments. The renewed excitement around zk-rollups, following zkSync’s protocol upgrade and Starknet’s improved developer tooling, has also contributed to a spike in network activity.

Kenya passes landmark crypto regulation

Kenya’s parliament has approved the Virtual Asset Service Providers Bill, a sweeping piece of legislation that establishes the country’s first formal regulatory framework for cryptocurrencies, exchanges, and stablecoins. The bill aims to bring order and legitimacy to one of Africa’s fastest-growing crypto markets, where millions of dollars in transactions occur daily but have operated largely outside formal oversight.

Under the new framework, the Central Bank of Kenya will regulate the issuance, custody, and transfer of digital assets, while the Capital Markets Authority will oversee trading platforms, token issuance, and investor protection standards.

The legislation also imposes mandatory licensing, capital requirements, and know-your-customer (KYC) procedures for all crypto service providers. It classifies stablecoins as a distinct category of digital asset subject to central bank approval and introduces specific reporting obligations for anti-money-laundering compliance.

Kenya’s new law is part of a broader push to attract investment into its financial technology sector. The country’s mobile-money ecosystem, led by platforms like M-Pesa, already processes more than half of Kenya’s GDP in digital payments annually. Policymakers see crypto as a natural extension of this digital infrastructure, with potential applications in remittances, cross-border settlements, and micro-savings.

If signed into law by President William Ruto, Kenya will become one of the first African nations with a fully defined legal regime for digital assets.

Chain of the Week

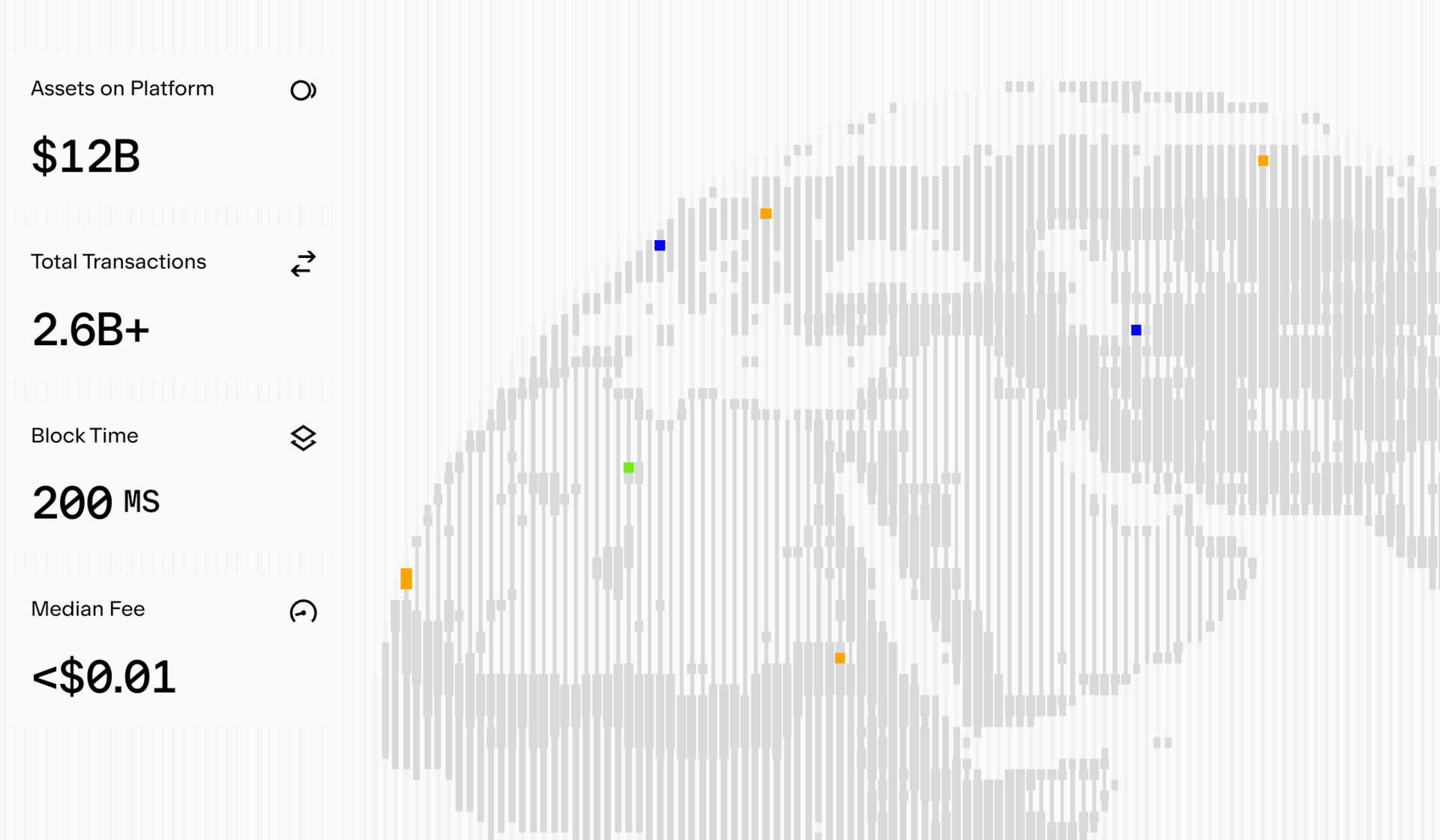

Base, Coinbase’s Layer-2 network built on Ethereum, has quietly become one of the most active and strategically important ecosystems in crypto. Designed to bridge Coinbase’s massive user base with the on-chain economy, Base now handles more daily transactions than any other Layer-2. It ranks among the top three by total value locked, and you can see how quickly it’s TVL has grown in this chart.

Network activity has surged over the past quarter as developers and users migrate from Ethereum mainnet to cheaper, faster rollups. Base’s average transaction fees remain well below one cent, making it ideal for consumer-grade apps and high-frequency DeFi activity.

Liquidity has poured into the network from major protocols including Uniswap, Aave, and Compound. While native projects such as Aerodrome, FriendTech, and Degen have helped anchor a growing ecosystem of traders, creators, and on-chain communities.

Coinbase’s tight integration gives Base an advantage few competitors can match. Users can move funds directly from centralized Coinbase accounts into on-chain wallets in seconds, removing one of the biggest onboarding barriers in crypto.

This seamless fiat-to-on-chain flow has positioned Base as a key driver of Ethereum adoption, particularly among first-time users who might otherwise never touch a self-custodied wallet.

The network’s momentum is also tied to its strong economic model. Fee revenue continues to trend higher, supported by steady network activity. Blockspace demand is rising as ecosystem incentives prioritize real usage over speculative farming.

For investors and builders alike, Base represents a rare combination of scalability, distribution, and regulatory clarity. A Layer-2 designed not just for crypto natives, but for the next hundred million users who will enter the space through Coinbase.

Closing Thoughts

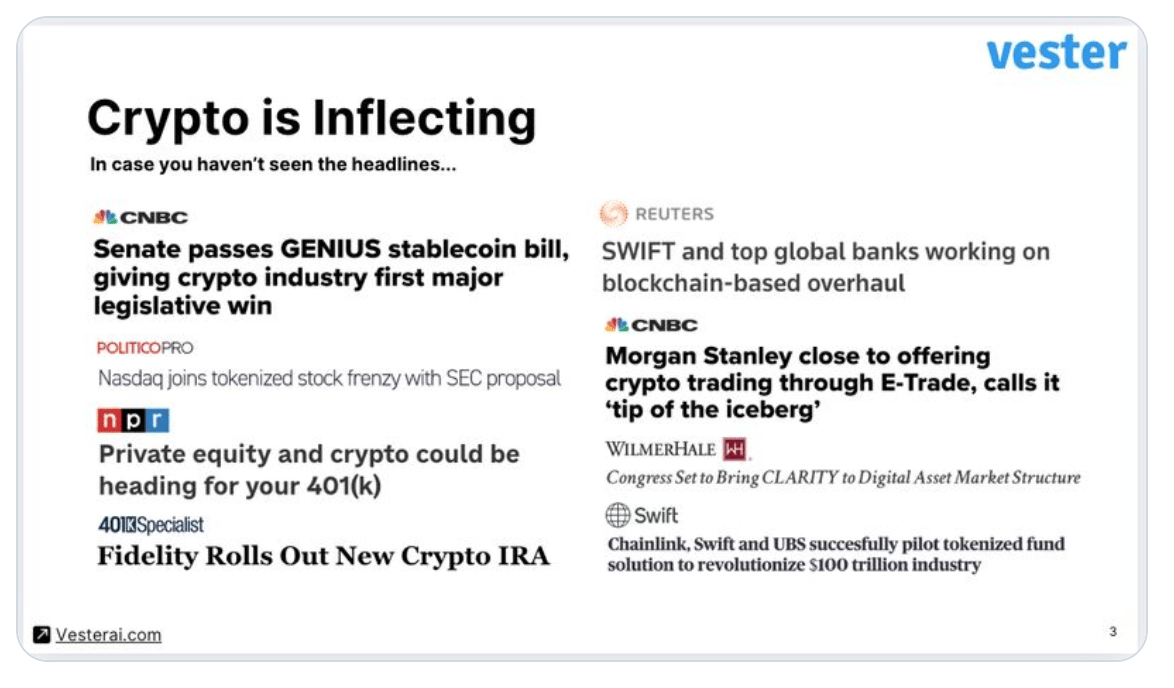

This image says everything. Since the beginning of this newsletter we’ve focused on the institutional adoption of digital assets, it is accelerating in so many different areas that we cannot keep track.

Everyone reading this newsletter is still early.

Thank you for reading this week, you can look forward to an extra special edition next week.